Perhaps the most confusing element in a financial plan is the estate plan. From the complex legal documents to the challenges of maximizing the legacy left to your heirs, it can be hard for many people to fully wrap their heads around what’s needed in their estate plan. Many people believe that if they have a will, their estate planning is complete, but there is much more to a solid estate plan. A good plan should be designed to avoid probate, save on estate taxes, protect assets if you need to move into a nursing home, and appoint someone to act for you if you become disabled.

All estate plans should include, at minimum, two important estate planning instruments: a durable power of attorney and a will. A trust can also be useful to avoid probate and to manage your estate both during your life and after you are gone. In addition, medical directives allow you to appoint someone to make medical decisions on your behalf.

Estate planning can give you control over your legacy while offering privacy and security. No matter if you’re rich, poor, young, old, or anything in between, having a well-developed plan for what happens to your assets can give you peace of mind that your loved ones will have financial security no matter what happens to you. The most successful estate plans factor in several considerations. For example, they might include name of who inherits your retirement accounts provide directives for your medical treatment if you become incapacitated.

Key Points:

• An estate plan can give you peace of mind that your loved ones will have financial security after your death.

• Estate planning can address who controls your finances and makes medical decisions when you’re injured or ill.

• Consult an estate planning attorney to review what documents you need to develop your estate plan and help prepare documents for you.

• Once you make an estate plan, notifying your loved ones about any responsibilities they may have as a result.

Why Is Estate Planning Important?

An estate plan is vital to helping you use your assets to provide for your loved ones in the event of your death or incapacity. When you don’t have an estate plan, financial decisions about your money, medical care and other issues may not be made in the way you would like. Not having a plan can cause a burden on your friends and family, especially if they have to manage your finances without knowing your wishes. Consulting with an estate planning attorney in Orem can help you get the most out of your estate plan by ensuring you complete the correct documents.

Death

You may not want to think about your death, but it’s practical to set a plan in place to prepare for it. A will is one common tool used to specify where your wealth goes after you die. If you don’t create a will, your state’s laws dictate what happens to your assets along with other decisions, and the results might not match your wishes. For example, you may want to pass your assets on to people outside your family, or you might want to name specific guardians to care for minor children.

Incapacity

An estate plan can also ensure someone can make the financial decisions for you if you’re unable to manage your finances because you’re injured or sick. For example, you might become unconscious, be medicated, or simply lack the energy to communicate or take action. Without help, your bills may go unpaid or insurance policies can lapse.

Who Is Estate Planning For?

It’s a common misconception that estate planning is for rich people and those with children, the fact is, estate planning is for everyone. People of any income and single people also need to establish plans for what happens to their estate when they die or become incapacitated. If you are single, you need to designate beneficiaries for your accounts and [perhaps] name someone to care for your dog, If you are married with a family, this is the only place you can designate your best friend rather than your brother to take care of your children.” An empty nester may want to leave specific items to their nieces or nephews instead of their children. Or an aging senior may want to leave money to their church. An estate plan can dictate what happens with online accounts such as social media accounts, websites you own, email accounts, or other digital assets.

Estate Plan Essentials

An estate plan prepares you to deal with some of life’s most challenging situations. The plan is the detail of what happens to your money and property when you are gone, The list of essentials below is some of the most common factors that shape estate plans. Depending on your financial situation, you might not need to include them all; or other strategies not listed here might make better sense for you. Again, discuss your goals with an estate planning attorney in Orem Utah.

Last Will and Testament

A will, a common foundation of an estate plan, is a legal document that provides instructions for handling assets in your estate after death. Your will can name who will receive cash, investments, homes, vehicles, valuables, and other items. A will does not necessarily address all your assets. For example, if you name a beneficiary on a retirement account or a life insurance policy, the will does not dictate who receives those funds—the beneficiary designation does.

Wills can accomplish more than distributing property. For example, a will might:

• Name an executor or personal representative to handle your estate

• Designate guardians for minor children

• Establish and fund trusts

Once the will is drafted, tell someone you trust where to find your estate planning documents.

Trusts

A trust is a legal arrangement in which a trustee holds assets for a grantor for the benefit of a beneficiary. So instead of holding assets in your name, you can hold them in a trust. Trusts are helpful for estate planning because they can help keep your assets out of probate, which can be a time-consuming and expensive process. A trust can also set detailed rules on when and how beneficiaries receive their inheritance. Not everyone needs a trust, but they can be especially useful in complicated situations. Trusts can also handle special situations, like a beneficiary with special needs or a beneficiary with poor money habits that needs conditions around their access to inheritance.

A trust can enable someone else to manage your finances if you’re incapacitated. By naming a successor trustee, you allow that person to act on your behalf. A successor trustee can pay your bills and manage your accounts. Finally, trusts can provide privacy. A will is a public document after it’s filed with the court. Likewise, if you’re incapacitated, anyone who wants to manage your affairs must go through the courts to get control of your assets. In contrast, a trust can eliminate the need to create public records.

Insurance Protection

Life insurance can play a key role in estate planning. A life insurance policy often pays a tax-free death benefit to beneficiaries, and the death benefit might be substantial. Those funds can replace the deceased’s income, pay off debt, ensure that children can afford education, and more. Determining how much life insurance you need to replace your income if you pass away is an important part of the estate planning process. An insurance agent or a financial planner can help you determine how much insurance you need and what types of policies may be appropriate.

Financial Power of Attorney

A power of attorney (POA) is a legal document that gives someone the right to manage legal and financial affairs for you. They can pay bills and invest money on your behalf in a variety of situations. You might want a POA in your estate plan to empower someone to make major life decisions, including about your health care or finances, when you can’t.

Health Care Directives

A thorough estate plan includes a specific plan for getting you the treatment that you would want when you’re unable to make or communicate decisions, no matter how old you are. Without proper health care directives, you might not get the treatment you’d like. You can either articulate your heath care wishes in a written document or assign someone to make decisions for you.

• Living will: This is a legal document that states your medical treatment preferences. For example, you might specify that you do not want to be kept alive via a feeding tube. Depending on your state, these documents may be called “advanced care directives” or “medical directives.”

• Health care proxy: This is a person you authorize to make medical decisions for you. So, for example, a person you assigned as a heath care proxy could direct a doctor not to use a feeding tube on your behalf.

If you assign a health care proxy in your estate plan, make sure they are aware of their responsibility. Discuss your health care treatment preferences with them as soon as possible so they understand the treatment choices you’d want.

Beneficiary Designations

With financial accounts such as IRAs and 401(k)s as well as with life insurance policies, you can designate a beneficiary to receive your assets after your death. This way, funds can pass to your beneficiaries without going through the probate process. The result is a relatively fast and easy transfer of assets after death.

Beneficiary designations on things such as retirement accounts supersede any instructions in your will or trust. That’s because assets that go to a designated beneficiary generally do not become part of your estate or trust. They go directly to the beneficiary. Once you choose your designated beneficiaries, periodically review your choices to make sure they remain your preferences. Estate planning attorneys usually ask clients to verify beneficiaries once a year and revisit the full estate plan with their attorney every five years or so.

Make a Plan for Your Assets

By considering the common essentials as you shape your estate plan, you can better reduce the financial and emotional impact of your death or incapacity on your loved ones.

Once you establish the right estate plan for you, review and update it periodically. Life events such as births, deaths, marriages, divorces, or changing health issues can affect your goals and priorities. It is strongly recommended to revise your state plan every five years to make sure they continue to align with your goals. Your finances, health, or family status may change dramatically in this time frame, Also, states update laws and federal tax rules are amended. … Be sure your documents reflect these changes.”

Frequently Asked Questions (FAQs)

1. What is the role of an executor in estate planning?

An executor, also known as a personal representative, administers an estate after someone dies. That person follows instructions in the will (and state laws) to pay bills, file taxes, sell property, distribute assets, and more.

2. How much does estate planning cost?

A standard estate plan can cost anywhere from a few hundred dollars to several thousand dollars. Online services are the least-expensive option, but they’re not customized to your needs. You might save money if your employer offers a legal benefit program that includes estate planning. Consult with an attorney to review the most cost-effective options for your situation.

3. What documents do you need for estate planning?

Some of the most common documents include a last will and testament, power of attorney, living will, and health care proxy. Some people also need one or more trusts. Insurance policies could also have a place in your estate plan. The specific documents required depend on your circumstances.

Probate attorneys in Orem Utah can help individuals establish strategies to avoid probate altogether. Options include revocable and irrevocable trusts, life insurance trusts, and various other techniques which transfer financial assets and personal property to intended beneficiaries.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney In Murray Utah

Estate Planning Attorney In Naples Utah

Estate Planning Attorney In Ogden Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

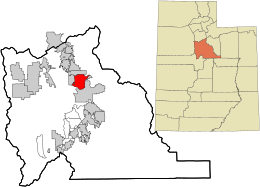

Orem, Utah

Nickname:

Coordinates: 40°17′56″N 111°41′47″WCoordinates: 40°17′56″N 111°41′47″WCountryUnited StatesStateUtahCountyUtahSettled1877Town charter grantedMay 5, 1919Named forWalter C. OremGovernment

• MayorDavid Young • SpokesmanSteven Downs • City ManagerJames P. DavidsonArea

• Total18.57 sq mi (48.10 km2) • Land18.57 sq mi (48.10 km2) • Water0.00 sq mi (0.00 km2)Elevation

4,774 ft (1,455 m)Population

• Total98,129[1] • Density5,267.22/sq mi (2,033.67/km2)Time zoneUTC-7 (Mountain (MST)) • Summer (DST)UTC-6 (MDT)Area codes385, 801FIPS code49-57300[3]GNIS feature ID1444110[4]Websitewww

Orem is a city in Utah County, Utah, United States, in the northern part of the state. It is adjacent to Provo, Lindon, and Vineyard and is approximately 45 miles (72 km) south of Salt Lake City. Orem is one of the principal cities of the Provo-Orem, Utah Metropolitan Statistical Area, which includes all of Utah and Juab counties. The 2020 population was 98,129,[1] while the 2010 population was 88,328[5] making it the fifth-largest city in Utah. Utah Valley University is located in Orem.

Orem uses the slogan “Family City USA.

[geocentric_weather id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_about id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_neighborhoods id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_thingstodo id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_busstops id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_mapembed id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_drivingdirections id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_reviews id=”c4afc332-0663-4e0a-beee-34107f681132″]