Even if your estate is very small you should speak to an experienced South Salt Lake Utah probate lawyer. How your estate passes on to your near and dear ones will depend on your decision. You may want to pass on your assets to certain persons close to you but unless you put that on a document, there is no way the State of Utah will know about it. So if you die without an estate planning document in place, the State of Utah will distribute your estate according to Utah intestacy laws.

It’s important to have an experienced South Salt Lake Utah probate lawyer prepare your estate planning documents. Too often financial plans and estate plans are created without attention to or articulation of core values. We need to keep at the heart of our estate planning what really matters, why we are planning, and for whom. Too often financial plans are created with only our own financial security and tax reduction as objectives. Likewise, estate plans are predominantly created to avoid or reduce taxes, or to pass money, meaningful objects, or lessons on to our families or friends. Little, if any, support is passed to the nonprofits we have cared most about. Establishing a philanthropic or giving plan may tie together and lend added meaning to your other planning. Having or making money for others, not just for ourselves, gives added significance to doing good for the greater community. With a giving plan in place, your financial plan and your estate plan are likely to shift.

It takes an effort to surmount the substantial denial about death in our culture, despite its very real presence. Without being able to face the fact of our inevitable end, we are unable to plan for what will happen to our assets—and our intentions for the world—toward the end of life and after we are gone.

All it usually takes to move us from denial to action is the loss of a close friend or relative who has yet to pass on their values or their wishes or who leaves a messy or puzzling patchwork of unresolved relationships and difficulties. It is a shame to leave those we love without direction or security, when a few hours of careful planning and execution can make a world of difference. The great thing about estate planning is that it can also wake us up to many lifetime possibilities:

• Long-term visioning and planning with family and loved ones

• Fulfilling dreams

• Facing realities

• Setting new goals

• Releasing fear

• Deepening intimacy or clarity with our friends or loved ones

• Propelling long-term efforts by some of the nonprofits or the leaders we count on

• Giving and investing with new objectives and spirit

• Working at a new level of teamwork with trusted advisors

• Considering gifts in our lifetime and beyond to nonprofits and people we love.

• In short, what seemed initially something to avoid can become an expression of our values and one of the most creative activities we do! Estate planning is part of actualizing a lifetime of love, commitments, and ideas.

In particular, we must take time to work intergenerationally. Estate planning is a gift for all generations; done well, it can transform each person and organization involved and become the avenue of greater generosity and a better world.

No matter where you are on the income or asset scale, being intentional with how you use your social and financial capital during your lifetime and after it are part of your story and your personal mythology. For the sake of your heirs, for your own dreams, and for humanity at large, you want to have as great an impact as you can. That is why your approach to your giving is as important as your civic responsibilities of birthright, voting, and achieving all you hope to with your family and community.

Wills, Trusts, And Estate Planning

Even if you have current and updated wills or trusts, prioritize your intentions, get to work on what is still unresolved or incomplete, and communicate about your legacy. If you have yet to engage this part of life, consider starting now, even if you are in your twenties or thirties, to begin “with the end in sight.” We have a lifetime to learn and grow and accomplish our vision for a better life and a better world. Your best source of advice and information is an experienced South Salt Lake Utah probate lawyer.

Many people feel they are too young to be doing estate planning. If you’re one of them, here’s an assignment that might stimulate your thinking: consider what you would say to your real or imaginary family of younger relatives and community members at your ninetieth birthday. What would your shared wisdom be? What values would you want to encourage in others? What will have been your achievements, lessons learned, and wisdom for the next generation? If you’re really brave, you might even consider what you would like your obituary to say about what you accomplished or left behind for the world. You are never too young for estate planning. Remember as your circumstances change as you get older, you can always modify or change your estate planning documents. An experienced South Salt Lake Utah probate lawyer can help you change or modify your estate planning documents at a later stage in life.

In fact, it is a privilege to consider our legacies for the world and our families. But without careful planning, we cannot be assured that any of our intentions will be fulfilled. Let it therefore be our moral responsibility to do all we can to be intentional and to focus steadily on turning our plans into decisions and documents for others to implement. It is a way for us to share in solving the challenges of our times.

Estate planning encompasses all your previous planning, including finances, giving, and your estate. It prepares for the intentional passing on of your social, financial, and wisdom capital for the benefit of your beloveds and future generations. For planning to become inspired, we must consider the whole of our lives, including our spiritual beliefs; our financial obligations; and our family, community, and global needs as well.

Probate Planning

Much of what we learn from our family money mentors and financial advisors is about planning conservatively with care, or “prudent estate planning.” In this chapter we explore what we call “inspired estate planning”—planning that goes beyond mere prudence to be responsive to what is highest and best in us. An inspired legacy plan includes a prudent plan but moves to higher ground, taking into account our family values, virtues, and vision and what we want to do for others. An inspired plan makes sure our family is well taken care of but also supports you in creating a lasting positive impact on your community and the causes you care about. Even if you have no heirs, estate planning is best done with some family members or friends. For those without remaining family of origin, consider your chosen family or friends in this process. Best practices in philanthropy have taught that in order to be fully “inspired” and have lasting influence, inspired giving decisions—and inspired legacy decisions—should be informed and ideally shared by some representatives of the constituencies we aim to serve. If you truly want dynamic impact, begin by having the beneficiaries in mind and by bringing them into your planning process. Imagine what excitement there can be if you engage as co-designers those who you hope will fulfill your dreams.

There are several benefits to planning your legacy. First, you will have the satisfaction and security of knowing that you have a prudent plan that will provide enough income for you, your spouse or partner, and your heirs. Your needs and wants will be met. Second, you will also have an “Inspired Plan,” one that goes beyond “enough for us” to abundance in the life you live in community with others. Third, as you develop a process that is true to your ideals, your experience in planning with your advisors should be positive, uplifting, meaningful, and effective— not a cold, dry process only but one that is joyous, creative, and fulfilling. Before you begin inspired estate planning, then, you want to have a prudent plan in place. A prudent plan makes sure that there is “enough,” whatever enough means to you, for you, your spouse or partner, and your heirs or children, whether you live to a very old age, die prematurely, become ill or disabled, or retire. A prudent plan generally has the following elements:

• Cash flow and budgeting: makes sure you have enough for current expenses and that you are saving for the future

• Retirement: provides enough for you and dependents if you live to normal life expectancy and work until retirement

• Education funding: provides for education of your children, if applicable

• Disability: insures that bills can be paid even if you are disabled

• Life insurance: provides enough to care for those left behind

• Investments: provides a balanced portfolio adjusted for your risk tolerance

• Income tax: minimizes income taxes or has you pay what you may deem fair

• Property and casualty: protects against property and casualty losses

• Liability coverage: protects against lawsuits and claims of creditors

• Estate plan: includes a will that has been updated or reviewed in the past three years and leaves the right assets to the right recipients in the right way:

Includes powers of attorney and health directives

Includes something personal from you as a final note or testament conveying thoughts and feelings for those you love

Provides details of your end-of-life wishes

Charitable Estate Planning

The portion of an estate plan that includes charitable gifts can take many forms and offers many creative alternatives benefiting both donors and recipients. For example, charitable estate planning vehicles such as charitable remainder trusts. Charitable estate planning is a complex, creative, and highly technical field that a competent estate lawyer, financial advisor, and certified public accountant can help you with. Many people, especially those with sizable assets, find that lawyers and tax accountants do not take the initiative to suggest charitable estate planning options. They will not know your heart, your passion, or your vision of a better world unless you tell them. You don’t need to become an expert yourself in the tools and techniques of planning, but you do need to convey your goals and priorities to your experienced South Salt Lake Utah probate lawyer so that he can create a plan that reflects your ideals as well as your prudent concerns. Learning to speak a little of the lawyer’s language also helps you achieve an optimal outcome. Your local university, hospital, public or community foundation, or any other large nonprofit institution cultivating donors probably offers charitable estate planning workshops, with no obligation that your estate plans include them. An experienced South Salt Lake Utah probate lawyer can help you with charitable estate planning.

It is very important that your will be as specific as possible (whether in a letter or more formal document or in audio form) so that those executing your estate understand your charitable intent. Giving specific designations or examples of what kinds of projects or geographic limitations you have in mind for your charitable bequests is an important part of your estate planning.

Your giving is likely to be more successful if you work with an experienced South Salt Lake Utah probate lawyer to know and understand your spending, your cash flow, and the creative and wise timing and uses of your assets.

Choosing an experienced South Salt Lake Utah probate lawyer who is knowledgeable and has a great reputation is essential. You should look for an experienced South Salt Lake Utah probate lawyer who shares at least some of your values, communicates effectively, and honors and adds value to your work as a donor. Giving takes time and care; it also requires clear, realistic goals and patience. With a carefully drafted estate plan in place, it will be easier for you to relax knowing well that your estate will be distributed according to your wishes after your death.

South Salt Lake Utah Probate Lawyer Free Consultation

When you need legal help for a probate in South Salt Lake Utah, please call Ascent Law (801) 676-5506 for your Free Consultation. We can help with Estate Planning. Avoiding Probate. Last Will and Testament. Living Trusts. Asset Protection. Charitable Planning. Health Care Directives. Powers of Attorney. Probate Litigation. And Much More. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How Long After Loan Modification Can I Buy A House?

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

South Salt Lake, Utah

|

|

|

South Salt Lake, Utah

|

|

|---|---|

| City of South Salt Lake | |

South Salt Lake City Hall, South Salt Lake, Utah

|

|

| Motto:

City on the Move

|

|

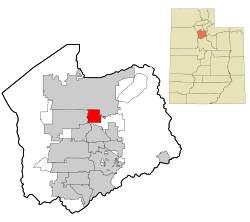

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°42′28″N 111°53′21″WCoordinates: 40°42′28″N 111°53′21″W | |

| Country | United States |

| State | Utah |

| County | Salt Lake |

| Settled | 1847 |

| Incorporated | 1938 |

| Named for | Great Salt Lake |

| Area | |

| • Total | 6.94 sq mi (17.98 km2) |

| • Land | 6.94 sq mi (17.98 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,255 ft (1,297 m) |

| Population

(2010)

|

|

| • Total | 23,617 |

| • Estimate

(2019)[2]

|

25,582 |

| • Density | 3,685.11/sq mi (1,422.76/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84106, 84115, 84119

|

| Area code(s) | 385, 801 |

| FIPS code | 49-71070[3] |

| GNIS feature ID | 1432753[4] |

| Website | https://sslc.gov/ |

South Salt Lake is a city in Salt Lake County, Utah, United States and is part of the Salt Lake City Metropolitan Statistical Area. The population was 23,617 at the 2010 census.

[geocentric_weather id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_about id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_neighborhoods id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_thingstodo id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_busstops id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_mapembed id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_drivingdirections id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_reviews id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]