If you have been subject to retaliation by your employer for reporting your employer, speak to an experienced Orem, Utah Corporate Lawyer to know your options.

Companies should implement procedures that provide employees who make complaints to the audit committee with protection from personnel action. A company should establish a “zero tolerance” policy for retaliation against whistleblowers. In addition to informing employees of their rights under the SOX whistleblower provisions, employers should institute a mandatory disciplinary program for managers who are found guilty of having retaliated against employees. For example, if the Department of Labor makes a finding that a manager engaged in discriminatory practices against an employee, the employer needs to have a mechanism in place to hold the manager accountable.

Internal Procedure

Even if an employee does not file a formal SOX complaint with the Department of Labor, an employer should institute internal procedures both to assist and protect employees who have been subjected to retaliation and to internally investigate allegations of retaliation. There are many ways this can be done without identifying the employee as a whistleblower. If personnel changes are necessary after the filing of a confidential or anonymous complaint with the audit committee, companies should be encouraged to reassign the supervisor, not the employee who made the complaint.

Finally, the law provides special protections for persons employed as auditors or who are otherwise involved in corporate oversight functions. The SOX whistleblower statute itself directly protects employees who provide information in-house to persons with “authority to investigate, discover, or terminate misconduct.” This provision not only protects employees who provide information to auditors, but also protects the auditors themselves.

In order to carry out its obligations under SOX Section 301 in larger companies, it may become necessary for an audit committee to establish liaison officials, compliance officers, or even an Ombudsman office who work directly for the audit committee and not company management. The creation of such independent offices will further instill confidence among employees with the audit committee procedures required by SOX Section 301 and provide potential compliance, enforcement, and alternative dispute resolution mechanisms. Again, it is imperative that such liaison officials have operational independence and that the company’s policies prohibiting retaliation equally apply to such officials, as well as to the formal audit committee itself.

Criminal Sanctions for Retaliation

The Sarbanes-Oxley Act does not merely provide whistleblowers with a traditional employment discrimination remedy within the U.S. Department of Labor or a federal court. The Act contains two very strong enforcement-related provisions that actually criminalize retaliation against whistleblowers. The first provision, contained in Section 1107 of the Act, amended the federal obstruction of justice statute and specifically criminalized retaliation against certain whistleblowers. The second provision, contained in Section 3(b)(1) of the Act, makes the violation of any of the whistleblower protection provisions within Sarbanes-Oxley also a violation of the Securities Exchange Act of 1934. This provision also criminalizes discrimination against whistleblowers and permits the SEC to independently enforce the whistleblower provisions of the Act.

Obstruction of Justice

One of the most significant reforms contained in the SarbanesOxley Act was an amendment to the criminal obstruction of justice statute. Discrimination against whistleblowers who provided “truthful” information to a federal “law enforcement officer” concerning the “possible” violation of “any federal offense” was criminalized. Any person who retaliated against whistleblowers covered under this provision could be subject to federal criminal prosecution and fines, and could be “imprisoned” for 10 years. The criminal statute’s definition of protected activity is narrower than the definition contained in the employment discrimination section of Sarbanes-Oxley.

The criminal law only protects disclosures to federal law enforcement officials, whereas the civil/administrative wrongful discharge provision protects a broader range of conduct, such as filing allegations of misconduct with an in-house audit committee, a supervisor, or members of Congress. However, the scope of coverage under Section 1513(e) is far broader than the Sarbanes-Oxley wrongful discharge provision. Unlike the wrongful discharge provision of Sarbanes-Oxley, the criminal law covers every employer in the United States, and is not limited to publicly traded corporations. Moreover, the criminal law protects persons who blow the whistle on any violation of any federal law. Section 1513(e) is not limited to prohibiting retaliation against employees who “blow the whistle” on corporate fraud. It would cover any employee who reported violations of any federal law, including environmental, health and safety, or any other federal offense. Thus, the protections offered by Section 1513(e) are not limited to corporate whistleblowers who disclose potential fraud against shareholders. Any employee who reports any potential federal offense to a law enforcement officer could be protected.

Finally, although the criminal statute requires the employee whistleblower to contact a federal law enforcement officer to obtain protection under the law, the definition of such an officer is very broad. The definition of a “law enforcement officer” set forth in the obstruction of justice statute covers almost every federal investigative body that could be contacted by the whistleblower.

Penalties

Section 3(b)(1) of the Sarbanes-Oxley Act, 15 U.S.C. 7202(b)(1) provides that a violation of any provision of the Sarbanes-Oxley Act “shall be treated for all purposes” as a violation of the Securities Exchange Act of 1934.

The penalties provided for under the Securities Exchange Act of 1934 are steep. Section 32 of the Act provides significant criminal penalties for any “willful” violation of the law, including prison term and fine for each violation. In addition to criminal penalties, various sections of the Securities Exchange Act of 1934 provide authority for the SEC to investigate and punish persons who violate the Act.

Simply stated, any person who violates any provision of the Sarbanes-Oxley Act, including any of the whistleblower protection provisions, also violates the Securities Exchange Act of 1934. The SEC would have jurisdiction to investigate and sanction any such violations. If the violations were “willful,” the wrongdoer may face a long prison sentence.

The failure of a publicly traded company to properly maintain the confidentiality of a whistleblower who contacts the audit committee, the failure of an attorney licensed to practice law before the SEC to properly disclose wrongdoing, and the wrongful discharge of a whistleblower within a publicly traded corporation all constitute separate and independent violations of the Securities Exchange Act of 1934.

The implications of Section 3(b) are enormous. First, it grants the SEC jurisdiction to investigate and sanction corporate contact that violates the various whistleblower provisions of Sarbanes-Oxley. Second, it subjects wrongdoers to potentially significant civil and criminal penalties should they be found guilty of discrimination against whistleblowers. Third, it authorizes the SEC to implement regulations protecting whistleblowers.

Subjecting corporations that discriminate against whistleblowers to multiple penalties is not without precedent. Under the Atomic Energy Act, whistleblowers are entitled to file employment discrimination cases within the U.S. Department of Labor under procedures nearly identical to the SOX law.

The Sarbanes-Oxley Act authorizes a similar duel track for whistleblower cases. Employment discrimination cases may be filed with the Department of Labor, but whistleblowers are also free to utilize Section 3(b) (1) to request enforcement action against employers that discriminate against whistleblowers directly from the SEC.

Federal Court Actions

Congress provided employees who file a Sarbanes-Oxley corporate whistleblower case (SOX) a unique procedural right. The SOX permits employees who exhaust their administrative remedies within the DOL to withdraw their DOL cases and refile their case, de novo, in federal district court. This election may only be utilized by employees. Corporate employers must defend SOX cases in the forum chosen by the employee. No other DOL-administered whistleblower law contains this election procedure.

SOX requires an employee who elects to file in federal court to provide the DOL and the parties to the SOX administrative proceeding 15 days’ advance written notice of “his or her intention to file such a complaint.” The notice must be served on all the parties and the Assistant Secretary of Labor for OSHA and the Associate Solicitor of the Division of Fair Labor Standards. In order to exercise this right, an employee must do the following:

• File their initial complaint in the Department of Labor (DOL) in accordance to the rules and regulations of the DOL.

• Participate in the DOL proceedings. If the employee engages, in “bad faith” conduct that could delay the DOL proceedings, the employee’s right to file in federal court could be compromised or delayed.

• After participating in the DOL proceedings for 180 days, the employee may withdraw his or her proceeding from the DOL and file a claim in federal district court under the SOX.

• The current DOL regulations require that an employee provide the DOL and the parties to the proceeding at least 15 days’ notice of an intent to withdraw a claim from the DOL in order to file a federal court action.

• If the DOL issues a final order within the 180-day time period, an employee may not file the federal court action.

• Only an employee can elect to withdraw his or her claim from the DOL; the employer is required to defend the claim in the forum chosen by the employee.

• Once a SOX claim is filed in federal court, the court must hear the case de novo. In other words, any preliminary or recommended decisions issued by OSHA or an ALJ are nonbinding in federal court.

A case filed in federal court is heard de novo, and consequently the federal court is not bound by any interlocutory order of the DOL (i.e., a decision by OSHA or an Administrative Law Judge), provided that the Administrative Review Board has not issued a final order.

Once filed in federal court, the court will hear the claim under its federal question jurisdiction, and should have the authority to award any remedy normally applied by a federal court.

Regardless of whether the claim is heard before the DOL or a federal court, most of the substantive case law applicable in DOL proceedings should be equally applicable in federal court proceedings. Thus, regardless of which court hears the case, the same definitions of employee, employer, adverse action, protected activity, and discriminatory conduct should apply. Moreover, the courts are required to apply the same “contributing factor” test in evaluating evidence of discrimination as is applied by the DOL.

Although the substantive law applicable in federal court will be similar to that applied by the DOL, procedurally the two forums are very different. In federal court, the Federal Rules of Civil Procedure and the Federal Rules of Evidence are applicable. These rules are not applicable in the DOL. Although the statute is silent on the question, the legislative history of the SOX clearly states that cases heard in federal court under this provision may be tried before a jury. DOL cases are heard before an Administrative Law Judge. Also, the applicability of punitive damages in a federal court action is an open question. Punitive damages are available in civil actions filed in federal court, and they are available in Section 1983 actions.

Factors to Consider

A decision whether to file a claim in federal court must be balanced against a number of factors. The DOL offers an employee a number of favorable options. First, the DOL adjudicatory procedures are less complex and costly than those in federal court. The informality of the hearings, combined with the traditional willingness of ALJs to provide whistleblowers with a full opportunity to present their case, weigh heavily in favor of pursuing a case within the labor department, even after the 180-day time period has expired.

Second, the DOL year of experience deciding whistleblower cases. Many of the major legal precedents have been established, and most DOL judges have experience in the corporate whistle blower laws on which the SOX was modeled. Many complex legal questions heard initially in district court may relate directly to issues which were thoroughly litigated within the DOL. Having the case heard in federal court could result in re litigating many of these issues, some of which are very favorable to whistleblowers.

Third, most litigators who have appeared before the DOL have found its adjudication process to be fair and reasonable. For example, in the mid-1980s a controversy arose regarding whether a DOL corporate whistleblower law covering the nuclear power industry (one law on which the SOX administrative procedures were modeled) preempted state wrongful discharge law. Industry vigorously argued that if the courts did not find preemption, employees would abandon the federal statutory remedies, and flock to the state courts in which they could obtain jury trials and punitive damages.

Before you choose the forum, speak to an experienced Orem Utah Corporate Lawyer.

Orem Utah Business Lawyer Free Consultation

When you need legal help with a business in Orem Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Bankruptcy Lawyer Spanish Fork Utah

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Orem, Utah

|

Orem, Utah

|

|

|---|---|

Orem City Center

|

|

| Nickname:

Family City USA

|

|

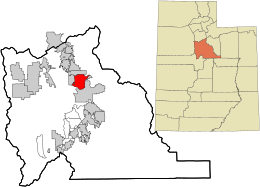

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°17′56″N 111°41′47″WCoordinates: 40°17′56″N 111°41′47″W | |

| Country | United States |

| State | Utah |

| County | Utah |

| Settled | 1877 |

| Town charter granted | May 5, 1919 |

| Named for | Walter C. Orem |

| Government

|

|

| • Mayor | David Young |

| • Spokesman | Steven Downs |

| • City Manager | James P. Davidson |

| Area | |

| • Total | 18.57 sq mi (48.10 km2) |

| • Land | 18.57 sq mi (48.10 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,774 ft (1,455 m) |

| Population

(2020)

|

|

| • Total | 98,129[1] |

| • Density | 5,267.22/sq mi (2,033.67/km2) |

| Time zone | UTC-7 (Mountain (MST)) |

| • Summer (DST) | UTC-6 (MDT) |

| Area codes | 385, 801 |

| FIPS code | 49-57300[3] |

| GNIS feature ID | 1444110[4] |

| Website | www |

Orem is a city in Utah County, Utah, United States, in the northern part of the state. It is adjacent to Provo, Lindon, and Vineyard and is approximately 45 miles (72 km) south of Salt Lake City. Orem is one of the principal cities of the Provo-Orem, Utah Metropolitan Statistical Area, which includes all of Utah and Juab counties. The 2020 population was 98,129,[1] while the 2010 population was 88,328[5] making it the fifth-largest city in Utah. Utah Valley University is located in Orem.

Orem uses the slogan “Family City USA.

[geocentric_weather id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_about id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_neighborhoods id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_thingstodo id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_busstops id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_mapembed id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_drivingdirections id=”c4afc332-0663-4e0a-beee-34107f681132″]

[geocentric_reviews id=”c4afc332-0663-4e0a-beee-34107f681132″]