If you are unable to pay off your loans and you are overburdened with debt, bankruptcy may be an option for you. Speak to an experienced Farmington Utah bankruptcy lawyer.

Loans are divided into two major groups: business and personal. Business loans may be needed for expansion, buying new equipment, financing a cash flow difference between income and expenses, or starting a new venture. Personal loans may be needed for mortgages, education, medical bills, debt consolidation, auto financing, or cash advances on credit cards.

There are also as many sources of money for loans as there are loans. Although we often think of banks originating a loan, there are two different types of banks, retail banks and commercial banks. Commercial banks usually handle loans for businesses and emphasize long-term business relationships. Retail banks generally loan smaller amounts for things like autos, boats, or other installment purchases.

Other sources of money include savings and loans institutions and finance companies, as well as mortgage brokers and credit unions. Savings and loans (S&Ls) were originally designed to provide money for mortgage loans. With the deregulation of the financial markets in the 1980s, some S&Ls then moved to offer loans beyond real estate. But many lacked experience handling these loans, and the 1980s saw many S&Ls fail.

Credit unions are nonprofit cooperative savings organizations. Members have a common bond, such as the same employer, same union, or same neighborhood, and the members own the institution. Credit unions offer services such as savings and checking accounts, and their loan rates may be lower and their qualifications less stringent than those of banks.

Finance companies are organizations of investors who seek to lend their own money or the money of their investors instead of using the money of depositors. They are not subject to the same laws as other lenders because they do not use depositors’ money. They often make personal loans, but are considered to be aggressive lenders, and usually charge higher interest rates. Be aware that fees charged to process loans from finance companies can also raise interest rates substantially.

Mortgage brokers use fees from loans to make their money. Using a mortgage broker can save time and aggravation because he or she knows the ins and outs of preparing loan requests. Mortgage brokers save lenders from having to do a lot of paperwork because they will have the borrower complete all the necessary forms prior to submitting the mortgage application for approval to the lender. If the loan is approved, the lender then pays the broker a small percentage of the loan as a loan fee, also known as points. This fee can range from one to ten points, and although the lender pays the broker, the borrower ends up paying the points as part of the loan.

Do not pay a pre-application or up-front application fee to a broker. If the broker is legitimate and can find a lender, he or she will be paid for this service after the loan is approved.

Understanding the Loan Process

You must understand the loan process before you borrow in order to prevent yourself from having to file for bankruptcy protection. No matter why you are borrowing money, it is important to understand the three basic components of any loan: the interest rate, the security component, and the term. The interest rate is what the lender is going to charge for use of the money. Interest rates can be fixed or variable. A fixed percentage rate will not change over the life of the loan. A variable rate will increase or decrease over time. Variable rates are tied to other rates–usually the prime lending rate–and if that rate drops, your interest rate will also fall. However, if that rate rises, the cost of your loan will increase along with the rate.

All loans are either secured or unsecured. For a secured loan, you put up collateral to guarantee payment; for an unsecured loan, you do not need collateral. When you take out a secured loan, you guarantee that the lender will not lose money by giving them claim on something of value you own. Then, if you default on the loan, the lender can claim the asset used as collateral. Because of this guarantee, financial institutions charge lower rates for secured loans than for unsecured loans.

The term of the loan is the length of time given to repay it. Most personal loans have a payback time of between one and five years. Some loans do not have a term, such as lines of credit and credit cards, where you are only required to pay the interest on an ongoing basis and can keep owing on the principal indefinitely.

For any personal loan you will need to complete a detailed application and supply a number of documents, including a copy of your W-2 form showing your current income, as well as a current pay stub. You will often be asked to provide copies of your income tax returns for the last several years. Lenders want to see whether your cash flow is sufficient to cover the payments you are obligated to make. They also look to see if you have a history of timely payments of debts, and whether you have assets in case the loan fails. You can discharge personal loans by filing for bankruptcy protection. Consult with an experienced Farmington Utah bankruptcy lawyer.

Mortgages

For most people, a mortgage is their biggest and most important personal loan. Mortgages come in many different makes and styles. The most popular mortgage is the one that is amortized over 30 years, at which time it’s paid in full. However, 15-year mortgages offer some attractive advantages, including saving thousands of dollars in interest costs. The monthly payments on 15-year mortgages are higher, but counselors suggest getting the shortest term you can afford to save you money.

Mortgage loans come with either fixed or variable rates. Variable rates by definition vary or change over the life of the loan depending on how they are structured. Fixed rates are harder to qualify for but may be easier to maintain because the payments do not change.

For a $100,000 30-year mortgage at 8%, the borrower would pay $733.77 principal and interest per month. Loans that are repaid gradually over their life are called amortizing loans. The borrower’s money goes largely toward paying the interest in the early years of this loan, and most of the principal is not paid off until the later years.

The total interest paid on this loan would be $164,160. At the end of five years, the borrower would still owe $95,070 of the original $100,000 borrowed. That’s because in those early years, the bulk of each monthly payment goes to interest. It is not until sometime in the fifth year that the amount allocated toward principal repayment tops $100 per month. By around the 20th year of the loan payoff, more of the monthly payment goes toward repaying principal than paying interest. Once that happens, of course, the payoff goes much more rapidly, but by then the borrower has already paid more than $143,000 in interest.

The 15-year mortgage has an obvious advantage if the borrower can afford higher monthly payments. By paying the total loan sooner, the borrower needs less money for less time and pays less interest over the life of the loan. The disadvantage to the shorter 15-year loan is that the monthly payments are much higher than for a comparable 30-year loan and borrowers need to have a higher income to qualify for it.

For example, a $100,000 15-year mortgage at 8% interest would have a monthly payment of $955.65. Over the life of the loan, the borrower would pay only $72,017 in interest. By the end of the fifth year, the balance on this loan would be just under $79,000, but by the end of the 10th year, it would be down to $47,000. In those last five years, the payoff accelerates because the payments go almost entirely toward principal repayments, not on paying interest.

Another way to save thousands over the lifetime of a loan is to make additional principal payments. Let’s say you cannot afford the higher monthly payments of a 15-year mortgage. So you take a 30-year mortgage. At the same time, purchase an amortization chart or run one on some personal financial software such as Quicken. These charts show precisely how much money is going toward interest and principal for every payment. In this example, initial principal payments range around $70. So when you send in your monthly mortgage payment, add an extra $70 to it and note on the coupon or mortgage voucher that the additional money is to go toward the principal. You still have to pay the mortgage the next month, of course, but what you’ve done is effectively cut one payment off the life of the loan. Do that whenever you have additional money on hand and two things happen: the equity in your home builds faster, and the loan balance decreases. Some mortgagors require that these additional principal payments reflect the exact amount of the next month’s due; others allow borrowers to contribute as much to additional principal payments as they wish.

The equity that you have in your home is the value of the home less the outstanding mortgage balance. The equity begins as your down payment and grows depending on the interest rate and length of the loan. If the home appreciates, or increases in value, equity likewise increases. If you need additional funds for college tuition payments, a home equity line of credit loan is a popular choice. Home equity loans are a line of credit with an adjustable rate you may draw on over time, secured by the equity in a home. Home equity lines of credit and second mortgages are similar in that the interest on both loans is tax deductible. However, a home equity loan is in essence a second lien against your property and must be paid off in full if and when you sell your home. A home equity loan works best for people with good credit who do not need all the money at once. That way they won’t be paying interest on the money until it is actually withdrawn, and pay interest only on the outstanding balance. If you are unable to pay off your mortgage and are facing foreclosure, talk to an experienced Farmington Utah bankruptcy lawyer. You may be able to save your home.

Line of Credit

A line of credit, if handled correctly, can effectively be used to purchase large items like cars. If you secure an attractive rate on the line of credit on your house, the best plan is to structure payments to pay it off in about three years. That way you enjoy the benefit of a tax deduction on the interest portion of your equity line of credit.

Car Loans

Next to a mortgage or student loan, a car loan is the most common debt for most people. It is important to get pre-approval for a car loan before you go out to select the car. First, decide what appeals to you in a car, from safety features to gas mileage to repair costs. Research its price using various consumer sources. Then apply for a conventional loan at a local bank or credit union. Once you have preapproval for your loan, you will not be as easily swayed when bargaining because you have a firm figure in mind. This is more cost-effective than selecting a car on the showroom floor that you cannot afford.

Although auto loans run between 12 and 60 months, financial advisers suggest not going over 36 months or three years for many reasons. First, you will obviously pay more interest the longer the term of the loan. For example, a car that sells for $16,995, with a down payment of $1,700 and a 36-month loan, will have monthly payments of $486. This means that when you are finished paying the loan, the car will have cost a total of $19,196 when you include interest, some $2,000 above the cost of the car.

There is another reason not to prolong your loan. If something happens to the car, your insurance settlement is based on actual cash value instead of market value. The older the car, the smaller the cash value settlement you can expect from your insurance company. A good rule of thumb for first-time automobile buyers is that if you can’t afford the payments on a 36-month loan, choose a less expensive car. And keep in mind that although dealers offer special financing programs, such offers may have hidden finance charges.

If you are unable to pay off your car loan, consider bankruptcy as an option. You may be able to retain your car as well. Talk to an experienced Farmington Utah bankruptcy lawyer.

Farmington Utah Bankruptcy Attorney Free Consultation

When you need legal help with a bankruptcy, whether it is a chapter 7, 13, 11, 12 or 9, please call Ascent Law now at (801) 676-5506 for your Free Consultation. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Filing For Divorce While Living Abroad

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Farmington, Utah

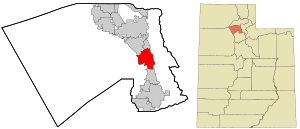

Farmington is a city in Davis County, Utah, United States. The population was 24,531 at the 2020 census.[3] The Lagoon Amusement Park and Station Park transit-oriented retail center (which includes a FrontRunner train station) are located in Farmington.

[geocentric_weather id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_about id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_neighborhoods id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_thingstodo id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_busstops id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_mapembed id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_drivingdirections id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_reviews id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]