When it comes to wills, probate and estate planning, there is only one expert – an experienced Alpine Utah probate lawyer. The lawyer will review your circumstances and advise you on your best option. While many people try to avoid making a will because they are worried about the probate process, it does not necessarily mean that the probate process is bad. Sometimes you may be better of making a will and having the will go through probate. It all comes down to your individual circumstances. There is no one size fits all when it comes to planning on how to distribute your estate once you are gone. Never take a decision without speaking to an experienced Alpine Utah probate lawyer. Remember it is they who have to deal with the distribution of your estate once you are gone. It’s always better to have your will go through probate. By having a will, you are ensuring that your estate is distributed to those whom you wanted it to be distributed. In the absence of a will, your estate will be distributed by your default estate planning device – Utah intestacy laws. That’s why its important for you to speak to an experienced Alpine Utah probate lawyer.

Terminal Illness

If your parent is suffering from a terminal illness, besides providing medical care, you must also ensure that your parent’s estate is taken care of – your parent must have a distribution plan in place so that the estate is distributed according to his or her wishes after death. Your best source of information is an experienced Alpine Utah probate lawyer.

The Nature of the Problem

When a medical diagnosis is finally made, the patient’s prognosis becomes clear, and the patient and/or the family begin to consider inter vivos estate and financial planning, consideration should optimally also begin to be given to postmortem estate planning, the traditional estate planning that focuses on asset transfer at death. As enumerated earlier, the traditional estate-planning objectives include asset transfer and management, the minimization of taxes, and probate delays and expenses.

Probate Considerations

The orderly transfer of patients’ property to their intended beneficiaries is certainly an immediate and compelling issue for both the patient and the family, whatever the legal instruments used to effectuate the estate plan and therefore the transfer of assets (a will, for example).

There is more to this issue, however. As patients develop their intended plan of asset distribution, for instance, they must specifically consider the individuals and institutions that will be receiving and sharing their assets (e.g., a spouse, children, siblings, an elderly dependent, such as a parent, and perhaps, a charitable institution) and the beneficiaries’ present and future needs, their ages, their financial capabilities, and their personal wishes and objectives with respect to the property.

One of the issues that must be considered is the management of assets for those beneficiaries who are either unable or unwilling to manage the assets received. For whatever reason, advanced age or lack of aptitude, some individuals will never develop management skills and therefore should not be given such responsibilities—ever. Moreover, not all individuals want the burden of asset management and should not be so encumbered. On the other hand, despite youth or lack of experience, other individuals may subsequently develop sufficient management capabilities and will then want to assume the responsibility. Such considerations require answers to these questions: What legal instruments or combination of them will be most effective to achieve these objectives? What forms should the transfers assume? Should the beneficiaries receive the property outright, or should the property be held in trust for some period of time for their benefit?

In addition to the form and the effectiveness of the asset transfer, there is the concern that such assets be transferred with a minimum of loss in value. A number of factors may contribute to the diminished value of estate assets; most commonly, they are the ordinary cost of the transfer, the absence of an orderly plan of property transition, and delays in estate administration. The transfer of virtually any asset involves some cost. This cost may be held to an acceptable level, however, by the selection of the least expensive mode of transfer for different assets—the use of a discount stock broker, for example.

Beyond ordinary asset transfer cost and expense, unanticipated difficulties and delays in accomplishing a particular transfer can prove to be expensive and therefore wasteful of estate assets. The characteristics of certain types of assets require a measure of foresight and advance planning. When, for example, an estate holds assets for which there is no active market, such as a “family” business or undeveloped real estate, careful advance estate planning is essential if the full value of the assets is to be preserved and realized by the beneficiaries. A forced or distressed sale to discharge estate debts, taxes, and other expenses of administration rarely realizes an asset’s fair market value; rather, estates have frequently diminished in value significantly when such sales were rendered necessary by the owner’s failure to plan adequately for the costs and expenses of death. Ensuring the availability of adequate liquid funds in the estate will prevent the untimely and unorganized disposition of assets for which there may be no active market.

The unanticipated difficulties and delays frequently encountered in the process of estate probate may also increase the expenses of administration and reduce the value of the estate assets available to the beneficiaries. Again, certain assets inherently require anticipatory planning for their administration within the estate context, such as an asset that may require “active” participatory management, like a family business. A dispute over a fiduciary authority often requires judicial resolution. Pending court action, estate-held businesses, formerly productive, have declined when such disputes paralyzed their daily operation and jeopardized their continued viability. Expressly conferring the powers necessary to manage such assets effectively should not only prevent costly disputes over authority but should create an economically productive administration.

Similarly, as one or more of the beneficiaries may not be pleased with their treatment in the will, a skillfully prepared will, carefully executed in accordance with all of the requirements of the state statute and with a thoughtful consideration of the various grounds for the contest of wills, can prevent costly and time-consuming probate challenges to its validity and to the legitimacy of its provisions.

Many individuals assume that their estates are too small to be significantly affected by taxes. This widely held view, unfortunately, reflects an inadequate understanding of the reach of the various taxes involved. As an illustration, a division of the ownership of income-producing property among various family members or trusts frequently produces a net increase in the overall spendable income of the family as a unit. Unfortunately, this aspect of estate planning is often overlooked.

It should also be pointed out, however, that the avoidance of taxation is frequently overemphasized by estate planners and is permitted to become the principal, if not the sole, motivating factor. This unbalanced emphasis can lead to a plan that fails to accomplish the other personal and financial objectives of the patient.

Estate Planning And Probate

A number of estate-planning devices are available to the patient and family with which to accomplish the various lifetime and postmortem estate-planning objectives. Speak to an experienced Alpine Utah probate lawyer to know the options.

To know more about the will as a method of estate planning, you should understand the Utah intestacy laws. An experienced Alpine Utah probate lawyer is your best source of information on Utah intestacy laws. Utah intestacy laws are complex. Certain general rules apply to the use and ownership of property. The laws of descent and distribution determine how the property interests and controls are distributed when there is no predetermined distribution plan. Basically Utah intestacy laws are the default estate planning device for those Utah residents who die without an estate planning device in place. Practically speaking, there isn’t much of a choice for an individual. You either make your own plan or use the default plan – Utah intestacy laws.

Although the actual distributive plans vary in their preferences among the various states, the design, however comprised, applies uniformly to all family situations, regardless of differences in individual needs, deeds, and abilities. And although a particular statutory design may be based on that particular legislature’s notions of an equitable distribution of property or its perceptions of commonly held dispositive preferences, rarely does such a uniform plan accord with the testamentary intent of any particular individual.

Inter Vivos Trusts

Inter vivos trusts are fiduciary agreements by which a patient may transfer assets to a trustee during his or her lifetime for management purposes. The legal nature of inter vivos trusts, together with their utility as a management form, was considered in detail in the section on asset management. As was suggested there, these fiduciary agreements may, in addition, be used as asset transfer devices and, accordingly, may be used to achieve a number of the patient’s postmortem estate-planning objectives.

Where, for example, patients transfer assets to the trustees of an inter vivos trust during their lifetime for the accomplishment of a variety of lifetime management objectives, that trust instrument may, in addition, be specifically designed to control the disposition of those assets on the death of the patient. Accordingly, the terms of the trust instrument, rather than the terms of the patient’s will, would control the disposition of the assets held in that trust. In this sense, the trust could be considered an alternative to the will. This result alone could significantly mitigate the problem of diminished asset value due to the delays encountered in their transfer as well as those encountered in the probate process.

When assets have been transferred to a trust during the lifetime of the patient, problems of asset transfer not encountered then may be anticipated and adequately provided for, such as the disposition of a difficult asset and provisions for estate liquidity. Moreover, as the assets held in the trust would not normally be subject to the terms and provisions of the will and therefore to the probate process, neither would they be subject to the variety of challenges and delays frequently encountered there—such as a challenge to the will’s provisions or its validity.

Unlike conservatorships, guardianships, and powers of attorney, however, the life of an inter vivos trust may be designed to extend beyond the death of the patient. And unlike the simple will (one without a testamentary trust), its life may be designed to extend beyond the relatively brief period of the estate’s administration—in each instance to perform a variety of functions both after the death of the patient as well as after the administration of the patient’s estate.

Avoiding Probate

Every will has to pass through probate in Utah. Probate law is complex. Probating a will isn’t easy. You have to pay probate fees at the time of filing for probate. However, there are ways you can avoid probate and yet ensure that your relatives get their due share in your estate after you are gone. An experienced Alpine Utah probate lawyer can advice you on how to avoid probate in Utah. You should introduce your terminally ill relative to an experienced Alpine Utah probate lawyer.

Come To Ascent Law

It is important for your terminally ill relative to make plans on how his estate should be distributed. This should be done when the patient still has the capacity to do so. Certain illness cause the patient to loose metal capacity over a period of time. There are certain valid requirements of a valid will. It must be made when the person has the mental capacity to do so. In case of a patient suffering from an illness that is likely to cause mental issues later, at the time of making a will, it is a good idea to get a certificate from the treating doctor as to the mental soundness of the patient. This will help if subsequently someone challenges the will on the grounds of mental incapacity. Seek the assistance of an experienced Alpine Utah probate lawyer.

Alpine Utah Probate Lawyer Free Consultation

When you need legal help with a probate in Alpine Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How Long Should A Separation Last?

Criminal Defense Lawyer Provo Utah

How To Register A Trademark With The USPTO

Update Your Insurance Policies After A Divorce

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Alpine, Utah

|

This article needs additional citations for verification. (April 2008)

|

|

Alpine, Utah

|

|

|---|---|

Overlooking Alpine

|

|

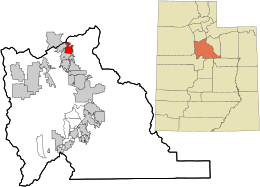

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°27′23″N 111°46′25″WCoordinates: 40°27′23″N 111°46′25″W[1] | |

| Country | United States |

| State | Utah |

| County | Utah |

| Settled | 1850 |

| Incorporated | January 19, 1855 |

| Area | |

| • Total | 7.96 sq mi (20.60 km2) |

| • Land | 7.96 sq mi (20.60 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,951 ft (1,509 m) |

| Population

(2020)

|

|

| • Total | 10,251 |

| • Density | 1,319.67/sq mi (509.55/km2) |

| Time zone | UTC-7 (MST) |

| • Summer (DST) | UTC-6 (MDT) |

| ZIP code |

84004

|

| Area codes | 385, 801 |

| FIPS code | 49-00540[3] |

| GNIS feature ID | 1438174[4] |

| Website | City of Alpine |

Alpine is a city on the northeastern edge of Utah County, Utah. The population was 10,251 at the time of the 2020 census. Alpine has been one of the many quickly-growing cities of Utah since the 1970s, especially in the 1990s. This city is thirty-two miles southeast of Salt Lake City. It is located on the slopes of the Wasatch Range north of Highland and American Fork. The west side of the city runs above the Wasatch Fault.[5]

[geocentric_weather id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_about id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_neighborhoods id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_thingstodo id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_busstops id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_mapembed id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_drivingdirections id=”fe576a96-1511-46ab-80ed-a9d39268d279″]

[geocentric_reviews id=”fe576a96-1511-46ab-80ed-a9d39268d279″]