Many people believe that if they have a will, their estate planning is complete, but there is much more to a solid estate plan. A good plan should be designed to avoid probate, save on estate taxes, protect assets if you need to move into a nursing home, and appoint someone to act for you if you become disabled. All estate plans should include, at minimum, two important estate planning instruments: a durable power of attorney and a will. A trust can also be useful to avoid probate and to manage your estate both during your life and after you are gone. In addition, medical directives allow you to appoint someone to make medical decisions on your behalf.

<h2A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. If you die without a will, those wishes may not be carried out. Further, your heirs may end up spending additional time, money, and emotional energy to settle your affairs after you’re gone. Though no single document will likely resolve every issue that arises after your death, a will—officially known as a last will and testament can come pretty close. Here’s what you need to know about these vital documents.

• A will is a legal document that spells out your wishes regarding the care of your children, as well as the distribution of your assets after your death.

• Failure to prepare a will typically leaves decisions about your estate in the hands of judges or state officials and may also cause family strife.

• You can prepare a valid will yourself, but you should have the document witnessed to decrease the likelihood of successful challenges later.

• To be completely sure everything is in order, consider having your will prepared by a trusts and estates attorney.

Why You Should Have a Will In Ogden Utah

Some people think that only the very wealthy or those with complicated assets need wills. However, there are many good reasons to have a will.

• You can be clear about who gets your assets. You can decide who gets what and how much.

• You can keep your assets out of the hands of people you don’t want to have them (like an estranged relative).

• You can identify who should care for your children. Without a will, the courts will decide.

• Your heirs will have a faster and easier time getting access to your assets.

• You can plan to save your estate money on taxes. You can also give gifts and charitable donations, which can help offset the estate tax.

A Written, Witnessed Will Is Best

To maximize the likelihood that your wishes will be carried out, create what’s known as a testamentary will.

This is the most familiar type of will; you prepare the document and then sign it in the presence of witnesses.

It’s arguably the best insurance against successful challenges to your wishes by family members or business associates after you die. You can write one yourself but having it prepared by a trust and estates attorney tends to ensure it’ll be worded precisely, correctly, and in keeping with your state’s laws.

Other Types of Inheritance Wills

While a testamentary will is likely your best bet, several other types of wills get varying degrees of recognition.

Holographic wills

Wills written and signed by the testator but not witnessed are known as holographic wills—from the less common secondary meaning of the word holograph, meaning a document hand-written by its author. Such wills are often used when time is short and witnesses are unavailable, for example, when the testator is trapped in a life-threatening accident. Holographic wills are not recognized in some states, however. In states that permit the documents, the will must meet minimal requirements, such as proof that the testator wrote it and had the mental capacity to do so. Even then, the absence of witnesses often leads to challenges to the will’s validity.

Oral Wills

Least widely recognized are oral wills, in which the testator speaks their wishes before witnesses. Lacking a written record, or at least one prepared by the testator, courts do not widely recognize oral wills.

Pour-Over Wills

Another type of will, a pour-over will, is used in conjunction with creating a trust into which your assets flow.

Mutual Wills

A married or committed couple usually executes this type of will. After one party dies, the remaining party is bound by the terms of the mutual will. Mutual wills can be used to ensure that property passes to the deceased’s children rather than to a new spouse. Because of state differences in contract law, a mutual will should be established with a legal professional’s help. Though the terms sound similar, a mutual will should not be confused with a joint will.

What Does a Will Cover?

A will allows you to direct how your belongings such as bank balances, property, or prized possessions should be distributed. If you have a business or investments, your will can specify who will receive those assets and when. A will also allows you to direct assets to a charity (or charities) of your choice. Similarly, if you wish to leave assets to an institution or an organization, a will can assure that your wishes are carried out.

While wills generally address the bulk of your assets, some aren’t covered by their instructions. Those omissions include payouts from the testator’s life insurance policy. Since the policy has specified beneficiaries, those individuals will receive the proceeds. The same will likely apply for any investment accounts that are designated as “transfer on death.” There’s a key exception: If the beneficiaries of those assets predeceased the testator, the policy or account then reverts to the estate and is distributed according to the terms of a will or, failing that, by a probate court—a part of the judicial system that primarily handles wills, estates, and related matters. Most states have elective-share or community property laws that prevent people from disinheriting their spouses. If a will assigns a smaller proportion of such assets to the surviving spouse than state law specifies, which is typically between 30% and 50%, a court may override the will.

In addition to directing your assets, a will states your preferences for who should take over as guardian for your minor children in the event of your death.

Wills and Trusts

A will is also helpful even if you have a trust—a legal mechanism that lets you put conditions on how your assets are distributed after you die and, often, to minimize gift and estate taxes. That’s because most trusts deal only with specific assets, such as life insurance or a piece of property, rather than the sum total of your holdings. You might also consider setting up a trust as a way to provide for a beneficiary who is underage. Once the beneficiary is deemed capable of managing their assets, they will receive possession of the trust. Even if you have what’s known as a revocable living trust into which you can put the bulk of your assets, you still need what’s known as a pour-over will. In addition to letting you name a guardian for your children, a pour-over will ensure that all the assets you intended to put into the trust are put there, even if you fail to retitle some of them before your death. Any assets that are not retitled in the name of the trust are considered subject to probate. As a result, if you haven’t specified in a will who should get those assets, a court may decide to distribute them to heirs whom you may not have chosen.

What Happens if I Don’t Have a Will?

If you die intestate—that is, without a Will—the state oversees the dispensation of your assets, which it will typically distribute according to a set formula. Because of the elective-share and community property provisions mentioned above, the formula often results in half of your estate going to your spouse and the other half going to your children. Such a scenario sometimes results in the sale of the family home or other assets, which can negatively affect a surviving spouse who may have counted on the bulk of your assets to maintain their standard of living. Further complications may ensue if your children are minors, as the court will appoint a representative to look after their interests.

Dying intestate may have tax consequences, too, since a properly prepared will can reduce the estate tax liability. In 2021, a U.S. estate tax return must be filed on individual estates valued at $11,700,000 or more; in 2022, that threshold rises to $12,060,000 or more. No federal estate tax is due if the estate is worth less than that amount.

Getting Started on Your Will

To prepare a will, begin by compiling a list of your assets and debts. Be sure to include the contents of safe deposit boxes, family heirlooms, and other assets that you wish to transfer to a particular person or entity. If you wish to leave particular personal property to specific heirs, begin a list of those allocations for eventual inclusion in your will. Besides, you can identify the recipients of specific assets in a separate document called a letter of instruction, kept with the will. However, if you include assignments only within this letter, check that the document is legally binding where you live; some states do not recognize them.

The letter of instruction can be written more informally than the will. It can also include specifics that will help your executor settle your estate, including account numbers, passwords, and even burial instructions.

Other addenda to the will, such as power of attorney, a medical directive, or a living will, can direct the court on handling matters if a person becomes physically or mentally incapacitated. If both you and your spouse lack wills, you might be tempted to prepare a single document that covers you both. Resist the temptation.

Estate planners almost universally advise against joint wills, and some states don’t even recognize them. Separate wills make more sense, even if your will and that of your spouse may end up looking remarkably similar. (As noted above, a joint will is not to be confused with a mutual will.)

How to Prepare and Validate Your Will

You don’t necessarily need professional help to prepare a valid will. If you are comfortable taking care of the task on your own, several software programs are available to assist you, as are various DIY websites. Once you’ve drafted the document, it needs to be witnessed, usually by two adults of sound mind who know you well.

Any person may act as a witness to your will, but it’s best to pick what’s known as a disinterested witness—someone who isn’t a beneficiary and has no financial or personal stake in your choices. Some states require two or more witnesses. If a lawyer prepared the will, they shouldn’t serve as one of the witnesses. In some states, a will must also be notarized, so check the rules where you live. Even if that formality isn’t required, you might consider having your witnesses complete what’s known as a self-proving affidavit. Signed in the presence of a notary, the document may facilitate the probate process by reducing the likelihood witnesses will be called into court to validate their signatures and the will’s authenticity.

How to Change a Will

Your will may never need to be updated. Or, you may choose to update it regularly. Remember, the only version of your will that matters is the most current valid one in existence at the time of your death. Review your will every two or three years and at pivotal moments in your life. Such events might include marriage, divorce, or the birth of a child. Your kids probably won’t need guardians named in a will after they’re adults, for example.

Changing your will is easy. You write a new will to replace the old one or make an addition using an amendment known as a Codicil. Because of the serious nature of codicils and their power to change the entire will, two witnesses are usually required to sign when a codicil is added, much like when the original will was created.

Some states, however, have loosened the legal regulations surrounding codicils and now allow for them to be notarized at a public notary. Ideally, you want to make any changes when you are of sound mind and in good health. This limits the likelihood that your wishes can be successfully challenged and avoids decisions made in haste or under intense emotional pressure

</h2

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney In Mountain Green Utah

Estate Planning Attorney In Murray Utah

Estate Planning Attorney In Naples Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

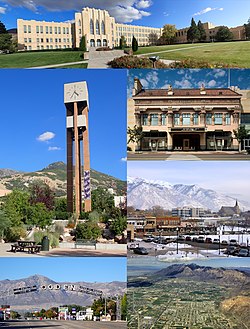

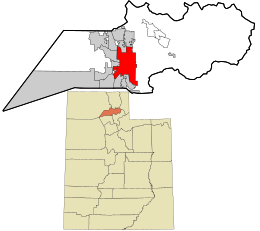

Ogden, Utah

Nickname:

Motto:

Coordinates: 41°13′40″N 111°57′40″WCoordinates: 41°13′40″N 111°57′40″WCountryUnited StatesStateUtahCountyWeberSettled1844IncorporatedFebruary 6, 1851 (As Brownsville)Named forPeter Skene Ogden[1]Government

• TypeCouncil-Mayor • MayorMike CaldwellArea

• Total27.55 sq mi (71.35 km2) • Land27.55 sq mi (71.35 km2) • Water0.00 sq mi (0.01 km2)Elevation

4,300 ft (1,310 m)Population

• Total87,321 • Density3,169.55/sq mi (1,223.84/km2)DemonymOgdenite [3]Time zoneUTC−7 (MST) • Summer (DST)UTC−6 (MDT)ZIP Codes

Area codes385, 801FIPS code49-55980[4]GNIS feature ID1444049[5]Websitehttp://ogdencity.com/

Ogden /ˈɒɡdən/ is a city in and the county seat of Weber County,[6] Utah, United States, approximately 10 miles (16 km) east of the Great Salt Lake and 40 miles (64 km) north of Salt Lake City. The population was 87,321 in 2020, according to the US Census Bureau, making it Utah’s eighth largest city.[7] The city served as a major railway hub through much of its history,[8] and still handles a great deal of freight rail traffic which makes it a convenient location for manufacturing and commerce. Ogden is also known for its many historic buildings, proximity to the Wasatch Mountains, and as the location of Weber State University.

Ogden is a principal city of the Ogden–Clearfield, Utah Metropolitan Statistical Area (MSA), which includes all of Weber, Morgan, Davis, and Box Elder counties. The 2010 Census placed the Metro population at 597,159.[9] In 2010, Forbes rated the Ogden-Clearfield MSA as the 6th best place to raise a family.[10] Ogden has had a sister city relationship to Hof in Germany since 1954. The current mayor is Mike Caldwell.

[geocentric_weather id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_about id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_neighborhoods id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_thingstodo id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_busstops id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_mapembed id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_drivingdirections id=”795a0e26-23bc-470c-a334-135af97269ac”]

[geocentric_reviews id=”795a0e26-23bc-470c-a334-135af97269ac”]