Using an LLC for Estate Planning

Somewhere between a corporation and a partnership lies the limited liability company (LLC). This hybrid legal entity is beneficial for small-business owners and is also a powerful tool for estate planning. If you want to transfer assets to your children, grandchildren, or other family members but you are concerned about gift taxes or the burden of estate taxes your beneficiaries will owe upon your passing—an LLC can help you control and protect assets during your lifetime, keep assets in the family, and reduce taxes owed by you or your family members.

• A limited liability company (LLC) can be a useful legal structure through which to pass assets down to your loved ones while avoiding or minimizing estate and gift taxes.

• A family LLC allows your heirs to become shareholders who can then benefit from the assets held by the LLC, while you retain management control.

• The tax benefit of the LLC lies in the fact that the value of the shares transferred to heirs can be discounted quite steeply, often up to 40% of their market value.

• Just about any asset can be put into an LLC.

An LLC is a legal entity recognized in all 50 states, although each state has its own regulations governing the formation, running, and taxation of these companies. Like a corporation, LLC owners (called members) are protected from personal liability in case of debt, lawsuit, or other claims, thus protecting personal property such as a home, automobile, personal bank account, or investment. Unlike a corporation, LLC members can manage the LLC in whatever fashion they like and are subject to fewer state regulations and formalities than a corporation. As a partnership, members of an LLC report the business’s profits and losses on their personal tax returns, instead of the LLC itself being taxed as a business entity.

Benefits of Using an LLC for Estate Planning

You’ve worked hard to earn and grow your wealth, and you probably want as much of it as possible to stay in your family once you’re gone. Establishing a family LLC with your children allows you to:

• Effectively reduce the estate taxes your children would be required to pay on their inheritance

• Distribute that inheritance to your children, during your lifetime, without being hit as hard by gift taxes

• Maintain control over your assets

In short, it can be a win-win for you and your children. If you are attempting to avoid estate taxes, it’s important to note that as of 2021, the feared 40% federal estate tax only takes effect if an individual’s estate is valued at over $11.7 million. For 2022, the number is $12.06 million. Estates worth less than this are considered exempt from the tax.

Gift taxes, however, go into effect after $15,000 (increasing to $16,000 in 2022) is transferred in a single year if the giver is unmarried (married couples can jointly give $30,000, increasing to $32,000 in 2022).

This total resets each year, and the taxes are owed by the person giving rather than receiving the gift. This limit applies per recipient, so giving $15,000 to each of your three children and five grandchildren would not incur gift taxes. Also, keep in mind that if you exceed the $15,000 per year annual gift tax exclusion limit, there is a lifetime cap of $10 million. After that, the gift tax becomes 40%. Before you reach the cap, each amount given over the $15,000 limit is deducted from your lifetime cap, bringing you closer to the 40% tax rate. Considering this, the benefits of transferring wealth between family members with the use of an LLC become more apparent.

Family LLCs

In a family LLC, the parents maintain management of the LLC, with children or grandchildren holding shares in the LLC’s assets, yet not having management or voting rights. This allows the parents to buy, sell, trade, or distribute the LLC’s assets, while the other members are restricted in their ability to sell their LLC shares, withdraw from the company, or transfer their membership in the company. In this way, the parents maintain control over the assets and can protect everyone from financial decisions made by younger members. Gifts of shares to younger members do come under the gift tax, but with significant tax benefits that allow you to give more, as well as lower the value of your estate.

How a Family LLC Works

After you have established your family LLC according to your state’s legal process, you can begin transferring assets. You then decide on how to translate the market value of those assets into LLC units of value, similar to stock in a corporation. Now you can transfer ownership of your LLC units to your children or grandchildren, as you wish.

The discount on the value of units transferred to non-managing members of an LLC is based on the fact that without management rights, LLC units become less marketable.

Here’s where the tax benefits really come into play: If you are the manager of the LLC, and your children are non-managing members, the value of units transferred to them can be discounted quite steeply, often up to 40% of their market value.

Lower Estate Tax

Now your offspring can receive an advance on their inheritance, but at a lower tax burden than they otherwise would have had to pay on their personal income taxes, and the overall value of your estate is reduced, resulting in an eventual lower estate tax when you pass away. The ability to discount the value of units transferred to your children also allows you to give them gifts of discounted LLC units, thus going beyond the current $15,000 gift limit without having to pay a gift tax.

If you wish, for example, to gift one of your children non-management shares of LLC units that are valued at $1,000 each, you can apply a 40% discount to the value (bringing the value of each unit down to $600). Now, instead of transferring 15 shares before having to pay a gift tax, you can transfer 25 shares. In this fashion, you can give significant gifts without gift taxes, all while reducing the value of your estate and lowering the eventual estate tax your heirs will face.

What Can I Transfer Into an LLC?

You can transfer just about any asset into an LLC, and then pass those assets along to your children and grandchildren. Typical assets include the following:

• Cash: You can transfer money from your personal bank accounts into the LLC, and then distribute it among the LLC members.

• Property: You can transfer the title to land and structures built on that land into your LLC. Check with any mortgage holder prior to such a transfer, however, as you might need their approval.

• Personal possessions: You can transfer ownership of automobiles, stocks, precious metals, artwork, or other significant belongings into your LLC.

How Does an LLC Pass at Death?

When the owner of an LLC passes away, some states declare that the LLC must dissolve unless a specific plan of succession has been made. However, dissolution can be avoided by providing for a transfer to another individual upon death detailed in the operating agreement, creating a joint tenancy membership, creating a revocable trust to hold the LLC membership, or probating the LLC through court to determine the succession plan.

What Are Some of the Downsides of an LLC?

When compared to a sole proprietorship, an LLC is more costly to create and maintain. Depending on the state, an LLC typically requires a formation fee and various ongoing fees to maintain the LLC. Sole proprietorships do not typically require registration and, therefore, any associated fees. The owner of an LLC is not liable for the debts of the company, which is one of the key benefits of an LLC. An LLC provides protection to the owner from creditors in the event that the company defaults, enters bankruptcy, or otherwise cannot make its obligations. Creditors are not allowed to go for the owner’s own personal assets. A family-owned LLC is a powerful tool for managing your assets and passing them along to your children. You can maintain control over your estate by assigning yourself as the manager of the LLC while providing significant tax benefits to both yourself and your children. Because estate planning is very complex and the regulations governing LLCs vary from state to state and evolve over time, always check with a financial advisor before formalizing your LLC plan. You will also need legal assistance to create the LLC. You will also incur both initial and annual fees. Factor all these costs into your planning and your decision about whether this type of structure makes sense for your estate.

What Happens When a Will and a Revocable Trust Conflict?

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan. While these two items ideally work in tandem, due to the fact that they are separate documents, they sometimes run in conflict with one another–either accidentally or intentionally. By definition, a revocable trust is a living trust established during the life of the grantor, and may be changed at any time, while the grantor is still living. Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

• A will and a living trust are both part of a comprehensive estate plan, that sometimes is inconsistent with one another.

• When there are conflicts, the trust takes precedence.

• A will has no power to decide who receives a living trust’s assets, such as cash, equities, bonds, real estate, and jewelry.

A Trust Is a Separate Entity

From a legal standpoint, a trust is a separate entity from an individual. When the grantor of a revocable trust passes away, the assets in the trust do not enter into the probate process along with a decedent’s personal assets. When a person dies, their will takes effect in a legal proceeding called probate, which aims to distribute the deceased individual’s property, according to the terms dictated by the decedent’s will. But probate does not apply to property held in a living trust, because those assets are not legally owned by the deceased person. In other words, the will has no authority over a trust’s assets, which may include cash, equities, bonds, real estate, automobiles, jewelry, artwork, and other tangible items.

Naming a Trust as Beneficiary of a Retirement Account: Pros and Cons

When designating beneficiaries for a retirement account one option is to leave the money to a trust. In the financial community, the advantages and disadvantages of this route have been a topic of an ongoing debate between estate planning attorneys and financial advisors.

• Naming beneficiaries for qualified retirement plans means that probate, attorneys’ fees, and other costs associated with settling estates are avoided.

• Naming a trust as a beneficiary is a good idea if beneficiaries are minors, have a disability, or can’t be trusted with a large sum of money.

• The major disadvantage of naming a trust as a beneficiary is required minimum distribution payouts.

Qualified retirement savings accounts are a great way to build a retirement nest egg. But what happens to the money in the account if the account holder passes away?

For retirement accounts, investors are given the opportunity to name both primary and contingent beneficiaries—that is, the person or entity who will inherit the account upon the original owner’s death. The exact mechanism for doing this can get complicated, and factors like taxes and required minimum distributions have to be taken into account. The number of beneficiaries named and whether they are the benefactor’s spouse or not also make a difference.

Pros of Naming a Trust as Beneficiary of a Retirement Account

Naming a trust as a beneficiary is advantageous if your beneficiaries are minors, have a disability, or cannot be trusted with a large sum of money. Some attorneys will recommend a special trust be established as the IRA beneficiary to avoid its assets becoming part of a surviving spouse’s estate, all in an effort to avoid future estate tax issues. Since qualified retirement plans—such as a 401(k) or 403(b), an IRA or a Roth IRA—pass by way of contract directly to a named beneficiary, the often lengthy probate process, attorneys’ fees, and other costs associated with wills and settling estates are avoided.

Cons of Naming a Trust as Beneficiary of a Retirement Account

The primary disadvantage of naming a trust as beneficiary is that the retirement plan’s assets will be subjected to required minimum distribution payouts, which are calculated based on the life expectancy of the oldest beneficiary. If there is only one beneficiary, it does not matter as much, but it can be problematic if there are several heirs of varying ages: The ability to maximize the deferral potential of the qualified plan’s interest is lost under this approach. In contrast, naming individual beneficiaries will allow each beneficiary to take a required minimum distribution based on their life own expectancy, which can stretch an IRA’s earnings out for a longer period of time.

For trusts and accounts inherited after Jan. 1, 2020, there’s another wrinkle. Under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, most non-spousal beneficiaries of an IRA must take full distribution of all amounts held in the IRA by the end of the 10th calendar year following the year of the IRA owner’s death.

But exceptions to this SECURE Act rule do exist for certain people. Known as eligible designated beneficiaries (EDB), they include a surviving spouse, minor children of the IRA owner (until they reach the age of majority), disabled or chronically ill individuals, and individuals who are not more than 10 years younger than the IRA owner. For these beneficiaries, the 10-year payout rule does not apply, and the trust can stretch payments out over the EDB’s lifetime, subject to the same life-expectancy rules outlined above.

It’s also important for the trust containing the IRA to be a see-through trust.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney In Riverton Utah

Estate Planning Attorney I Salina Utah

Estate Planning Attorney In Sandy Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

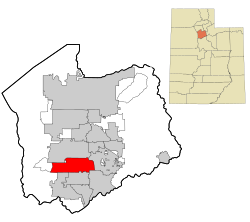

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of The Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

[geocentric_weather id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_about id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_neighborhoods id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_thingstodo id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_busstops id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_mapembed id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_drivingdirections id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_reviews id=”9d240370-0efd-4320-8bd2-de15226eaa86″]