Estate planning is an important process, where you will be legally documenting your assets and property sharing decisions. Your ‘Will’ will be legally executed by your attorney after your death. Property planning can also be a crucial step to secure your financial future too, as almost all companies have abandoned the pension and retirement plans. The estate planning can be of any type, such as a will trust, power of attorney, power of appointment, property ownership and etc. At some point of time, it becomes important to decide what your descendants should get from you, after your death. It helps you resolve your worries regarding your assets, and it gives you with the peace of mind in the golden period of your life, after the retirement.

Why Estate Planning is Necessary

There is no individual on this planet who can predict death, as it is something that is not really in our hands. In the first place, it may seem less important for small estate owners. However, it is still important to secure your estate, whether you are a landlord or a small property owner. A proper estate plan may help in reducing the taxes and other acquisition expenses, after one passes away.

The Right Person to Perform Estate Planning

The firm or individual who is going to plan your estate should be qualified and knowledgeable, and they should have the track record of professional experience in the field. They generally offer their services as financial planners, trust and estate practitioners, chartered financial analysts, estate planners, etc. However, you will need to make sure if they are certified and are licensed for the job.

Tips For Estate Planning In American Fork, Utah

There are several aspects and key elements of planning your estate, which can help you to minimize the worries and maximize the inheritance benefits to the beneficiaries.

• Specific Declarations – Probably it is the most critical aspect of estate planning. The failure in planning may give rise to legal problems, and your actual beneficiary may not be able to acquire the estate. The declaration of property sharing should be clear and specific.

• Deciding the Plan for Spending – If you wish that your assets to be used for any other goodwill, like forming of trusts like colleges, then the allocated trustee is legally bound to make these plans. It means that they must spend the amount specified on the trust.

• Estate Planning Team – Your lack of knowledge on this matter may cause problems to your beneficiaries. So, it is suggested for you to work on it with a team of experts. The financial advisor will help you design appropriate investment plans.

• Minimizing Estate Taxes and Other Income tax – While choosing a financial advisor firm, make sure that they clearly understand your planning needs. They should also have tax professionals in their team, to advice you on the possibilities of minimizing the payable tax amount by your beneficiaries. The taxable estate can be gifted to the beneficiaries when you are alive.

Being Open Minded

Estate planning is not a complicated process, but you are planning for things to be done, after you are gone. Instead of thinking too much and complicating it, it is always wise to be open minded and consider how best you can help your family members. You must believe in securing their future. Also, make sure that you revisit the estate plan periodically, for ensuring if the names of your beneficiaries and their shares, are still in line with your current thoughts or not.

How to Avoid Estate Planning Mistakes In American Fork, Utah

Estate planning is important; without one, your loved ones may have to wade through tedious legal procedures after you die and your final wishes may not be recognized by state probate and intestate laws. In fact, the most common mistake people make when planning their estates is not actually taking the time to plan. To ensure that your last wishes are acknowledge, talk to an attorney and begin planning for the security of you loved ones today. It is important to name a legal guardian for your minor children in your estate plan. Until now, you may have assumed that estate planning only involved your personal belongings and financial assets. This is false. Without an assigned, legal guardian, the state will decide who raises your children if you die before they reach legal adulthood. You can only assigned guardianship in a will. Avoid this mistake by making sure that your children’s future is protected in your estate plan.

Joint ownership is another mistake that people make when planning your estate. It is not unusually for elderly people to add an adult child to the title of their belongings and assets to avoid complicated legal procedures after they pass away. This may be problematic for several reasons. First, joint ownership decreases the amount of control you have over you estate – you might even lose some of your assets to your joint owner’s creditors or ex-spouse. After you die, your assets will probably be distributed via the probate process. If you have a will, your loved ones cannot receive their inheritances until probate is complete. One common mistake made by individuals planning their estates is failing to avoid probate. Probate is tedious, but you may be able to avoid it by establishing co-ownership, beneficiary designations or a revocable living trust. Because co-ownership is not preferred, the best way to avoid probate is through a living trust.

Estate planning can take effect before you die. If you become seriously ill or incapacitated before you pass away, your estate may fall into the hands of your beneficiaries. For example, if you suffer a stroke and are unable to manage your assets, someone else will be appointed to take care of them. If you plan ahead for incapacity, you are able to control who will be in charge of you estate if you become seriously. Additionally, you may include instruction for your medical care in the event of serious incapacitation. Using a qualified attorney to help you plan your estate is imperative. Avoid using kits, online programs, or attempting to plan your estate by yourself. An experienced attorney can help you understand the estate planning process, help you avoid probate and give you peace of mind about the future of your family, belongings and financial assets. Estate planning involves a variety of tedious laws, statutes and regulations. Protect your final wishes by having a knowledgeable lawyer on your side.

Estate planning isn’t a one-time event. As your wishes, financial circumstances and other variables change, you may wish to adjust something in your plan. For instance, if a specific charitable organization becomes significant to you, you may want to leave a gift for it when you die. Your personal wishes and circumstances are always changing; your plan should too. If you have questions about estate planning, writing a will or establishing a living trust, talk to an attorney today. Having a knowledgeable lawyer guiding you through the estate planning process can help you secure the future of your assets, family, and ensure that your final wishes are executed correctly.

Estate Planning Traps and How to Avoid Them

If you’re thinking about setting up an estate plan in American Fork, you probably want to accomplish one or more of the following goals:

• Protect your assets in the event you become disabled.

• Create as trauma-free a transition as possible for your loved ones when you pass away.

• Control your medical destiny.

• Pass on as much of your hard-earned assets as possible to loved ones.

• Leave a legacy of family harmony.

Even with the best of intentions, however, there are many estate planning traps that can sabotage your goals. Below are common estate planning mistakes that can undermine your estate plan, and advice on how to avoid them. Remember, your estate plan will speak for you when you cannot, so it’s imperative to get it right. Always seek the guidance of a certified elder law/estate planning attorney.

MISTAKE 1: Permitting the provisions of your will to conflict with the beneficiary designations of your assets.

Why it’s a mistake: Your beneficiary designations trump your will. For example, if your will says that your two children will share everything equally, but you name only one child as the beneficiary of your largest asset, that child will inherit the asset in its entirety. That’s not much of a foundation for family harmony!

How to avoid it: Review all your beneficiary designations, and make sure they are in synch with your will.

MISTAKE 2: Believing that your will provides protection if you become disabled.

Why it’s a mistake: A will is a death instrument only. Basically, it’s a blueprint that describes who will get what asset after you’re gone. A will has absolutely no impact on what happens if you become incapacitated. If you haven’t made legal provisions for incapacity and you become incapable of making your own personal, financial and medical decisions, you could find yourself the subject of a costly court guardianship.

How to avoid it: Create a health care surrogate (health care power of attorney) to ensure that if you become incapacitated, someone you know and trust can make your medical decisions. Create a Durable Power of Attorney appointing someone to make your financial decisions, or alternatively, create and fund a revocable living trust.

MISTAKE 3: Making one or more children co-owners of your assets in order to avoid probate of the asset.

Why it’s a mistake: Even if you have implicit faith in your child’s integrity, if he/she runs into financial difficulties, your child’s creditors could go after your assets. Co-ownership also means that after you die, that asset will belong to your child, which may be in conflict with your will or trust

How to avoid it: You may make your child a beneficiary of your asset, or allow the asset to pass to your child through your will or trust.

MISTAKE 4: Creating a living trust (aka revocable trust) but failing to transfer your assets into it.

Why it’s a mistake: A revocable trust can offer many benefits – for example, probate avoidance – but it remains just a piece of paper until it is “funded.” Funding means that the trust actually owns your assets. (Note: Certain assets should not go into your living trust while you’re alive, but may pass into your trust when you pass away. Examples of such assets are your 401k, 403b or IRA.)

How to avoid it: Consult your elder law attorney about what assets belong in your trust. Then contact your financial institutions to retile the appropriate assets into the name of your revocable trust.

MISTAKE 5: Leaving specific assets to specific people.

Why it’s a mistake: Other than certain pieces of personal property – jewelry, for example – it’s generally a bad idea to leave certain assets to certain people. The reason: the value of the asset may fluctuate, skewing the value of what gets passed down to your heirs. By way of example, let’s say you want your son and daughter to share your estate equally. You leave your $200,000 house to your son and your brokerage account of $200,000 to your daughter. However, over time, if the value of one or the other asset changes, your children could end up getting significantly unequal shares of your estate.

How to avoid it: Generally speaking, it’s better to leave your heirs percentages of assets rather than specific assets.

MISTAKE 6: Assuming that your child with the most business experience is the best candidate to serve as your Personal Representative, Trustee, or Agent.

Why it’s a mistake: Most people appoint one or more of their adult children as fiduciaries, but overestimate the importance of business acumen. In reality, of equal or greater importance is general trustworthiness, and having the time to do the job properly. For example, the fact that your daughter is an accomplished CPA is fine but if she has a demanding job and young children, and lives at a great distance, serving as your Personal Representative may prove too much of a burden for her. Her selection could also stoke family tension if she cannot attend to her duties on a timely basis, thus delaying the distribution of assets to beneficiaries.

How to avoid it: Talk to whomever you are thinking about appointing as a fiduciary to determine if they are willing and able to serve. In some cases, it may be better to appoint a third-party fiduciary like a bank or brokerage trust department. A third-party fiduciary may also be a good idea if you want to avoid the discord that can arise when a parent designates one child as a fiduciary, thereby giving that one child “the power of the purse” over his/her siblings.

MISTAKE 7: Assuming that Medicare will pick up the tab for a nursing home if you ever need long-term care.

Why it’s a mistake: Contrary to common belief, Medicare does not pay for long-term care, but only for skilled nursing care on a limited basis. Given greater longevity, more and more of us will require long-term care at some point in our lives – and the astronomical expense can wipe out the average family in no time. Thus, planning for this eventuality should a cornerstone of most people’s estate plans.

How to avoid it: Long-term care insurance can be a good investment. However, if you cannot afford it or if you cannot qualify for health reasons, assets may often be preserved with strategies that incorporate Medicaid planning and/or Veterans benefits planning into your estate plan. Consult a certified elder law attorney for advice.

MISTAKE 8: Thinking that your will allows your estate to avoid probate.

Why it’s a mistake: When you die, any assets passing under your will must go through the probate court. The probate court will then direct the distribution of your assets to the beneficiaries named in your will, ensure creditors are paid, etc.

How to avoid it: If one of your estate planning goals is to keep your estate out of probate, a will is not the way to go. Instead, consider a revocable trust (aka living trust).

MISTAKE 9: Thinking that if your estate is not taxable, it avoids probate.

Why it’s a mistake: It’s a common misconception that only taxable must go through probate. The reality is that the need for probate and an estate’s tax status are unrelated. A modest estate not subject to estate tax may go through probate if the decedent relied on a will to transfer assets. A large, taxable estate may not be probated if the decedent utilized effective probate-avoidance strategies such as a living trust (aka revocable trust).

How to avoid it: Regardless of the size of your estate, a will is not the estate planning vehicle of choice for anyone intent on making sure his family avoids dealing with the probate court. Other estate planning strategies should be investigated with the advice of a certified elder law/estate planning attorney.

MISTAKE 10: Relying on a do-it-yourself websites or books to draft your documents, in order to save money.

Why it’s a mistake: The do-it-yourself sites and books disclaim any liability; in fact, they advise you to check with an attorney! Remember, if you get your estate plan wrong, the errors will probably not be discovered until after you’re gone. And then, there are no do-overs.

How to avoid it: See an experienced and certified elder law attorney in the state in which you reside. The Florida Bar certifies lawyers in elder law, as do many other states.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Estate Planning Attorney Woods Cross Utah

Estate Planning Attorney In Provo Utah

Estate Planning Attorney Alpine Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

American Fork, Utah

|

American Fork

|

|

|---|---|

The old city hall is on the National Register of Historic Places.

|

|

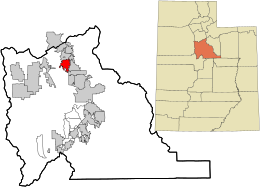

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°23′3″N 111°47′31″WCoordinates: 40°23′3″N 111°47′31″W[1] | |

| Country | |

| State | |

| County | Utah |

| Settled | 1850 |

| Incorporated | June 4, 1853 |

| Named for | American Fork (river) |

| Area | |

| • Total | 11.16 sq mi (28.90 km2) |

| • Land | 11.15 sq mi (28.87 km2) |

| • Water | 0.01 sq mi (0.02 km2) |

| Elevation

|

4,606 ft (1,404 m) |

| Population

(2020)

|

|

| • Total | 33,337 |

| • Density | 2,987.19/sq mi (1,154.73/km2) |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84003

|

| Area codes | 385, 801 |

| FIPS code | 49-01310[3] |

| GNIS feature ID | 1438194[4] |

| Website | www |

American Fork is a city in north-central Utah County, Utah, United States, at the foot of Mount Timpanogos in the Wasatch Range, north from Utah Lake. This city is thirty-two miles southeast of Salt Lake City. It is part of the Provo–Orem Metropolitan Statistical Area. The population was 33,337 in 2020.[5] The city has grown rapidly since the 1970s.

[geocentric_weather id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_about id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_neighborhoods id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_thingstodo id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_busstops id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_mapembed id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_drivingdirections id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]

[geocentric_reviews id=”f9bf6a63-bf88-44b0-b78b-971b613889ca”]