When a person dies, their estate must be dispersed and debts must be paid. The estate must go through probate, which can be a complicated process. If you have recently lost a loved one, you may be anxious about the idea of going to court. It can be helpful to understand the court process and what to expect at a court hearing.

What is Probate Court?

Probate court is where the legal process of dealing with the debts and assets of a person who has recently died is handled. These specialized courts ensure the debts of the deceased are paid, their assets are distributed properly to heirs or beneficiaries, and their wishes are carried out in a legal manner. For probate to begin, the executor or personal representative must file with the county court where the decedent lived.

The Court’s Role in Probate

You may wonder why the court gets involved in probate. The court is responsible for ensuring that the will is followed and the decedent’s wishes are honored. If there is no will, the court will make sure that the assets go to the heirs as listed in the state statutes on probate. Another task of the court is to judge on appeals made by creditors or heirs about their rights to the estate. The executor may deny a claim made by a creditor, but it is up to the court to determine whether it is legitimate or not. An heir may file a claim against the estate regarding the validity of the will. The court will have to review evidence to determine if the will is valid. In essence, the court acts as overseer and manager of the estate until probate has been completed. The first step in probate is to file the petition with the court. Once that has been recorded, the court will set a hearing date and all parties will receive a notice for the date and time. Parties include the executor or personal representative, heirs, creditors and anyone named in the will.

The First Hearing

At the first hearing in Lindon Utah court, the executor of the estate is chosen. While the will may have named someone to act in that role, the court must approve the decision and give them the powers necessary to act on behalf of the estate. The court may ask about the relationship between the deceased and the personal representative. The executor or representative may need to explain why the estate must go through probate. For instance, it may be due to the size of the estate or type of assets. The court will determine whether to appoint the personal representative. In most cases, it will approve whoever is named in the will. However, the person chosen may not want to act as the personal representative or other heirs may dispute the choice of executor. In these situations, the court may need to appoint someone else.

If the person is accepted as personal representative, the court will issue Letters Testamentary, which basically state that they have the authority to act for the estate. It allows them access to assets and information during the probate process. The first hearing may be continued if more information is needed by the court or if there is a dispute about who the executor should be. Depending on the situation and state, the court may require the executor to have a bond to cover any issues of negligence to prevent loss to the estate.

The Next Steps

Once the hearing has concluded and the executor has been appointed, they must begin carrying out their duties.

They will find and appraise all assets, pay creditors and file taxes. They may need to liquidate some assets or transfer title to the heirs. The personal representative or executor will need to publish notice to all parties about the estate. This may include sending out letters to heirs and all known creditors or just publishing in a local newspaper. The details vary by state, but posting notice is required in some form.

The Second Hearing

Once the personal representative has completed their duties, they will file a Petition for Final Distribution. This petition must be approved with second hearing. The hearing will happen about 10 to 12 months after the probate was filed. Of course, this depends on the size and complexity of the estate and if there were any issues and delays. The executor or personal representative will provide details of what they did, which the judge will review. The judge will make sure all requirements were met within the timelines and that all duties have been performed. Some states require a detailed accounting of where the funds went. Once the judge has reviewed everything and it is in order, they will sign the petition for distribution. The estate will then be closed.

Does Every Estate Go Through a Probate Hearing?

There are times when an estate may be able to avoid a formal probate process and the hearing. For instance, if the assets of an estate were placed in a trust, probate wouldn’t be necessary. Another situation is when the estate is small enough to qualify for non-formal probate or a small estate administration. While a hearing might be necessary to appoint the executor, the entire process is usually more informal and the court doesn’t maintain such strict control over what happens.

When a Will is Disputed?

If the will is being disputed, the court will need to hear the evidence as to why the party believes it should be contested. The person will notify the court of their reason to dispute the will. They have only four allowable reasons to contest the will:

• Issues with how the will was signed and executed

• Mental capacity of the decedent when the will was signed

• Fraud

• Undue influence

If any of these situations exist, the person has a right to contest the will. However, they will have to prove their case with the court before the will or any part of it will be thrown out. Once the judge has ruled on the contested will, the rest of the probate process can move forward. Court hearings in the probate process are a necessary part of distributing the estate and following the will. They do extend the timeline for probate because they must get on the court’s docket. However, they won’t seem as imposing or frightening once you understand their purpose.

Steps to Probate a Will

• Determine if Probate Will Be Required: Here’s the simplest test: are there titled assets in the estate that will need to change hands? If the answer is yes, the will is likely to require probate. Examples of assets for which a title would need to change if they were owned individually would include real estate, a boat, autos, or a privately held business. If you plan to sell those assets during the estate settlement process or pass them to a beneficiary, you’ll need to go through probate. If assets in the estate are held in trusts, in accounts with designated beneficiaries, or are jointly owned (with the other owner still alive), probate may not be required. If the jointly owned asset is real estate, probate is the only way to remove the deceased party from the title. In some states, small estates (with values of less than $50,000 or $100,000 may not require probate regardless of titles changing hands.

• File Documents with Probate Court: Documents like the Petition for Probate of Will and state-specific forms related to the appointment of the executor will be filed with the clerk of courts in the county of residence of the deceased person. This formally begins the process. The will, which will determine who will receive assets, is filed at this time. The court will determine the validity of the will and rule on that. In some cases, the will may state (or state law or probate court will require) that an executor get a probate bond. A probate bond is purchased by the executor and typically reimbursed by the estate. The bond guarantees that you will comply with federal and state laws and complete your duties ethically. If you do not fulfill your duties as an executor, someone can make a claim against the bond. The court will then issue an order admitting the will to probate. This step legally confirms the will as valid and as the guiding document in the process.

• Swear in the Executor: A will typically designates an executor, or personal representative, to settle the estate. If the individual dies without a will, the courts will select a personal representative. Upon taking an oath and being sworn in, the executor will receive Letters of Testamentary. This document informs all third parties, like banks and investment firms, that you have the legal authority to act on behalf of the estate.

• File Public Notice.: In most states, even in the digital age, the estate is required to publish a death notice in the local newspaper and send news releases, notifying creditors, heirs, and others of the death. This process formally makes anyone who believes they have a claim against the estate aware of the death and starts the clock for when they are able to make a claim that the estate owes them money.

• Value the Estate.: One of the more challenging duties of the executor is to determine the value of the estate. For financial assets (like stocks and bank accounts), this is straightforward, but you must determine the date of death valuation for each asset as there are significant tax issues related to this. For real estate, jewelry and other valuable items, determining value can be more challenging and require an appraisal from a licensed professional. Valuing the estate accurately is a critical part of the role. This process will also help determine if there are enough assets in the estate to cover its debts and ongoing expenses (like mortgage payments on a home). Here are helpful spreadsheets where you can inventory your financial and non-financial assets to help you get organized. Safeguarding assets and making sure they are not prematurely distributed to (or taken by) a beneficiary is a vital part of the role. If you do not protect the assets of the estate, you may end up in a situation where there are not enough assets to cover debts and expenses of the estate. You also create legal liability for yourself as executor.

• Pay Legitimate Bills and Taxes: As executor, you’ll pay the bills and taxes for the estate. Make sure the expenses are valid before paying them, even if that requires a phone call or a bit of detective work (if you’re unsure if they’re real.) If you deny a claim, that creditor has the right to petition the court for payment. As executor, you’ll also be responsible for payment of federal and state estate taxes and income taxes by the estate. Estates with less than $11.2 million in assets are not subject to federal estate taxes based on the new US tax law, but state estate tax thresholds are much lower in most states. Additionally, one or two years of federal, state, and local income taxes may be owed, depending on if the deceased passed before filing their taxes for the previous year. While laws can differ by state and county court, the costs to settle the estate are the first to be paid by the estate. These include professional fees such as hiring a law firm, executor fees, and the cost of public filing fees. Just be sure to follow the probate court local rules (if you’re unsure of something, ask your county probate court). Next are funeral expenses and taxes, with all other claims following those. If proper legal notices are filed, claims made after state-mandated deadlines are not typically valid.

• Distribute Assets: Only after all the obligations of the estate have been made, beneficiaries will receive their share of the assets. The court and probate court judge will supervise this process, as you will petition the court for approval prior to making these distributions. The court’s role is to ensure that the executor is acting fairly and that all obligations of the estate have been satisfied. This process is ultimately of benefit to the executor, since you will minimize your legal risk by acting under the supervision of the court.

• Close the Estate: The court will formally close the estate, completing the probate process and your role as executor. The probate process, while intimidating to many, is a manageable process and will help provide some structure to the estate settlement process. With professional help and a bit of patience, probate court should help ensure you settle the estate effectively and with managed legal liability.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney Kearns Utah

Estate Planning Attorney La Verkin Utah

Estae Planning Attorney In Layton Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

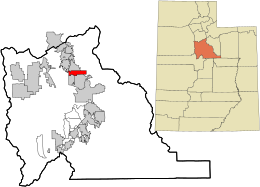

Lindon, Utah

Coordinates: 40°20′19″N 111°42′58″WCoordinates: 40°20′19″N 111°42′58″WCountryUnited StatesStateUtahCountyUtahSettled1850IncorporatedMarch 5, 1924Named forLinden treeArea

• Total8.54 sq mi (22.11 km2) • Land8.35 sq mi (21.63 km2) • Water0.19 sq mi (0.48 km2)Elevation

4,642 ft (1,415 m)Population

• Total10,070 • Estimate

11,100 • Density1,329.34/sq mi (513.27/km2)Time zoneUTC-7 (Mountain (MST)) • Summer (DST)UTC-6 (MDT)ZIP code

Area code801FIPS code49-45090[3]GNIS feature ID1442630[4]Websitewww.lindoncity.org

Lindon is a city in Utah County, Utah, United States. It is part of the Provo–Orem, Utah Metropolitan Statistical Area. The population was 10,070 at the 2010 census. In July 2019 it was estimated to be to 11,100 by the US Census Bureau.

[geocentric_weather id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_about id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_neighborhoods id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_thingstodo id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_busstops id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_mapembed id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_drivingdirections id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]

[geocentric_reviews id=”d16e6aa9-593a-450c-a7df-9db47d757bfc”]