Probate refers to the process whereby certain of decedent’s debts may be settled and legal title to the decedent’s property held in the decedent’s name alone and not otherwise distributed by law is transferred to heirs and beneficiaries. If a decedent had a will, and the decedent had property subject to probate, the probate process begins when the executor, who is nominated by the decedent in the last will, presents the will for probate in a courthouse in the county where the decedent lived, or owned property. If there is no will, someone must ask the court to appoint him or her as administrator of the decedent’s estate. Often, this is the spouse or an adult child of the decedent. Once appointed by the court, the executor or administrator becomes the legal representative of the estate.

You start by asking the probate court to name you executor or personal representative, whichever term is used in your state. If there’s no will, in some states you’ll ask to be the “administrator.” To make this request, you will probably need to file an application, death certificate, and the original will (if you haven’t deposited it with the court already) with the local probate court in the county where the deceased person was living at the time of death. The document in which you make your request will probably be called a petition or application. It must contain certain information, such as the date of death, names of surviving family members and of beneficiaries named in the will, and so on. Many courts provide fill-in-the-blanks forms; if yours doesn’t, you’ll have to type something up from scratch. (Every probate court has its own rules about the documents it requires.) If the deceased person owned real estate in more than one county in the same state, you can handle it all in one probate. There’s no need to conduct a separate probate proceeding in the other county.

When a property owner dies, his assets must be distributed to the people that are named in the decedent’s will or are the decedent’s heirs under state law. Many of the decedent’s assets go through the “probate process,” which is a court supervised process that includes proving the authenticity of the deceased person’s will, appointing an executor to handle the estate, inventory of the decedent’s property, paying debts and taxes, identifying heirs, and distributing the decedent’s property according to the will or state law if there is no will. Keep reading to learn how to start the probate process.

Probate Paperwork: Where to Look

In the house, start your sweep by checking the most obvious places. These include filing cabinets, fireproof lock boxes (which may be hidden in a closet or under a bed) and recent mail. Important probate paperwork may also be in a safe-deposit box at the deceased person’s bank or credit union. Some people have their attorney hold the original copy of their Will, so it’s worth finding out if the person had an attorney and contacting them. If you know the decedent’s passwords, you may also be able to log into their online accounts and review financial account information. If you’re unable to find the records you need, expand your search. Look under beds and through drawers in the house. Call trusted friends and family members who may know the whereabouts of those documents or may have been asked to keep a copy of the Will. For example, there may be shares in the Estate to sell through a stockbroker or share registrar which can be time consuming, with forms to be completed and signed by the Executors/Administrators. Or share certificates can be lost and unless they are held electronically then a search for them will have to be made; otherwise costs to the Estate will be incurred in order to replace them. Another common cause of delay is a potential Beneficiary being missing, where the close relatives of the deceased do not know the whereabouts of someone who has been named as a Beneficiary in the Will. In these circumstances reasonable investigations have to be carried out, usually by using a tracing agent in an attempt to find them. If the deceased owned a property that needs to be sold, obtaining a Grant of Probate is crucial. But finding a buyer for a Probate property that needs to be sold can take much longer and can often cause delays. Foreign assets will also add time to the process. Should there be a property abroad that needs to be sold, the acting Personal Representative have to sell that property by instructing foreign estate agents and lawyers. The Personal Representative must also comply with different requirements to issue notifications regarding the death and obtain the necessary permissions to sell the property. Another common reason for distribution to take a long time is if the Department for Work and Pensions (DWP) makes an investigation into any benefits the deceased may have been in receipt of. This will usually add a further 6 to 9 months before the final sum due back to them is confirmed as a liability of the Estate. If an insurance policy forms part of the Estate, the insurer has discretion as to whom they pay out to. Often a lot of questions will be asked of potential Beneficiaries and the circumstances of the death. Individual assets include all property titled in the decedent’s sole name without co-owners or payable-on-death and beneficiary designations. They commonly include bank accounts, investment accounts, stocks, bonds, vehicles, boats, airplanes, business interests, and real estate. They can also include personal property that may or may not have much value, such as artwork, memorabilia, and electronics. Holding title to property as tenants in common can’t typically avoid probate, at least not without a little help. If your loved one has died and you owned property together as tenants in common, certain laws and rules determine who will inherit his ownership interest.

Review and Sign the Documents Required to Open the Probate Estate

Once the estate lawyer has enough information to draft the court documents required to open the probate estate, the Personal Representative/Executor and, if applicable, the beneficiaries named in the decedent’s Last Will and Testament or heirs at law will be required to review and sign the appropriate documents. While these legal documents will vary from state to state, or even from county to county within the same state, they will generally include the following:

• Petition for Probate Administration

• Oath and Acceptance of Personal Representative/Executor

• Appointment of Resident Agent

• Joiners, Waivers, and Consents

• Petition to Waive Bond

• Order Admitting Will to Probate

• Order Appointing Personal Representative/Executor

• Order Waiving Bond

• Letters of Administration/Letters Testamentary

Hiring a Probate Lawyer: With a Will In West Valley City

The process will likely go smoother when the decedent has drafted a will prior to his or her death. If an individual dies with a will, a probate lawyer may be hired to advise parties such as the executor of the estate or a beneficiary on various legal matters. For instance, an attorney may review the will to ensure the will wasn’t signed or written under duress (or against the best interests of the individual). Elderly people with dementia, for example, may be vulnerable to undue influence by individuals who want a cut of the estate. There are numerous reasons that wills may be challenged, although most wills go through probate without a problem. Additionally, a probate attorney may be responsible for performing any of the following tasks when advising an executor:

• Collecting and managing life insurance proceeds;

• Getting the decedent’s property appraised;

• Finding and securing all of the decedent’s assets;

• Advising on how to pay the decedent’s bills and settle debts;

• Preparing/filing documents as required by probate court;

• Managing the estate’s checkbook; and

• Determining whether any estate taxes are owed.

Hiring a Probate Lawyer: Without a Will

If you die without having written and signed a will, you are said to have died “intestate.” When this happens, your estate is distributed according to the intestacy laws of the state where the property resides, regardless of your wishes. For instance, the surviving spouse receives all of your intestate property under many states’ intestate laws. However, intestacy laws vary widely from state to state. In these situations, a probate lawyer may be hired to assist the administrator of the estate (similar to the executor) and the assets will be distributed according to state law. A probate lawyer may help with some of the tasks listed above but is bound by state intestacy laws, regardless of the decedent’s wishes or the family members’ needs. A relative who wants to be the estate’s administrator must first secure what are called “renunciations” from the decedent’s other relatives. A renunciation is a legal statement renouncing one’s right to administer the estate. A probate attorney can help secure and file these statements with probate court, and then assist the administrator with the probate process (managing the estate checkbook, determining estate taxes, securing assets, etc.).

Benefits of Working with a Probate Attorney

When a loved one dies, the profound sense of loss can overwhelm you. It’s important to take time to heal. You should step back from your job duties and household responsibilities. It’s essential to maintain a connection with family and friends. And if you’re the executor or executrix of your loved one’s estate, or if they had no will, you should seek professional guidance and assistance from a probate attorney. When you’re in charge of handling an estate, you must navigate the probate court system and comply with court guidelines and schedules. You’ll execute complicated will provisions, create complex court required documents, obtain a federal tax identification number, secure a probate bond and manage funds. Even minor estate matters can present added burdens when you’re least prepared to handle them. It’s not a time for a DIY legal fix. Consider these benefits of working with a probate attorney In west Valley City.

• Your probate specialist: Any attorney can agree to handle your probate case, but only probate attorneys are dedicated probate specialists. They don’t negotiate injury claims or defend criminal matters. Probate attorneys resolve probate and trust cases only. They know probate court rules, forms, procedures, court officials, and probate complications. They perform the same tasks and see different versions of the same issues every day so they understand what’s critical to your case.

• No upfront fees: You don’t have to pay a retainer or any other attorney fees to get your case moving forward. Your probate attorney will eventually receive payment for services but only after the case is finalized. Probate legal fees are approved by the court and paid out of the proceeds of the estate. You’ll never have to worry about budgeting for legal expenditures.

• Time to connect with family: Estates can be complicated and time-consuming. The process can seem like an endless stream of details, documents, and court requirements. The activity can take you away from friends and family members when they need you most. Probate attorneys shoulder these responsibilities on your behalf and keep you apprised of the details. If your attorneys require an answer or an action from you or need to inform you of a hearing or procedure, they keep you notified.

• Faster Resolution: If you attempt to administer an estate without professional help, you’ll eventually learn by trial-and-error. You’ll get it done, but it’s not a prudent, efficient, or timely way to handle such an important matter. Probate cases involve a lot of details. Your best effort can translate into a long, drawn-out, frustrating process. Probate attorneys don’t have that learning curve. They have the knowledge and experience to expedite the process and that can make a big difference in your peace of mind

• Freedom from liability: With so many details to master, it’s easy for an inexperienced administrator to make a mistake. If you fail to properly marshal assets, pay heirs or creditors or perform other required tasks, you may be financially liable for your inadvertent error. Your probate attorneys can perform these tasks more accurately and efficiently. And if they commit an error, they assume the responsibility instead of you.

• Minimal disputes: Estate cases sometimes trigger disputes that end up in litigation. The resultant court cases can take years to resolve. The legal fees and expenses can reduce the estate’s value. Probate attorneys minimize the chance of disputes by handling cases in the most efficient, effective, professional, and timely manner.

• You Need a Probate Professional: When you’re responsible for administering an estate, the added responsibilities can monopolize your time. In the absence of a will, the process can become even more complicated Probate attorneys can minimize problems, expedite the process, and give you more time to care for your family. The purpose of probate is to prevent fraud after someone’s death. Imagine everyone stealing the castle after the owner dies. It’s a way to freeze the estate until a judge determines that the Will is valid, that all the relevant people have been notified, that all the property in the estate has been identified and appraised, that the creditors have been paid and that all the taxes have been paid. Once all of that’s been done, the court issues an order distributing the property and the estate is closed.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney Brigham City Utah

Estate Planning Attorney Cedar City Utah

Probate Lawyers Taylorsville Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

West Valley City, Utah

|

West Valley City, Utah

|

|

|---|---|

| City of West Valley City | |

The Maverik Center in West Valley City, home of the Utah Grizzlies ice hockey team.

|

|

| Motto:

“Progress as promised.”[1]

|

|

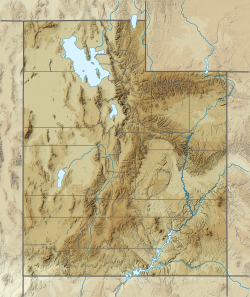

Location within Salt Lake County

|

|

| Coordinates: 40°41′21″N 111°59′38″WCoordinates: 40°41′21″N 111°59′38″W | |

| Country | |

| State | |

| County | Salt Lake |

| Settled | 1847 |

| Incorporated | 1980 |

| Government

|

|

| • Mayor | Karen Lang [2] |

| Area | |

| • Total | 35.88 sq mi (92.92 km2) |

| • Land | 35.83 sq mi (92.79 km2) |

| • Water | 0.05 sq mi (0.14 km2) |

| Elevation

|

4,304 ft (1,312 m) |

| Population | |

| • Total | 140,230 |

| • Density | 3,913.76/sq mi (1,511.11/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| Area code(s) | 385, 801 |

| FIPS code | 49-83470[5] |

| GNIS feature ID | 1437843[6] |

| Website | www |

West Valley City is a city in Salt Lake County and a suburb of Salt Lake City in the U.S. state of Utah. The population was 140,230 at the 2020 census,[4] making it the second-largest city in Utah. The city incorporated in 1980 from a large, quickly growing unincorporated area, combining the four communities of Granger, Hunter, Chesterfield, and Redwood. It is home to the Maverik Center and USANA Amphitheatre.

[geocentric_weather id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_about id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_neighborhoods id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_thingstodo id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_busstops id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_mapembed id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_drivingdirections id=”02b3d746-3bff-4387-9149-f206cfe1d375″]

[geocentric_reviews id=”02b3d746-3bff-4387-9149-f206cfe1d375″]