Most of us, at one time or another, must take on the responsibility of wrapping up the affairs of a loved one who has died. The essence of the job is to carry out the deceased person’s wishes to collect the person’s assets, pay debts and taxes, and distribute what’s left to the people or institutions the person wanted to inherit it. That’s how an estate is “settled.” Because an executor is in charge of someone else’s money, the law imposes a high ethical standard. An executor (also called personal representative) must be completely honest and always act in the best interests of the estate. You must also deal with the people who inherit under the terms of a will or, if there isn’t a will, under state law. And if necessary, you must shepherd the estate through probate court proceedings, probably with the help of an attorney and other experts. If you need expert advice, you can hire professionals, and pay them from estate assets. Estate settlement requires a broad range of skills and carries a long list of responsibilities, from preparing and filing taxes to resolving conflicts among beneficiaries. It also carries significant legal liabilities and requires a commitment of time and energy; it can take as much as two years to settle even the most straightforward estates.

Find The Will, If Any.

Sometimes finding the will is easy and sometimes it’s not. Look in desks and filing cabinets (home and office), fireproof boxes, and anywhere else the deceased person was likely to stash important documents. If there’s a safe deposit box, even if you don’t have a key you will be allowed to open it for the sole purpose of looking for the will. If there is no will, property will pass through intestate succession.

File The Will With The Local Probate Court.

Make a copy for yourself, and then file the original with the probate court. Even if you don’t think you’re going to need to conduct a formal probate court proceeding, you’re required by law to deposit the will with the court.

Notify Agencies And Business Of The Death.

For example, you should notify:

• the post office

• utility companies

• credit card companies

• banks, and

• Other businesses with whom the deceased person had an account.

Communicate With Beneficiaries.

Your court, or a lawyer, can help you notify beneficiaries. If the estate goes through probate, you’ll have to send very particular kinds of notices to a certain group of people. Whether or not there’s a court proceeding, it’s always a good idea to be in regular communication with beneficiaries. Beneficiaries can grow unhappy or suspicious of wrongdoing when they aren’t kept in the loop about what’s going on with the estate. Even if nothing is going to happen for a while, let them know you’re moving ahead as fast as you can to get them their inheritance. Don’t surprise them with big moves like selling real estate if they think you’re incompetent or dishonest, they can go to court and try to have you removed.

Take Good Care Of Estate Assets.

This is a key part of an executor’s job. You must keep real estate well maintained, small valuables secure, and everything of value insured. Keep investments safe, the goal is to avoid losing money, not to reap big returns.

Collect Money Owed To The Estate.

This will take some time to fill out paperwork and make phone calls, but it should be pretty straightforward. You can deposit the money you collect in the estate bank account.

Pay Bills Owed By The Estate.

You’re responsible for paying legitimate bills, as there is enough money in the estate to pay them. You don’t have to pay the deceased person’s debts out of your own pocket. If you think there won’t be enough money to go around, stop paying bills and get some guidance from the court or an attorney about which debts should take priority.

Deal With Taxes.

You’ll need to file income tax returns for the deceased person and possibly for the estate. The deceased person’s tax preparer can be a big help here. If the estate was very large over $5 million you may also need to file estate tax returns. Smaller estates may owe a separate state estate tax; it all depends on where the deceased person lived and owned property.

Distribute The Assets.

When the debts and taxes are paid, when the probate (if any) is closed, your last job is to distribute property to the people who inherit it under the will or state law. (Then congratulate yourself for a job well done.) Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who’s familiar with local probate procedure. But if you’re handling an estate that’s straightforward and not too large, you may find that you can get by just fine without professional help. Most or all of the deceased person’s property can be transferred without probate. The best-case scenario is that you don’t need to go to probate court, because assets can be transferred without it. This depends on the planning the deceased person did before death-you can’t affect it now. But you won’t need probate if all estate assets are held in joint ownership, payable-on-death ownership, or a living trust, or if they pass through the terms of a contract (like retirement accounts or life insurance proceeds). The estate qualifies for simple “small estate” procedures. No probate is best, but simple or “summary” probate is better than regular probate. Whether or not the estate qualifies for the summary procedure depends on state law. A few states let estates worth a couple of hundred thousand dollars not counting non-probate assets use the simpler process. If probate is necessary, the state has a relatively simple process. Probate is easier in states that have adopted the Uniform Probate Code (a set of laws designed to streamline probate) or have simplified their own procedures. The estate doesn’t contain a business or other complicated asset. Managing, appraising, and selling a business are all tasks that require some expertise and experience. You’ll probably want expert advice.

How Can I Avoid the Probate Process?

There are a few different ways to distribute a decedent’s estate that does not involve the probate process. Some of these include:

• Joint Tenancy: This is a type of property ownership in which two or more people own part of a property. When a joint tenant dies, the remaining joint tenants inherit the decedent’s share of the property, as opposed to the decedent’s heirs inheriting the share. Joint tenancy is typically associated with the legal co-ownership of a home, car, or bank account. The property’s co-owner automatically receives full ownership of the asset without having to first go through the probate process in order to pass the title. There are specific conditions that must be met for joint tenancy to exist;

• Life Insurance Policies: Life insurance policies in which a person pays a premium each year and names a beneficiary may circumvent the probate process. The named beneficiary automatically receives the life insurance policy benefits and payout when the policyholder dies; and

• Trusts: Trusts involve transferring the legal title of an asset to a trustee. When the estate owner dies, the named trustee is bound to distribute the decedent’s property according to the terms of the trust.

Pros and Cons of Avoiding the Probate Process

The main advantage to avoiding probate is cost. Probate costs generally include attorney’s fees, and can be costly, especially if the decedent owns property in a different state. This is due to the fact that probate proceedings would be required in both states, although a trust would likely correct this problem. Trusts can also be tailored to meet specific requests, which is not necessarily true of the probate process. Because the execution of a trust is much less formal than that of a will, the terms of a trust can easily be changed to suit the needs of the estate. Another advantage to avoiding the probate process is that the process can be complicated, as well as time consuming. Probate can take up to several years to completely resolve all matters related to the decedent’s estate. Avoiding the process can help settle things more quickly. Another advantage to avoiding the probate process is privacy. Wills and probate proceedings are matters of public record.

If you would prefer to keep your affairs private, and that people not involved do not know how your estate was distributed, you will need to distribute your estate through a trust or some other estate planning mechanism. There are some disadvantages to avoiding probate that you should consider. In general, it costs slightly more to create and fund a trust than it does to create a will. However, as previously mentioned, it could save money in the long run by avoiding paying probate costs out of the estate. Additionally, in order to completely avoid the probate process, you must carefully place all new assets you obtain into the trust. Otherwise, probate may still be necessary. Finally, taxes can be a bit higher for the first years after your death if the estate is distributed through a trust, as opposed to a will. As with any estate planning, you should consult with a skilled and knowledgeable probate attorney. An experienced probate attorney can ensure you understand your state’s laws regarding probate and estate distribution, as well as advise you of your best estate planning options. Additionally, an estate attorney can also advise you regarding the best possible estate plan suited for your needs and the size of your estate. Finally, an attorney can represent you in court, should any dispute arise.

Advantages of Estate Planning

Taking care of your family has always been the number one priority in your life, and that isn’t going to change. The best way to make sure they are taken care of after you pass is to establish an estate plan while you are still of sound mind. Here are the advantages of creating an estate plan:

• Provide for your immediate family: The estate plan will provide enough money for your surviving spouse to continue to care for the family. If both you and your spouse pass, an estate plan will name appointed guardians to care for your children.

• Ensure property goes to the right beneficiaries: Your estate plan will outline exactly where your assets are to go in the event of your death. This leaves no questions to be resolved by the courts or cause for family discord.

• Minimize the expenses and taxes: When you take care to create an estate plan, you should be able to keep the cost of transferring any property to your named beneficiaries.

• Ease the burdens of your family: It can be difficult to plan the funeral of a loved one when grieving. When working on your estate plan, you can outline your wishes for funeral arrangements and even set aside funds for them. This takes some of the burden off your family during this difficult time.

• Support a favorite cause: If you are passionate about a local cause or charitable organization, an estate plan can allow you to support them after your passing.

• Plan for any kind of incapacity: Life is unpredictable. If you should ever become mentally or physically incapacitated, an estate plan will outline your wishes regarding life and who will make medical decisions on your behalf.

• Reduce taxes that take place on your estate: By crafting an estate plan, you should be able to minimize the amount of taxes collected on your estate, which results in your beneficiaries keeping more of the money you set aside for them.

• Establish trustees over your estate: You’ll need someone to serve as the executor of your estate to make sure everything is handled properly. Your estate plan will name this person, which will save money and simplify the administration process.

• Provide for those who many need help: Do you have a child who has a disability? Or perhaps you have grandchildren who will be attending college in the future. Through your estate plan, you can set up a special trust to provide funds to support them.

• Ensure a business continues with a succession plan: If you own your own business, you’ll want to establish some kind of plan to keep it going after you pass. An estate plan will name your successor and outline what happens to your interest in the business.

Disadvantages of Estate Planning

• Loss of control: Once an asset is in the irrevocable trust, you no longer have direct control over it. However, in the case of a husband and wife, it is possible to create separate trusts for each, thereby collectively maintaining control. There are many pitfalls with this technique, such as observance of the Reciprocal Trust Doctrine, so this strategy should only be employed with the assistance of a skilled estate planning attorney.

• Fairly Rigid terms: Irrevocable trusts are not very flexible. Once the terms are established, they can be difficult to change.

• The Three-Year Rule: If you include life insurance in an irrevocable trust and pass away within three years, the proceeds return to your estate and become taxable.

• The Five-Year Rule: If you put assets in an irrevocable trust and need Medicaid within a five-year period, you may have to repay all prior transfers to the trust by covering the costs of a nursing home privately. Only after you have repaid all gifted assets will you be eligible for Medicaid.

The Estate Planning Process

• Create an inventory of what you own and what you owe: Compile a comprehensive list of your assets and debts, including account numbers and contact information, as well as names and contact information for your important advisers. Keep the summary in a secure, central location along with original copies of important documents and provide a copy of the summary for the executor of your will. This list could be a piece of paper or also a digital file kept in a secure location.

• Develop a contingency plan: An estate plan allows you to control what would happen to your property and assets if you or your spouse passed away today. It also puts a documented plan in place so that if you became incapacitated, your family could carry on your affairs without having to go through court. This includes a strategy for providing income if you were to become disabled and covering potential expenses for care giving that may be needed at some point.

• Provide for children and dependents: A primary goal for many estate plans is to protect and provide for loved ones and their future needs. Your estate plan should include provisions for any children, including naming a guardian for children under age 18 and providing for those from a previous marriage if you remarry, your assets may not automatically pass to them. It also would specifically address the care and income of children or relatives with special needs that must be planned carefully to avoid jeopardizing eligibility for government benefits.

• Protect your assets: A key component of estate planning involves protecting your assets for heirs and your charitable legacy by minimizing expenses, and covering estate taxes while still meeting your goals. If necessary, your estate plan would include specific strategies for transferring or disposing of unique assets like a family-owned business, real estate or investment property, or stock in a closely held business. Many people use permanent life insurance and trusts to protect assets while ensuring future goals can be met.

• Document your wishes: If you want your assets distributed in a certain way to meet financial or personal goals, you need to have legal documentation to ensure those wishes are followed if you die or become incapacitated. This includes designating beneficiaries for your life insurance policies, retirement accounts and other assets that are in line with your goals. It also means ensuring that titles of material assets, such as automobiles and property, are named properly. Work with an attorney to be sure you have an updated will disposing of your assets, a living will reflecting your end-of-life wishes, as well as powers of attorney for health-care and financial matters.

• Appoint fiduciaries: To execute your estate plan, you must designate someone to act on your behalf if you are unable to do so as executor of your will, trustee for your assets, legal guardian for your dependents or personal representative or power of attorney if you became incapacitated. You need to be sure your fiduciaries are aware of and agree to their appointments, and that they know where to find your original estate planning documents. Fiduciaries can be family members, personal friends or hired professionals such as bankers, attorneys or corporate trustees. Whether you are just starting out or have accumulated wealth over a lifetime, an up-to-date estate plan helps you minimize the impact of unexpected events on you and your family by preserving, protecting and managing your assets. A financial advisor can help you create a financial security plan to meet your goals, and provide tools and resources to build an estate plan that makes an impact well into the future.

Utah Probate Lawyer

When you need an estate planning attorney or probate lawyer, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Top DUI Lawyer In Salt Lake City

Estate Planning AttorneyAscent Law St. George Utah Office

Ascent Law Ogden Utah Office

Salt Lake City

|

Salt Lake City, Utah

|

|

|---|---|

| City of Salt Lake City[1] | |

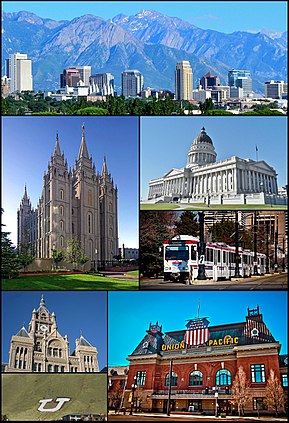

Clockwise from top: The skyline in July 2011, Utah State Capitol, TRAX, Union Pacific Depot, the Block U, the City-County Building, and the Salt Lake Temple

|

|

| Nickname:

“The Crossroads of the West”

|

|

Interactive map of Salt Lake City

|

|

| Coordinates: 40°45′39″N 111°53′28″WCoordinates: 40°45′39″N 111°53′28″W | |

| Country | |

| State | Utah |

| County | Salt Lake |

| Platted | 1857[2] |

| Named for | Great Salt Lake |

| Government

|

|

| • Type | Strong Mayor–council |

| • Mayor | Erin Mendenhall (D) |

| Area | |

| • City | 110.81 sq mi (286.99 km2) |

| • Land | 110.34 sq mi (285.77 km2) |

| • Water | 0.47 sq mi (1.22 km2) |

| Elevation

|

4,327 ft (1,288 m) |

| Population | |

| • City | 199,723 |

| • Rank | 122nd in the United States 1st in Utah |

| • Density | 1,797.52/sq mi (701.84/km2) |

| • Urban

|

1,021,243 (US: 42nd) |

| • Metro

|

1,257,936 (US: 47th) |

| • CSA

|

2,606,548 (US: 22nd) |

| Demonym | Salt Laker[5] |

| Time zone | UTC−7 (Mountain) |

| • Summer (DST) | UTC−6 |

| ZIP Codes | |

| Area codes | 801, 385 |

| FIPS code | 49-67000[7] |

| GNIS feature ID | 1454997[8] |

| Major airport | Salt Lake City International Airport |

| Website | Salt Lake City Government |

Salt Lake City (often shortened to Salt Lake and abbreviated as SLC) is the capital and most populous city of Utah, as well as the seat of Salt Lake County, the most populous county in Utah. With a population of 199,723 in 2020,[10] the city is the core of the Salt Lake City metropolitan area, which had a population of 1,257,936 at the 2020 census. Salt Lake City is further situated within a larger metropolis known as the Salt Lake City–Ogden–Provo Combined Statistical Area, a corridor of contiguous urban and suburban development stretched along a 120-mile (190 km) segment of the Wasatch Front, comprising a population of 2,606,548 (as of 2018 estimates),[11] making it the 22nd largest in the nation. It is also the central core of the larger of only two major urban areas located within the Great Basin (the other being Reno, Nevada).

Salt Lake City was founded July 24, 1847, by early pioneer settlers, led by Brigham Young, who were seeking to escape persecution they had experienced while living farther east. The Mormon pioneers, as they would come to be known, entered a semi-arid valley and immediately began planning and building an extensive irrigation network which could feed the population and foster future growth. Salt Lake City’s street grid system is based on a standard compass grid plan, with the southeast corner of Temple Square (the area containing the Salt Lake Temple in downtown Salt Lake City) serving as the origin of the Salt Lake meridian. Owing to its proximity to the Great Salt Lake, the city was originally named Great Salt Lake City. In 1868, the word “Great” was dropped from the city’s name.[12]

Immigration of international members of The Church of Jesus Christ of Latter-day Saints, mining booms, and the construction of the first transcontinental railroad initially brought economic growth, and the city was nicknamed “The Crossroads of the West”. It was traversed by the Lincoln Highway, the first transcontinental highway, in 1913. Two major cross-country freeways, I-15 and I-80, now intersect in the city. The city also has a belt route, I-215.

Salt Lake City has developed a strong tourist industry based primarily on skiing and outdoor recreation. It hosted the 2002 Winter Olympics. It is known for its politically progressive and diverse culture, which stands at contrast with the rest of the state’s conservative leanings.[13] It is home to a significant LGBT community and hosts the annual Utah Pride Festival.[14] It is the industrial banking center of the United States.[15] Salt Lake City and the surrounding area are also the location of several institutions of higher education including the state’s flagship research school, the University of Utah. Sustained drought in Utah has more recently strained Salt Lake City’s water security and caused the Great Salt Lake level drop to record low levels,[16][17] and impacting the state’s economy, of which the Wasatch Front area anchored by Salt Lake City constitutes 80%.[18]

[geocentric_weather id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_about id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_neighborhoods id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_thingstodo id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_busstops id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_mapembed id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_drivingdirections id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]

[geocentric_reviews id=”938d21e0-6c09-4f16-89a4-3026157ac6d0″]