When the Mormons arrived in the Great Basin in 1847, they welcomed the opportunity to shape a virgin land into the Kingdom of God, and they pursued an aggressive colonization pattern. Heber Valley in the Wasatch Mountains, forty miles southeast of Salt Lake City and twenty-eight miles northeast of Provo, could not be settled until there was a wagon road through either Parley’s or Provo canyons. The first attempt to build such a road, however, was delayed by the Utah War and the Move South. Once Johnston’s Army was settled at Camp Floyd near Utah Lake, Brigham Young responded to appeals by residents of Provo to build a road up the canyon. By 1859 a road linked Provo and Heber Valley and newcomers who were looking for land settled the little valley communities of Heber City, Midway, Charleston, Center Creek, Daniels, and Wallsburg. The Heber City area economy depended on agriculture, livestock, and dairying. Once the Rio Grande Western railway track was completed in 1899, the city became a shipping center for agricultural products. For example, in 1915 the D&RGW could boast that Heber annually shipped 360 cars of sheep, 280 cars of hay, 40 cars of cattle, and 60 cars of sugar beets. As Heber grew, local residents and imports started hotels, retail stores, markets, lumberyards, banks, and other businesses.

The local weekly newspaper, The Wasatch Wave, began publishing in 1889. Elementary schools, middle schools, and eventually a high school trained the young. The local chamber of commerce was active in promoting the tourist industry and was pleased when U.S. Highway 40 passed through the community. In the 1990s Heber City continues as an agricultural center, an attractive place for tourists to visit, and a bedroom community for the Salt Lake and Utah valleys.

A divorce is the legal termination of a marriage by a court in a legal proceeding, requiring a petition or complaint for divorce (or dissolution in some states) by one party. There are two types of divorce– fault and no-fault. A fault divorce is a judicial termination of a marriage based on marital misconduct or other statutory cause requiring proof in a court of law by the divorcing party that the divorcee had done one of several enumerated things as sufficient grounds for the divorce. All states now have adopted some form of no-fault divorce; although some restrict the availability of no-fault divorce and retain fault divorce generally. A no-fault divorce is one in which neither party is required to prove fault, and one party must allege and testify only that either irretrievable breakdown of the marriage or irreconcilable differences between the parties makes termination of the marriage appropriate. Many states continue to offer a separation agreement or decree, under which the right to cohabitation is terminated but the marriage is not dissolved and the marital status of the parties is unaltered. State law governs divorces, so the petitioning or complaining party can only file in the state in which he/she is and has been a resident for a certain period of time, which varies by state. The most common issues in divorces are division of property, child custody and support, alimony (spousal support), child visitation and attorney’s fees. Only state courts have jurisdiction over divorces, so the petitioning or complaining party can only file in the state in which he/she is and has been a resident for a period of time.

In most states, the legal process of the divorce procedures takes some time, to allow for a chance of reconciliation. The divorce decree is a court order that states the rights and responsibilities of the divorced parties, including the basic information regarding the divorce, case number, parties, date of divorce, and terms the parties have agreed upon. Sexual relations with anyone other than your spouse is still a crime in many states, even if the married couple is seeking a divorce. The judge has a great deal of discretion in custody cases and in awarding or restricting visitation rights. Extramarital sexual relations before divorce may be used as evidence of marital misconduct during the marriage. Also, cohabitation with another person may be a factor in reducing support payments received.

Divorce and Your Finances – The Most Costly Mistakes

Mistake #1: Not Knowing the Liquidity of Assets

Liquidity refers to the ability to access the cash value of an asset. For example, a bank savings account is highly liquid, because you can simply withdraw funds from an ATM when you need them. An antique automobile, however, is nearly illiquid because it is very difficult to quickly sell this asset to access the actual cash value. Often in a divorce settlement, one party will receive mostly illiquid assets, including the home, while the other party receives liquid assets such as retirement plans, brokerage accounts etc. On the surface, this scenario may appear to be equitable assuming that the home and other assets are of approximately the same value. However, the challenge lies in cash flow. How will the party that keeps the home pay the bills if his or her major asset is illiquid? One can borrow against the equity of the home, but that’s costly (closing costs, interest etc.) and it takes time to close the loan. In worst-case scenarios, the home must be sold, a smaller home is purchased and the remaining equity is utilized for living expenses. If your proposed financial settlement has very little liquidity, be sure that you will have enough cash flow throughout the years to handle your living expenses. If not, you may have to consider selling the home, other assets or significantly decrease your expenses in order to meet your budgetary needs.

Failure to Consider the Impact of Taxes

The effect of your settlement on various taxes can be very costly if not addressed thoroughly. Capital gains, income tax, and alimony are just a few of the areas that may be impacted. Capital gains taxes need to be analyzed when property is being divided. Capital gains refer to the fair market value of an asset minus its cost. For example, if you paid $5 for a share of stock and it is now worth $25, you have a capital gain of $20. This applies to other assets such as real estate (including your home), mutual fund accounts and just about any investment that has appreciated in value. Be very careful that the property you are receiving in a settlement does not have large capital gains as compared with your ex-spouse’s property. Don’t be fooled if your spouse offers you property of equal value but conveniently forgets to inform you of the tax liability.

Filing status is an important decision after the divorce. If you were still married on 12/31 of the tax year, you have the option of filing a joint return. If you can peacefully deal with your spouse after the divorce, you should consider this option as it could save considerable tax for both parties. (Here are some divorce tax tips if you don’t trust your husband’s accounting.)

Mistake #3: Not Understanding the Rules of Retirement Accounts

Retirement accounts are a tax related issue, but their complexity merits a separate category. If a large portion of your settlement consists of retirement assets, you need to be aware of the many tax ramifications and potential penalties involved. Normally, distributions from a retirement plan prior to age 59 1/2 are considered “early distributions” and are subject to a 10% penalty tax as well as ordinary income tax. An exception to this rule, however, is a transfer to an ex-spouse as part of a divorce settlement. A Qualified Domestic Relations Order (QDRO) is used to affect this transfer. Income taxes still apply, so any assets you receive from a “qualified plan”, such as a 401(k), will be subject to a mandatory 20% tax withholding. To avoid this mandatory withholding, the transfer must be made directly to another retirement account, such as your own IRA. Once the assets are in your retirement account, you are now subject to the early distribution rules. If you need some of the assets to live on, or pay bills, make sure you take them out prior to transferring them to an IRA to avoid the 10% penalty.

Mistake #4: Overlooking Debt and Credit Rating Issues

Nothing is worse than starting out a new life with bad credit. Several steps can be taken during the divorce process to minimize the chances of this occurring. First, obtain a copy of your credit report. This will identify all joint accounts, accounts you may not have been aware of, and any potential credit problems. Next, be sure to pay off and close all joint accounts prior to the divorce settlement and open new accounts in your own name. Unfortunately, creditors don’t care how a separation agreement divides responsibility for joint debt (joint credit cards, auto loans etc.). Each person is liable for the full amount of debt until the balance is paid, hence the importance of dealing with this issue prior to your divorce. Regarding income tax debt, even if the divorce is final, you may not be exempt from future tax liability. For 3 years after a divorce, the IRS can perform a random audit of a divorced couple’s joint tax return. If it has good cause, the IRS can question a joint return for seven years. To avoid any potential problems down the road, your divorce agreement should have provisions that spell out what happens if any additional penalties, interest or taxes are found as well as where the funds come from to pay for any expenses associated with an audit.

Not Maintaining Control over Insurance Policies

Most divorce decrees call for one of the parties to obtain a life insurance policy to insure the value of alimony payments, child support or some other financial need. If you are the person for whom the insurance is obtained, it is critical that you are either the owner or irrevocable beneficiary of the policy. If you are not, the ex-spouse who took out the policy could easily stop making payments and you would never know about it until the policy is needed and it no longer exists. This could be financially devastating. As the owner or irrevocable beneficiary, you would be notified of any outstanding issues with the policy, such as non-payment of the premium, and could therefore take action and prevent the policy from lapsing or being cancelled.

Mistake #6: Failure to Budget

One of the most common mistakes made post-divorce is the failure to budget based on one’s new lifestyle. We see this happen most often when one spouse keeps the home for the sake of the children or perhaps due to an emotional attachment. Because of the high value of the home, there are few other assets awarded in the settlement. The expense of maintaining the home and the lack of liquid assets often results in a rapid depletion of cash, leaving no choice but to sell the home. This scenario can be avoided if you take a good hard look at your expenses versus liquid assets and income. A Certified Divorce Financial Analyst can help you project several years into the future and determine if you’ll have enough resources to support your current lifestyle as well as your retirement years. This analysis should be completed prior to a settlement. If it is determined that you will be unable to maintain your lifestyle with the proposed offer, you have established a good case to request more assets, alimony or child support.

Mistake #7: Failure to Identify Hidden Assets

Hopefully, you’re not in a situation where you distrust your spouse and fear there are hidden assets that should be included in the settlement. Unfortunately, once a divorce is initiated, many individuals will do whatever they can to preserve what they feel is their own money. Some individuals maintain secret accounts or other financial activities throughout an entire marriage. If these assets are not exposed, one spouse is certain to obtain an unfair settlement. There are multiple resources and methods used by financial professionals and attorneys to uncover potential hidden assets. Being aware of these may help you avoid being victimized by a dishonest spouse. Forensic accountants are generally the most commonly utilized professionals to assist in this area.

• Tax returns are one of the best places to start. Most people are uneasy about misleading the IRS for fear of penalties, fines and even prison. Go back at least 5 years to look for any inconsistencies in income, the presence of trusts, partnerships or real estate holdings.

• If your spouse is a business owner, corporate or partnership returns may show a change in salary, charging personal expenses to the company, or excessive retained earnings. Another common trick is to put a “friend” on the payroll, who agrees to give back the money paid to him after the divorce. A forensic tax professional is of tremendous help in this area.

• Checking account statements and cancelled checks for the past few years can also be quite revealing. A cancelled check for a purchase you never knew about, such as an investment property, can make a substantial difference in total assets to be divided.

• Savings accounts may reveal unusual deposits or withdrawals in amount or pattern that could point to a hidden asset such as a dividend producing investment. In addition, cash may be hidden almost anywhere.

• Brokerage statements are valuable in tracking the purchase and sale of securities. If securities are sold and the proceeds are not accounted for, you can be sure that the assets are out there somewhere.

• Expense accounts can be abused when corporations give employees a great deal of leeway in their expense account reporting. Cross checking between expense account disbursements and savings/checking account deposits may indicate a pattern of abuse if the deposits exceed legitimate business expenditures.

• Children’s bank accounts may be opened as a custodial account for the intent of hiding assets as well. In some of these cases, interest is not reported as income on tax returns, and no return is filed for the children. This is not an exhaustive list of places to look for hidden assets. If you suspect this is occurring, you owe it to yourself to seek help from a financial professional or forensic accountant.

Heber City Divorce Lawyer

When you need a divorce attorney in Heber City Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How To Administer An Estate In Utah

Criminal Defense Lawyer Lehi Utah

How Many Years Do You Have To Be Married To Get Alimony?

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

Heber City, Utah

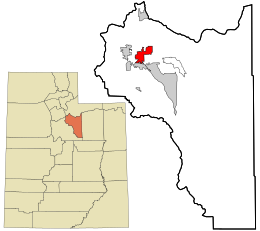

Coordinates: 40°30′24″N 111°24′44″WCoordinates: 40°30′24″N 111°24′44″WCountryUnited StatesStateUtahCountyWasatchSettled1859Named forHeber C. Kimball[1]Area

• Total8.99 sq mi (23.29 km2) • Land8.99 sq mi (23.29 km2) • Water0.00 sq mi (0.00 km2)Elevation

5,604 ft (1,708 m)Population

• Total16,856 • Estimate

17,082 • Density1,899.27/sq mi (733.33/km2)Time zoneUTC-7 (Mountain (MST)) • Summer (DST)UTC-6 (MDT)ZIP code

Area code435FIPS code49-34200[5]GNIS feature ID1455878[6]Websiteheberut.gov

Heber City is a city and county seat of Wasatch County, Utah, United States. The population was 11,362 at the time of the 2010 census. It is located 43 miles southeast of Salt Lake City.

[geocentric_weather id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_about id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_neighborhoods id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_thingstodo id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_busstops id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_mapembed id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_drivingdirections id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_reviews id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]