If you are having a joint account holder and your partner files for bankruptcy it will not discharge your debts. There are many factors that determine how bankruptcy affects a joint account. The “discharge” of debt in a bankruptcy case only relieves the liability of the debtor who filed for bankruptcy. The joint account holder who has not received a discharge may still be liable for and legally obligated to the creditors. You should plan ahead for bankruptcy. By doing so, you can sort out the complex issues concerning joint accounts. If you are a joint account holder and you are planning to file for bankruptcy, speak to an experienced American Fork Utah Bankruptcy lawyer.

Co-signers

While a single person can only file for individual bankruptcy, a married couple can file a joint bankruptcy petition. Whether you file a joint bankruptcy petition or an individual petition, the effect of bankruptcy on co-signers are the same. In Chapter 7, the creditors can seek to recover the debt from the co-signer but Chapter 13 provides protection to the co-signer as long as the bankruptcy plan is active but once the plan closes, the creditors can seek to recover the debt from the co-signers. The effect of bankruptcy on co-signers also depends on the type of debt. The debt must be a consumer or personal debt and not a business debt. Also the co-signer can avoid liability if he or she can prove that he or she is not the recipient of any benefits from the debt proceeds.

Joint account holders

The liability of joint account holder in bankruptcy depends on various factors. A joint account holder who shares signing authority with the debtor is not liable, simply for that reason, for the debts. The debtor’s interest in a joint account is an asset of the bankruptcy estate. The liability of a joint account holder in bankruptcy can be reduced if the he or she can offer proof that only a certain amount of the money actually belongs to the debtor, or that the debtor’s name is on the account merely as a convenience and it is the joint account holder who really owns the account.

Debts incurred after bankruptcy filing

The joint account holders will not be liable for the debts incurred by the bankrupt after the filing of the bankruptcy petition. You should seek the advice of an experienced bankruptcy attorney if you have a joint account and you are considering filing for bankruptcy or your joint account holder is filing for bankruptcy.

You must plan ahead for bankruptcy. With proper planning and the right advice, a joint account holder and a co-signer can protect themselves if the other joint account holder or co-signer files for bankruptcy.

Cram Down Investment Property Debt with Bankruptcy

You can cram down a loan amount with bankruptcy. A major benefit of Chapter 13 bankruptcy is its cram down provision. Cram down is a court ordered reduction of the balance of a secured loan.

Cram down

Legally, it is possible to cram down a loan amount with bankruptcy. In a cram down, the bankruptcy court splits the outstanding mortgage balance into two parts. The amount of debt equal to the current appraised value of the security is treated as a secured claim, which the debtor must continue to pay. The amount of debt in excess of the current property’s value becomes an unsecured claim, which is usually not repaid in full.

Chapter 13

Debtors considering bankruptcy can file Chapter 13 on investment property. The Chapter 13 cram down provision allows debtors to retain collateral as long as they offer repayment of the secured claim or fair market value of the collateral in their repayment plan. If you have investment property, you should file Chapter 13 on investment property. The cram down provision has a threefold effect. First, it reduces the amount of the secured claim to the value of the property at the time the bankruptcy plan is confirmed. Second, it provides the debtor with more time to pay the loan. Third, it reduces the value of interest to the prime rate.

Use it to your advantage

If you have investment or rental property and you are considering bankruptcy, you should use the cram down provision to your advantage. You can reduce the investment or rental property mortgage with a cram down. All you need to do is keep the rental property under bankruptcy.

Filing for bankruptcy is a complex process. There are numerous forms to filled up and submitted. To avail of the Chapter 13 cram down provision, you must fill and submit the required forms. Even a small error can prevent you from availing the benefit of the cram down provision. Contact an experienced bankruptcy attorney. He or she can advise you on how to keep rental property under bankruptcy and reduce rental property mortgage with a cram down. You can cram down the debt by paying the current value of the security in full plus interest with the remaining balance paid as little as a penny for every dollar owed.

File Bankruptcy Before Using Retirement Funds

Using your retirement funds to prevent bankruptcy is not a wise idea. Do not exhaust your retirement funds before filing bankruptcy. Retirement accounts are exempt from bankruptcy.

Protection under law

The Employee Retirement Income Security Act of 1974 (ERISA) and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) provide federal protection for retirement assets upon bankruptcy. However, there can be significant differences in protection based on the type of retirement account.

Retirement Assets

Your 401k is exempt from bankruptcy. Your IRA is protected by bankruptcy. However if before filing bankruptcy, you use your retirement funds as a collateral for any debt, the creditor can come after your retirement funds. Until 2005, whether a retirement asset was exempt from bankruptcy depended whether the retirement plan holding the assets was an ERISA or a non-ERISA retirement plan. For non-ERISA retirement plans, the level of protection was determined by the laws of the debtor’s state of residence, while the protection for ERISA plans was based on federal law.

Choosing the right chapter

Individual debtors generally file for bankruptcy under Chapter 7 or Chapter 13. Chapter 7 is a liquidation process wherein the debtor’s assets are liquidated by the bankruptcy trustee to pay off the creditors. In Chapter 13 the debtor makes payments according to the payment plan approved by the creditors. In Chapter 13 the debtors retain the possession of his or her assets. You should seek legal bankruptcy advice from an experienced bankruptcy attorney to determine which of the two chapters is better suited for you. A business can also file for bankruptcy protection under Chapter 7. However a Chapter 7 bankruptcy is more drastic than a Chapter 11. When a business files for bankruptcy under Chapter 7 a bankruptcy trustee appointed by the bankruptcy court will take over the assets of the business and liquidate them to pay of the creditors of the business. Most large business file for bankruptcy protection under Chapter 11. Chapter 11 bankruptcy is a form of reorganization. Once you file your bankruptcy petition under any chapter of the bankruptcy code, the stay prevents your creditors from contacting you or continuing any collection activity against you. The creditors cannot file a lawsuit to collect the debt once the automatic stay in is operation. Consult with an Utah experienced bankruptcy attorney. The attorney can review your circumstances and adviser you on the chapter most suited for you.

Means Tests

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) introduced a means tests as a criteria for Chapter 7 filing. Debtors who do not pass the means tests may be eligible to file under Chapter 13. If you are considering bankruptcy, seek legal bankruptcy advice from an experienced Utah bankruptcy attorney. Chapter 13 is best suited if you have a regular source of income. A Chapter 13 proceeding can only be filed by individual debtors. To be eligible for filing under Chapter 13 of the bankruptcy code, you must be an employee, self employed or operating an unincorporated business. Chapter 13 is also referred to as the wage earner’s plan. To be eligible you must demonstrate that you have sufficient income after deducting certain slowed expenses to meet the repayment obligations under the Chapter 13 plan. Unlike a Chapter 7 bankruptcy where your non-exempt assets taken over by the bankruptcy trustee, you can keep your assets in a Chapter 13 bankruptcy. You must submit a payment plant to the bankruptcy court. In the payment plan, you must specify how you intend to pay off your debts. Filing under the wrong chapter can have serious consequences on the outcome of your bankruptcy proceeding. Don’t take chances. Seek the assistance of an experienced American Fork Utah Bankruptcy lawyer.

Automatic Stay

When you file for bankruptcy under Chapter 7 or Chapter 13, an automatic stay comes into operation by law. When the stay is in operation, creditors cannot contact you or initiate or continue collection activity. If you are facing foreclosure, you can use bankruptcy to stop foreclosure. The automatic stay stops foreclosure during the operation of the stay. You can to permanently stop a foreclosure with Chapter 13 bankruptcy. If you make payments according to the Chapter 13 plan and include your mortgage debt in the plan, you should be able to permanently stop foreclosure. A Chapter 7 bankruptcy will temporarily delay foreclosure while the U.S. Bankruptcy Court works out the details. It can buy you 45 to 75 days.

Bankruptcy is a complex process and is best left to the experts. If you are considering filing for bankruptcy, you should hire the services of a personal bankruptcy lawyer. The benefits of a personal bankruptcy lawyer are immense.

Why you need a personal bankruptcy lawyer

Before deciding to file bankruptcy yourself, ask a few questions.

1. Do you know the means test?

2. How long does it take to discharge a bankruptcy?

3. Do you know the Summary of Schedules?

4. Do you know the Schedule D, E or F?

When you are unable answer these questions without looking up information from the Internet, you are probably not ready to file bankruptcy yourself. These Schedules are just a small part of the filing process. A proper bankruptcy filing is necessary to protect assets from bankruptcy.

Bankruptcy lawyers are professionals

Bankruptcy lawyers are professionals who know how to work with the legal system to make the process of discharging debt as quick and painless as possible. There are few people like a bankruptcy lawyer who are knowledgeable enough about law to handle an immediate or emergency request for filing from the court and one minor error can lead to debts not being discharged or the bankruptcy being drawn out over months and months. The qualified bankruptcy advice you will get from an experienced American Fork Utah Bankruptcy lawyer can be priceless for pre-bankruptcy planning and for chalking out a successful bankruptcy strategy. The attorney will also help you choose the bankruptcy chapter most suited for you.

Benefits

If you are planning to file bankruptcy, it is important that you know about bankruptcy laws. The knowledge of these laws will help you to take informed decisions and facilitate you during the entire process, from the filing of bankruptcy to its discharge. A personal bankruptcy attorney can provide you with qualified bankruptcy advice. Planning and strategy are very important when filing bankruptcy. An experienced American Fork Utah Bankruptcy lawyer can assist you with pre-bankruptcy planning and to chalk out an effective bankruptcy strategy.

Getting legal help

Debt which is riding over your head can be discharged in bankruptcy and the fee of an attorney to handle the filing is nothing compared to the consequences on your personal life if bankruptcy proceedings go wrong. A proper bankruptcy filing will protect assets from bankruptcy. Although you can file bankruptcy yourself, don’t risk the potential negative outcome to save a few dollars.

American Fork Bankruptcy Lawyer Free Consultation

When you need legal help with a bankruptcy in American Fork Utah, please call Ascent Law LLC at (801) 676-5506 for your Free Consultation. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

American Fork, Utah

|

American Fork

|

|

|---|---|

The old city hall is on the National Register of Historic Places.

|

|

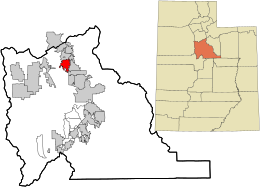

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°23′3″N 111°47′31″WCoordinates: 40°23′3″N 111°47′31″W[1] | |

| Country | |

| State | |

| County | Utah |

| Settled | 1850 |

| Incorporated | June 4, 1853 |

| Named for | American Fork (river) |

| Area | |

| • Total | 11.16 sq mi (28.90 km2) |

| • Land | 11.15 sq mi (28.87 km2) |

| • Water | 0.01 sq mi (0.02 km2) |

| Elevation

|

4,606 ft (1,404 m) |

| Population

(2020)

|

|

| • Total | 33,337 |

| • Density | 2,987.19/sq mi (1,154.73/km2) |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84003

|

| Area codes | 385, 801 |

| FIPS code | 49-01310[3] |

| GNIS feature ID | 1438194[4] |

| Website | www |

American Fork is a city in north-central Utah County, Utah, United States, at the foot of Mount Timpanogos in the Wasatch Range, north from Utah Lake. This city is thirty-two miles southeast of Salt Lake City. It is part of the Provo–Orem Metropolitan Statistical Area. The population was 33,337 in 2020.[5] The city has grown rapidly since the 1970s.

[geocentric_weather id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_about id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_neighborhoods id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_thingstodo id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_busstops id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_mapembed id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_drivingdirections id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_reviews id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]