Nearly all consumer bankruptcies in the United States are voluntary. The process usually begins with people contacting a bankruptcy attorney, or less commonly, making the decision to file without an attorney representation. The bankruptcy attorney will typically gather information about the family’s financial characteristics, such as assets, debts, and income. The family will often describe the particular problems that triggered their decision to seek bankruptcy relief. The most common pressures are repeated contact with debt collectors or concern about losing a home to foreclosure.

Foreclosure Stopped

An experienced Bluffdale Utah bankruptcy lawyer will counsel debtors on which type, or chapter, of bankruptcy to file. About two-thirds of consumer bankruptcy cases are filed under Chapter 7, with the remaining one-third being Chapter 13 cases. Chapter 7 differs greatly from Chapter 13; the choice of which chapter to file influences everything from the cost of legal fees and the length of the bankruptcy to the substantive type of debt relief available. Table 1.1 shows the main differences between Chapter 7 and Chapter 13.

Chapter 7 is the more familiar “liquidation” bankruptcy. The trustee reviews the debtor’s assets and determines what, if any, property the law permits to be sold to satisfy debts. The makeup of this “exempt property” varies depending on the debtor’s state of residence but often includes things thought to be necessary for basic existence, such as clothing, modest household furnishings, or a single household vehicle. The two most important exemptions are probably the amount, if any, of protection for a family home (“homestead exemption”) and for cash (often a pending tax refund) because these are often the most important property of debtors. If debtors want to avoid the sale of property that is not exempt, they may choose to file Chapter 13 instead. Speak to an experienced Bluffdale Utah bankruptcy lawyer to know more.

In the vast majority of Chapter 7 cases, there are no nonexempt assets for the trustee to liquidate. In other words, the debtor does not have any property that can be sold to repay unsecured creditors. The trustee examines the debtor at the meeting described in the opening of this chapter and files a report that there are no assets, and the debtor’s unsecured creditors receive no repayment from the bankruptcy. If there are nonexempt assets to sell, the trustee will sell them and distribute the sale proceeds pro rata to the debtors’ creditors. This means that each unsecured creditor receives a share of the proceeds that is in proportion to how much it is owed as a share of the total unsecured debt.

Chapter 7 Bankruptcy

Secured creditors, such as mortgage companies or car lenders, have taken collateral to secure repayment of the debt, so they are treated differently in bankruptcy. They have more rights, including most fundamentally the right to repossess the property if the debt remains unpaid during the bankruptcy proceedings. In Chapter 7, debtors are often current on their mortgage or car payments and simply continue making the payments. Alternatively, debtors will be required to reaffirm the debt in order to keep the property. A reaffirmation is a legally binding promise to repay the debt. These agreements must be filed with the bankruptcy court. Sometimes debtors cannot afford to keep the collateral. They may have been behind on payments when they filed for bankruptcy or not be able to keep up with payments during or after the bankruptcy. In these situations, the secured creditor will repossess the collateral (or foreclose on the home). The creditor gets the property or its value upon sale. A bankruptcy discharge, however, means that the debtor will not owe the creditor the deficiency amount; this is any amount that remains due to the creditor after the collateral is sold.

Chapter 7 bankruptcies usually last only four months. The debtor files the required paperwork, the trustee reviews the case, and the debtor receives a discharge from the bankruptcy court. The discharge is an injunction that forbids the debtor’s creditors from attempting to collect the discharged debts. The discharge is powerful relief, letting the debtor off the hook for many common debts, including credit card bills, hospital and medical bills, and deficiency obligations. A bankruptcy discharge is not complete relief, however, from all financial problems. Student loans, certain tax debts, and some obligations incurred shortly before bankruptcy usually are not discharged. Just as importantly, debtors emerge from Chapter 7 back into their regular lives, having to make ends meet on whatever income they earn. Many debtors continue to struggle financially, largely because the majority of bankrupt people have low incomes.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy operates on a different premise from Chapter 7. Debtors can retain all of their property, regardless of whether the law exempts it, but they in turn must commit to using all of the disposable income they have during the next three to five years to repaying their creditors. Some debtors cannot file Chapter 13 because they do not have any income at all, or more commonly, they do not have enough income to confirm a repayment plan. The operative issue in Chapter 13 is usually whether the debtors’ proposed treatments of their secured creditors are in accord with the requirements of bankruptcy law. Debtors must have enough income to keep up with payments on any property they want to keep, such as their house or car, and also to catch up on any missed past payments. While the law has some flexibility to adjust the terms of these debts, it is fairly limited, especially for mortgage debts. Successful Chapter 13 debtors need to have enough money to keep up with their regular, ongoing secured debt payments; find additional money in their budgets to make up missed payments; and keep their households supplied with food, clothing, gas, and other necessities. Perhaps because of these challenges, some Chapter 13 debtors do not confirm a repayment plan, either dropping out of bankruptcy entirely or converting their cases to Chapter 7. Many Chapter 13 debtors do confirm a plan but then stumble as they try to make the required payments for the three- to five-year plan period. In Chapter 13, the discharge of unsecured debts does not occur until the end of the repayment plan. Only one in three Chapter 13 filings gets to this point. The norm in Chapter 13 is not discharge (the standard outcome in Chapter 7) but instead continued liability for unsecured debts, along with temporary relief during the attempted repayment plan.

Chapter 13 is known as a reorganization plan. It allows debtors to keep property, such as a house or car, that they might otherwise lose. These types of filings often allow debtors to pay off an existing loan, over three to five years. This type of plan can work for people who have consistent income and need time to pay off debts, as well as relief from creditors while they’re trying to pay their debts down. Both types of bankruptcy filings may get rid of those debts to which creditors don’t have specific rights to properties. They can stop foreclosures, repossessions, garnishment of wages, utility shutoffs, and debt collection activities. However, bankruptcy does not eliminate the debtor from all financial obligations. Typically, it does not affect taxes, child support, alimony, fines, and some student loan obligations. Because bankruptcy is a federal legal proceeding, the cases must be filed in federal court. There’s a filing fee of $335 and additional attorney fees. Contact your local bar association for a referral to an attorney who specializes in bankruptcy filings. Some communities have legal services programs or law school programs that can assist with bankruptcy filings for low or no fees. Most credit counseling agencies want to help people, but even in this area there is opportunity for less honest people to profit from the vulnerability of someone in financial stress. Beware a counselor who asks for a large sum of money up front. “Managing Your Debt” recommends checking an organization’s reputation with the state attorney general, consumer protection agency, or Better Business Bureau. The U.S. Consumer Information Center, advises consumers to interview several counseling agencies and check with state and consumer agencies in the state to see if complaints have been filed before choosing a counseling agency.

Student Loans in Bankruptcy

Student loans for funding a college education are only part of the package, which can also come in the form of grants, scholarships, and work-study. Loans are more complex than grants and scholarships or work-study dollars because they must be paid back. Student loans contain many of the same components as conventional borrowing, including interest rates, terms of the loan, fees, and deferment options.

These loans are not secured, so there is no security component to student borrowing. Many students do not realize that once they sign the papers for a student loan it must be repaid even if they do not graduate, or if they have trouble finding a job or encounter other financial difficulties.

Under certain circumstances the federal government will cancel all or part of an education loan in a practice called loan forgiveness, but qualification can be time-consuming and costly in a personal sense. To qualify for loan forgiveness someone may perform volunteer work with AmeriCorps, the Peace Corps, or Volunteers in Service to America (VISTA). Another qualification can be through military service. Also, graduates who agree to teach or practice medicine in specific high-need communities can have a portion of a loan forgiven. However, loan forgiveness is based on meeting specific criteria and does not apply to all federal loans. However, most students do not qualify for loan forgiveness and if faced with financial difficulties and missed payments may consider defaulting on their government student loans. Be aware that those who do default on government student loans face possible litigation, collection fees, and late penalties that are not included under a Chapter 7 bankruptcy. There is also no statute of limitations on government student loans, which means that no matter how old the original loan is you can be sued and taken to court if you default.

The best advice for anyone who misses payments or falls behind is to contact the loan holder to make arrangements for a deferment, forbearance, or loan consolidation. If you do not make payments on your loans for 180 days without contacting the lender, the loan will be in default. Consequences of default may include having federal and state income tax refunds withheld; being ineligible to receive any more federal financial aid until the loan is repaid or some portion is paid; being ineligible for deferments (discussed below); having your wages garnished; being liable for costs associated with collecting the loan, including court costs and attorney fees; and having the defaulted loan appear on your credit record.

Two options for postponing repayment are deferments, where the lender allows you to postpone repaying the principal for a specific period of time, and forbearances, where the lender allows you to postpone or reduce payments but the interest charges continue to accrue. Deferments are often granted for students who enroll in graduate school, for students who are unemployed or disabled and participating in a rehabilitation- training program, or for economic hardship. However, deferments are granted only after you submit an application and provide documentation to support your request. Forbearances are typically granted in 12-month intervals for up to three years and usually in cases of extreme financial hardship or unusual circumstances. When you can’t qualify for a deferment, a forbearance is the next best choice.

Loan consolidation is another option if you have several student loans and want to roll them into one lower-interest loan. However, due to the complexity of servicing federal student loans, only a handful of lenders offer consolidation programs. In this situation you may also be able to extend the term of the loan in order to reduce the size of the monthly payments. But be careful: if a payment amount is too low to cover the interest portion, you could eventually end up with a bigger loan balance.

Bluffdale Utah Bankruptcy Lawyer Free Consultation

When you need legal help with bankruptcy in Bluffdale Utah, please call Ascent Law at (801) 676-5506 for your free consultation. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Going Public With Your Startup In Utah

Lessons Learned From 50 Cents Bankruptcy

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Bluffdale, Utah

Coordinates: 40°28′24″N 111°56′40″WCoordinates: 40°28′24″N 111°56′40″WCountryUnited StatesStateUtahCountySalt Lake, UtahFounded1886IncorporatedOctober 13, 1978Named forBluffs (high cliffs) and dales (valleys) along the Jordan RiverGovernment

• MayorDerk Timothy • City ManagerMark ReidArea

• Total11.14 sq mi (28.86 km2) • Land11.14 sq mi (28.85 km2) • Water0.00 sq mi (0.01 km2)Elevation

4,436 ft (1,352 m)Population

• Total17,014 • Density1,527.29/sq mi (589.74/km2)Time zoneUTC-7 (MST) • Summer (DST)UTC-6 (MDT)ZIP code

Area codes385, 801FIPS code49-06810 [3]GNIS feature ID1425844 [4]Websitebluffdale.com

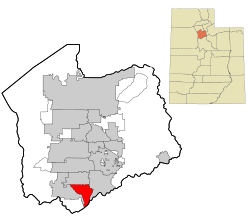

Bluffdale is a city in Salt Lake and Utah counties in the U.S. state of Utah, located about 20 miles (32 km) south of Salt Lake City. As of the 2020 census, the city population was 17,014.

From 2011 to 2013, the National Security Agency‘s (NSA) data storage center, the Utah Data Center, was constructed at Camp Williams in Bluffdale. It is approximately 1 million square feet in size.[5][6]

[geocentric_weather id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_about id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_neighborhoods id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_thingstodo id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_busstops id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_mapembed id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_drivingdirections id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_reviews id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

What happens to health insurance after filing for Chapter 11 bankruptcy?https://t.co/IpioaL85zG pic.twitter.com/OYEdAAKolo

— Tim Cella (@TimCella2) October 20, 2022