Probate is a legal proceeding that has to do with managing an estate after someone dies, such as a family member or other relative. In Silver Summit, Utah, probate proceedings are conducted in the Superior Court in the county in which the decedent lived. Probate can take many months up to several years to complete. Probate laws are designed to ensure that creditors are appropriately paid and that heirs receive their inheritance. If you need help with legal matters associated with probate, contact a Silver Summit Utah estate planning attorney.

The process of “probate” begins with a petition to open the estate and name a personal representative (person responsible for managing the estate) who will handle the decedent’s property and assets. Following this step, an official “Notice of Creditors” will be printed in a local newspaper and a Notice of Administration will be sent to the parties who are involved. The creditors will have a specified amount of time to file their claims against the estate. Once the personal representative pays the debt, they can move forward by distributing the remaining assets belonging to the estate. Upon completion, a petition for discharge will be filed with the court and the estate will be subsequently closed. Even small estates can go into probate. In the Silver Summit, Utah estates valued over $100,000 are typically entered into probate. However, if the decedent was survived by a spouse, there is a possibility that it may not go into probate, unless the property includes real property valued more than $30,000.

Matters relating to estates can be volatile and contested amongst family members and other individuals involved. There is often times a lot at stake when a property goes into probate. If you anticipate encountering any sort of dispute with an estate entering probate, you should contact an estate planning attorney that you can trust. These are situations that will not only affect you, they will have a profound impact on your entire family. To ensure that this situation is carried out legally to make sure that all documents are binding, it is in your best interests to get the involvement of a knowledgeable lawyer from a local firm. When looking for such a firm, it is encouraged that you do your research and find a firm that has the experience, knowledge and reputation that you can rely on. This is not a situation that you can procrastinate so don’t wait – call a lawyer today!

Reasons Why You Need Estate Attorneys

If you’ve never thought about what services estate attorneys can provide or you just don’t understand why they’re important, you probably don’t understand why it’s vital to have an attorney help you through the estate planning process. Many people mistakenly think that planning is only for the very rich or those who have a lot of family members to divide things between. Instead, consider these three situations that call for assistance from a lawyer.

Call A Lawyer Before You Think You Need One

Many people wait until it’s absolutely necessary to have a will created — that is, they wait until they’re facing their own mortality. This is a wakeup call that urges someone to take action, but you shouldn’t wait! An accident or illness could hit you at any time, which could render you unable to express your wishes to your friends or family members. Professionally drafted legal documents can help make sure your friends and relatives understand what medical decisions you want made Use Estate Attorneys Even If You Don’t Have Any Direct Beneficiaries so they can follow your wishes exactly.

If you don’t have any family members still living, you probably don’t know why it’s important to have a will. Without directly related family members, such as a mother, father, siblings, aunts, uncles or grandparents, your assets could be divided between relatives you don’t know, and in some cases, relatives you’ve never even met! When you write a will with a professional lawyer, he or she will be able to help you determine where your assets will end up. This means that you’ll be able to decide to leave your assets to a favorite charity of your choice or even to a friend. A friend has no legal rights to your estate so if you want them to receive anything, you’ll need to take legal steps to make this happen.

Keep Your Family from Arguing after You’ve Passed

It’s an unfortunate truth that family members often argue and squabble over asset distribution after a loved one passes away. To help keep them from fighting amongst themselves, make sure that they understand what will happen with your belongings or your life insurance policy after you’re gone. Ask your estate attorneys to help you divide your holdings equally so that everyone is given an equal portion of your assets. It’s also important that your loved ones understand what should happen during your funeral services. If you want a specific type of service or have certain burial or cremation wishes, you should talk them over with your loved ones beforehand.

This will help ensure that your wishes are followed and will reduce the stress on your family members when they’re already worried and feeling overwhelmed. Whether you have an extensive estate or you simply need a cut and dried will to protect your family, estate attorneys are an important part of this process. To find an experienced one in your local area, talk to your coworkers, friends and family members to receive a personal recommendation.

Fiduciary

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients’ interests ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other’s best interests.

A fiduciary may be responsible for the general well-being of another (e.g. a child’s legal guardian), but often the task involves finances; managing the assets of another person, or a group of people, for example. Money managers, financial advisors, bankers, insurance agents, accountants, executors, board members, and corporate officers all have fiduciary responsibility.

A fiduciary’s responsibilities and duties are both ethical and legal. When a party knowingly accepts a fiduciary duty on behalf of another party, they are required to act in the best interest of the principal, i.e. the client or party whose assets they are managing. This is what is known as a “prudent person standard of care;” a standard that originally stems from an 1830 court ruling. This formulation of the prudent-person rule required that a person acting as fiduciary was required to act first and foremost with the needs of beneficiaries in mind. Strict care must be taken to ensure no conflict of interest arises between the fiduciary and their principal.

Fiduciary duties appear in a wide variety of common business relationships, including:

• Trustee and beneficiary (the most common type)

• Corporate board members and shareholders

• Executors and legatees

• Guardians and wards

• Promoters and stock subscribers

• Lawyers and clients

• Investment corporations and investors

• Insurance companies/agents and policyholders

Fiduciary Relationship Between Trustee and Beneficiary

Estate arrangements and implemented trusts involve both a trustee and a beneficiary. An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust. In estate law, the trustee may also be known as the estate’s executor. Note that the trustee must make decisions that are in the best interest of the beneficiary as the latter holds equitable title to the property. The trustee/beneficiary relationship is an important aspect of comprehensive estate planning, and special care should be taken to determine who is designated as trustee.

Politicians often set up blind trusts in order to avoid real or perceived conflict-of-interest scandals. A blind trust is a relationship in which a trustee is in charge of all of the investment of a beneficiary’s corpus (assets) without the beneficiary knowing how the corpus is being invested. Even while the beneficiary has no knowledge, the trustee has a fiduciary duty to invest the corpus according to the prudent person standard of conduct.

Fiduciary Relationship Between Executor and Legatee

Fiduciary activities can also apply to specific or one-time transactions. For example, a fiduciary deed is used to transfer property rights in a sale when a fiduciary must act as an executor of the sale on behalf of the property owner. A fiduciary deed is useful when a property owner wishes to sell but is unable to handle their affairs due to illness, incompetence, or other circumstances, and needs someone to act in their stead. A fiduciary is required by law to disclose to the potential buyer the true condition of the property being sold, and they cannot receive any financial benefits from the sale. A fiduciary deed is also useful when the property owner is deceased and their property is part of an estate that needs oversight or management.

Fiduciary Relationship Between Attorney and Client

The attorney/client fiduciary relationship is arguably one of the most stringent. The Silver Summit, Utah Supreme Court states that the highest level of trust and confidence must exist between an attorney and client and that an attorney, as fiduciary, must act in complete fairness, loyalty, and fidelity in each representation of, and dealing with, clients. Attorneys are held liable for breaches of their fiduciary duties by the client and are accountable to the court in which that client is represented when a breach occurs.

Fiduciary Relationship Between Principal and Agent

A more generic example of fiduciary duty lies in the principal/agent relationship. Any individual person, corporation, partnership, or government agency can act as a principal or agent as long as the person or business has the legal capacity to do so. Under a principal/agent duty, an agent is legally appointed to act on behalf of the principal without conflict of interest.

A common example of a principal/agent relationship that implies fiduciary duty is a group of shareholders as principals electing management or C-suite individuals to act as agents. Similarly, investors act as principals when selecting investment fund managers as agents to manage assets.

Investment Fiduciary

While it may seem as if an investment fiduciary would be a financial professional (money manager, banker, and so on), an “investment fiduciary” is actually any person who has the legal responsibility for managing somebody else’s money. That means if you volunteered to sit on the investment committee of the board of your local charity or other organization, you have a fiduciary responsibility. You have been placed in a position of trust, and there may be consequences for the betrayal of that trust. Also, hiring a financial or investment expert does not relieve the committee members of all of their duties. They still have an obligation to prudently select and monitor the activities of the expert.

The Suitability Rule

Broker-dealers, who are often compensated by commission, generally only have to fulfill a suitability obligation. This is defined as making recommendations that are consistent with the needs and preferences of the underlying customer. Broker-dealers are regulated by the Financial Industry Regulatory Authority (FINRA) under standards that require them to make suitable recommendations to their clients. Instead of having to place their interests below that of the client, the suitability standard only details that the broker-dealer has to reasonably believe that any recommendations made are suitable for the client, in terms of the client’s financial needs, objectives, and unique circumstances. A key distinction in terms of loyalty is also important:

A broker’s primary duty is to their employer, the broker-dealer for whom they work, not to their clients. Other descriptions of suitability include making sure transaction costs are not excessive and that their recommendations are not unsuitable for the client. Examples that may violate suitability include excessive trading, churning the account simply to generate more commissions, and frequently switching account assets to generate transaction income for the broker-dealer.

Also, the need to disclose potential conflicts of interest is not as strict a requirement for brokers; an investment only has to be suitable, it doesn’t necessarily have to be consistent with the individual investor’s objectives and profile. The suitability standard can end up causing conflicts between a broker-dealer and a client. The most obvious conflict has to do with compensation. Under a fiduciary standard, an investment advisor would be strictly prohibited from buying a mutual fund or other investment for a client because it would garner the broker a higher fee or commission than an option that would cost the client less or yield more for the client. Under the suitability requirement, as long as the investment is suitable for the client, it can be purchased for the client. This can also incentivize brokers to sell their own products ahead of competing for products that may cost less.

Suitability vs. Fiduciary Standard

If your investment advisor is a Registered Investment Advisor (RIA), they share fiduciary responsibility with the investment committee. On the other hand, a broker, who works for a broker-dealer, may not. Some brokerage firms don’t want or allow their brokers to be fiduciaries. Investment advisors, who are usually fee-based, are bound to a fiduciary standard that was established as part of the Investment Advisers Act of 1940. They can be regulated by the SEC or state securities regulators. The act is pretty specific in defining what a fiduciary means, and it stipulates a duty of loyalty and care, which means that the advisor must put their client’s interests above their own.

For example, the advisor cannot buy securities for their account prior to buying them for a client and is prohibited from making trades that may result in higher commissions for the advisor or their investment firm.

It also means that the advisor must do their best to make sure investment advice is made using accurate and complete information basically, that the analysis is thorough and as accurate as possible. Avoiding conflicts of interest is important when acting as a fiduciary, and it means that an advisor must disclose any potential conflicts to placing the client’s interests ahead of the advisors. Additionally, the advisor needs to place trades under a “best execution” standard, meaning that they must strive to trade securities with the best combination of low cost and efficient execution.

The Short-Lived Fiduciary Rule

While the term “suitability” was the standard for transactional accounts or brokerage accounts, the Department of Labor Fiduciary Rule, proposed to toughen things up for brokers. Anyone with retirement money under management, who made recommendations or solicitations for an IRA or other tax-advantaged retirement accounts, would be considered a fiduciary required to adhere to that standard, rather than to the suitability standard that was otherwise in effect.

The fiduciary rule has had a long and yet unclear implementation. Originally proposed in 2010, it was scheduled to go into effect between April 10, 2017, and Jan. 1, 2018. After President Trump took office it was postponed to June 9, 2017, including a transition period for certain exemptions extending through Jan. 1, 2018. Subsequently, the implementation of all elements of the rule was pushed back to July 1, 2019. Before that could happen, the rule was vacated following a June 2018 decision by the Fifth U.S. Circuit Court.

In June 2020, a new proposal, Proposal 3.0, was released by the Department of Labor, which “reinstated the investment advice fiduciary definition in effect since 1975 accompanied by new interpretations that extended its reach in the rollover setting, and proposed a new exemption for conflicted investment advice and principal transactions.”

It is yet to be seen if it will be approved under President Biden’s new administration.

Risks of Being a Fiduciary

The possibility of a trustee/agent who is not optimally performing in the beneficiary’s best interests is referred to as “fiduciary risk.” This does not necessarily mean that the trustee is using the beneficiary’s resources for their own benefit; this could be the risk that the trustee is not achieving the best value for the beneficiary.

For example, a situation where a fund manager (agent) is making more trades than necessary for a client’s portfolio is a source of fiduciary risk because the fund manager is slowly eroding the client’s gains by incurring higher transaction costs than are needed.

In contrast, a situation in which an individual or entity who is legally appointed to manage another party’s assets uses their power in an unethical or illegal fashion to benefit financially, or serve their self-interest in some other way, is called “fiduciary abuse” or “fiduciary fraud.”

Fiduciary Insurance

A business can insure the individuals who act as fiduciaries of a qualified retirement plan, such as the company’s directors, officers, employees, and other natural person trustees. Fiduciary liability insurance is meant to fill in the gaps existing in traditional coverage offered through employee benefits liability or director’s and officer’s policies. It provides financial protection when the need for litigation arises, due to scenarios such as purported mismanaging of funds or investments, administrative errors or delays in transfers or distributions, a change or reduction in benefits, or erroneous advice surrounding investment allocation within the plan.

Investment Fiduciary Guidelines

In response to the need for guidance for investment fiduciaries, the nonprofit Foundation for Fiduciary Studies was established to define the following prudent investment practices:

Step 1: Organize

The process begins with fiduciaries educating themselves on the laws and rules that will apply to their situations. Once fiduciaries identify their governing rules, they then need to define the roles and responsibilities of all parties involved in the process. If investment service providers are used, then any service agreements should be in writing.

Step 2: Formalize

Formalizing the investment process starts by creating the investment program’s goals and objectives. Fiduciaries should identify factors such as investment horizon, an acceptable level of risk, and expected return. By identifying these factors, fiduciaries create a framework for evaluating investment options.

Fiduciaries then need to select appropriate asset classes that will enable them to create a diversified portfolio through some justifiable methodology. Most fiduciaries go about this by employing the modern portfolio theory (MPT) because MPT is one of the most accepted methods for creating investment portfolios that target a desired risk/return profile. Finally, the fiduciary should formalize these steps by creating an investment policy statement that provides the detail necessary to implement a specific investment strategy. Now the fiduciary is ready to proceed with the implementation of the investment program, as identified in the first two steps.

Step 3: Implement

The implementation phase is where specific investments or investment managers are selected to fulfill the requirements detailed in the investment policy statement. A due diligence process must be designed to evaluate potential investments. The due diligence process should identify criteria used to evaluate and filter through the pool of potential investment options. The implementation phase is usually performed with the assistance of an investment advisor because many fiduciaries lack the skill and/or resources to perform this step. When an advisor is used to assist in the implementation phase, fiduciaries and advisors must communicate to ensure that an agreed-upon due diligence process is being used in the selection of investments or managers.

Step 4: Monitor

The final step can be the most time-consuming and also the most neglected part of the process. Some fiduciaries do not sense the urgency for monitoring if they got the first three steps correct. Fiduciaries should not neglect any of their responsibilities because they could be equally liable for negligence in each step. In order to properly monitor the investment process, fiduciaries must periodically review reports that benchmark their investments’ performance against the appropriate index and peer group, and determine whether the investment policy statement objectives are being met. Simply monitoring performance statistics is not enough.

Fiduciaries must also monitor qualitative data, such as changes in the organizational structure of investment managers used in the portfolio. If the investment decision-makers in an organization have left, or if their level of authority has changed, investors must consider how this information may impact future performance. In addition to performance reviews, fiduciaries must review expenses incurred in the implementation of the process. Fiduciaries are responsible not only for how funds are invested but also for how funds are spent. Investment fees have a direct impact on performance, and fiduciaries must ensure that fees paid for investment management are fair and reasonable.

Current Fiduciary Rules and Regulations

A Department of the Treasury agency, the Office of the Comptroller of the Currency, is in charge of regulating federal savings associations and their fiduciary activities in the Silver Summit, Utah. Multiple fiduciary duties may at times be in conflict with one another, a problem that often occurs with real estate agents and lawyers. Two opposing interests can at best be balanced; however, balancing interests is not the same as serving the best interest of a client.

Fiduciary certifications are distributed at the state level and can be revoked by the courts if a person is found to neglect their duties. To become certified, a fiduciary is required to pass an examination that tests their knowledge of laws, practices, and security-related procedures, such as background checks and screening.

While board volunteers do not require certification, due diligence includes making sure that professionals working in these areas have the appropriate certifications or licenses for the tasks they are performing.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estae Planning Attorney Salt Lake City Utah

Estate Planning Attorney Santa Clara Utah

Estate Planning Attorney Santaquin Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

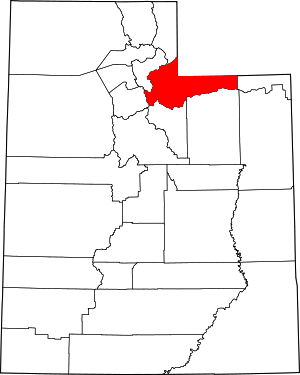

Summit County, Utah

Coordinates: 40.88°N 110.97°WCoordinates: 40.88°N 110.97°WCountry United StatesState

UtahFounded1854 (created)

1861 (organized)Named forThe summits of the mountainsSeatCoalvilleLargest cityPark CityArea

• Total1,882 sq mi (4,870 km2) • Land1,872 sq mi (4,850 km2) • Water10 sq mi (30 km2) 0.5%Population

• Total42,357 • Density23/sq mi (8.7/km2)Time zoneUTC−7 (Mountain) • Summer (DST)UTC−6 (MDT)Congressional district1stWebsitewww

Summit County is a county in the U.S. state of Utah, occupying a rugged and mountainous area. As of the 2010 United States Census, the population was 36,324.[1] Its county seat is Coalville,[2] and the largest city is Park City.

[geocentric_weather id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_about id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_neighborhoods id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_thingstodo id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_busstops id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_mapembed id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_drivingdirections id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]

[geocentric_reviews id=”8aeb5e93-7518-4007-94b1-8f43ac4d3c58″]