This is about how an estate planning attorney in Holladay Utah can help you. A little over one-third of Americans have a will, but fewer than half have any estate documents at all. Most people don’t want to think about dying. Considering it’s an uncomfortable topic, many people don’t do anything about estate planning. However, it is important for many reasons and shouldn’t be overlooked. By making arrangements for your final days and beyond, it not only helps your family and friends through a difficult time, but it makes sure your assets are managed and disposed of the way you want it when you die or become incapacitated.

Other reasons why you should do estate planning include:

• If you own your own company, it is crucial for the protection and continuation of your business.

• It established who is responsible for any money withdrawn from your accounts to pay your bills.

• It also protects any inheritances that you pass on to your heirs from getting taken by creditors.

• A good plan will help safeguard the financial security of your family.

You don’t have to be wealthy to have an estate plan in place. Everyone has estate-even young children who have had family heirlooms passed down to them or have a custodial account in their name. Simply put, if you own something of value that you want to pass on to someone else upon your death, then you have something to plan for. However, if you die without one, the responsibility of handling and arranging of your assets, even the care of your children, falls into the courts hands.

Choosing an Estate Planning Attorney

Planning an estate should be taken seriously. While there may be a number of inexpensive Do-It-Yourself kits, those could wind up costing you and your family more in the end. That’s why it’s beneficial to hire an estate planning attorney, so you can avoid costly mistakes and rest assured that your estate is properly protected. Drafting estate planning documents properly is critical; even if one word is wrong or a signature is missing, then the entire intent of the document could change. Not to mention, State laws are very strict about what is and isn’t allowed in the documents; from who can and cannot serve as a personal representative to what formalities must be observed when signing a Will or Trust. Estate planning attorneys have the legal expertise and knowledge to help establish a well-written, accurate and legitimate estate plan. They will evaluate your particular situation, and adjust the plan to best suit your needs and goals. The many facets of estate planning can make it seem quite overwhelming, but an attorney will help you through every step and make sure all legal requirements are met and all documents clearly specify what you want. While it may not be the most popular topic to discuss and deal with, estate planning is important for the continuity of your assets and your loved ones’ well-being after you die. There are plenty of horror stories out there about ownership issues and family disagreements over wealth that was not delegated before a loved one’s passing. Many people feel that their surviving family members can handle their affairs when they are gone. However, history tells us that this is most often not the case and that even the most basic plan can prevent many problems and family disagreements.

Some people falsely believe that they don’t need an estate plan. However, nearly everyone should have a plan in place as most of us have assets. These may include investments, retirement savings, insurance policies, real estate or business interests. Estate planning is not just about what happens after you pass away. Aside from death, there are other unpleasant things that could happen including accidents and injury, which could result in you being unable to manage your own affairs. It is not necessary to spend countless hours sifting through endless options when planning your estate. An attorney can provide you with valuable advice to help you determine who will receive your assets when you die. When you work with an estate planning lawyer, he or she will become familiar with your goals, concerns and assets to properly organize your final affairs so that your goals are met. Proper planning will ensure that your assets make a smooth transition into the hands of those you love. An estate planning attorney can also help you choose beneficiaries and plan for the care of your minor children. He or she can help you alleviate tax burdens by providing you with information regarding things like charitable contributions.

In short, a reputable estate lawyer will take the time to walk you through the rather confusing process of setting up your final affairs to ensure that your best interests are met, as are those of your loved ones when you pass away. It is never too early to put an estate plan in place — but it can be too late. Unfortunately, it is common for families to be left confused, angry and divided when a loved one has passed and has not planned his or her estate. Worse yet, minor children and disabled dependents often end up being split and put under the care of strangers. Regardless if you are starting your career or are about to retire, now is as good of a time as any to plan your estate. You never know what is going to happen tomorrow, but when you have your affairs in order, you will be as prepared as possible for the unexpected. Estate planning allows you to secure your future and the future of the people you care the most about. It is essential to carefully plan your estate so that your surviving loved ones are not left to pick up the pieces when you die.

Should You Create an Estate Plan?

The reasons for needing an estate plan are as varied as the individuals involved and, it seems, the many myths surrounding the subject do quite a bit of harm. For example, do you have to be “rich” in order to need an estate plan? The answer is, “No”, one does not need to be rich to need an estate plan. All you need is the desire to pass on to your heirs the greatest amount of the wealth possible that you have preserved during your lifetime. Among the major benefits of a well-drafted estate plan are minimizing the expense of passing your estate to beneficiaries, decreasing the administrative complexities and ensuring to the extent possible that your distribution wishes are followed.

For example, if you own a home, have minor children or grandchildren, grown children in their own marriages, have been divorced, own a business, or expect to receive an inheritance of your own, you need to seriously consider the benefits of properly planning your estate. Instead of passing problems on to your heirs, you can instead elect to pass on the greatest amount of wealth with the least amount of problems through estate planning. The largest hurdle, oftentimes, is building a lasting relationship with an attorney who specializes in estate planning. Going through the Yellow Pages, or asking friends for referrals or using the internet is often a haphazard process without much guarantee of success.

Compelling Reasons to Build an Estate Plan

Among the common motivations that compel creation of an estate plan are the following. The more the following reasons apply to any situation, the greater is the need to complete estate planning to not only build and protect your hard-earned wealth but, also, to transfer your wealth with as little depletion and expense as possible. With a proper estate plan in place, you can plan ahead to:

1. Designating who will manage your affairs if you become disabled and when you pass away. If you fail to do so, a court will decide for you not only who receives your wealth but who will make the distributions. You never know who the court will appoint. Keep control of your own destiny!

2. Planning for Medicaid and its impact on your estate if you must go into a nursing home. Nursing homes today can cost as much as $75,000 per year, or more, and a long term stay can easily impoverish all but the wealthiest families. With proper planning, however, you can shelter assets and keep your family’s wealth intact. Because there is a 50-50 chance that the average adult will spend at least one year in a long-term care facility, it becomes painfully clear this type of planning is extremely important.

3. Avoiding probate, during your lifetime and when you pass away. Do you want the court controlling you or your assets? Probate proceedings are public, expensive, and time-consuming and should be avoided whenever possible. Leave your money to your heirs quickly, privately and efficiently by establishing a proper estate plan.

4. Protecting children from a prior marriage if you pass away first. Second marriage planning can be complex and tricky. Expert legal guidance is needed to ensure your assets are preserved and your children of your first marriage will receive the proper share of their inheritance.

5. Protecting assets inherited by your heirs from lawsuits, divorces and other claims. Make sure your assets are inherited by your loved ones, not the people you don’t want to receive them, such as their ex-spouses, in-laws, creditors or the IRS.

6. Imposing discipline upon children or grandchildren who may not be capable or experienced in managing wealth. Make sure your children or grandchildren spend their inheritance wisely and protect their inheritance against inexperience and mismanagement by including specific conditions and rewards in your estate plan.

7. Providing for special needs children and grandchildren. The loss of governmental benefits can wipe out your estate. Special considerations and planning is needed to avoid the loss of governmental benefits.

8. Insuring that a specific portion of your estate actually gets to grandchildren, charities, etc. Without planning, a judge will decide who inherits your assets. Pre-planning your estate ensures your intentions and directions are followed.

9. Protecting a portion of your estate if you pass away first and your surviving spouse remarries. Special Trusts, commonly referred to as “A-B trusts”, can be crafted to protect your current surviving spouse and to insure that your assets don’t end up in the wrong hands. Take action now to protect your family.

10. Addressing different needs of different children. No two children are alike. Customized estate planning can assure that each child’s personal needs are addressed in the manner you deem best.

11. Preventing or discouraging challenges to your estate plan. Establishing a well-drafted and comprehensive Revocable Living Trust now makes it more difficult for objections when you are no longer around to speak for yourself.

12. Encouraging and rewarding your heirs who make smart life decisions and preventing the depletion of your estate from those who do not. There can be a point at which giving a child more money can make them less productive and less happy. A Family Incentive Trust can be tailored with financial incentives which encompass your family values and goals to encourage and motivate your children. Such a Trust can be a loving way to support your children while inspiring them to be productive members of society and fostering their sense of self-worth.

13. Assuring an education for children, or grandchildren, despite what they (or their parents) dream of doing with the inheritance. Establishing an educational trust can assure that your children or grandchildren use their inheritance for education and not fund a vacation in Holladay Utah.

14. Plan for a “Brady Bunch” family estate plan and assure that a stepparent doesn’t spend your children’s inheritance and/or provide for a spouse without sacrificing the intended legacy for children of a prior marriage. A divorce and subsequent marriage can have devastating effects on the inheritance you intend for your children if your estate plan is not reviewed and updated. Often times, the original “traditional” estate plan will not meet the needs or provide the protection needed for your new blended family so proper planning is imperative.

15. Pursuing charitable goals you may not otherwise feel you can afford. Considerably cutting probate expenses allows you to also leave a legacy to a charitable organization you admire. If your wealth or disposition desires fall into any one of the above groups, you should contact an estate planning attorney Holladay Utah. Many times, waiting to make a decision about distributing your wealth or deciding who can make decisions for you in case of death or incapacity will result in your dreams for your children and grandchildren, or your favorite charity, never, ever, being realized. Thus, tarrying in creating an estate plan can cause extreme confusion, turmoil and expense for your heirs that can easily be avoided by contacting a highly qualified, trained and tested estate planning specialist in your locale.

The Necessity of Estate Planning and Trusts

If you don’t have a good estate plan, your state treasurer or an attorney may be the happiest beneficiaries when you die. Estate planning and trusts are ways of your family avoiding unnecessary taxation and high payments to an attorney that can erode your estate. Proper estate planning doesn’t have to cost a fortune and it puts you in control of the division of assets. It gives you control from the grave on the disposition of your items besides saving dollars that you want to go to your family. The most important part of estate planning is the creation of a will. If you die intestate, without a will, your state has a plan on how to dispose of your property. The state’s scheme uses blood relationships to determine who gets the assets of the estate. While you might have a specific person in mind for a treasured item you know they’d love and cherish, the state’s plan might give it to another who would never value it as much. Depending on the family that remains when you pass, it could also pass your estate to family members you don’t really like and bypass those that really care about you or took care of you.

If you have dependent children, it’s important to select guardians for them if something should happen to you and your spouse. Make certain that you ask the party before you name them as the guardian. While they may be the perfect choice, it’s a big responsibility that they may not be ready to handle. You also name an executor or executrix for the estate in the will. This is the person in charge of distributing the property at your demise. It is best to name an alternate in the event that the primary executor is unable to do the job. You can use a spouse for this or a trusted child. This person overlooks the work of the attorney at the time of your death and arranges for the distribution of your property. If you worry about finding you’ll want someone else later, don’t. You can change any part of your will at any time. For those starting on the road to estate planning, you’ll need an estate planning checklist. The first item on the list is an assessment of all your assets. You need to identify the type of ownership of all the assets on the list. Most married people own their homes and other large items together. In those cases, tenancy by the entirety is the normal type of ownership. The final type of joint ownership is tenancy in common where each person owns a specific percentage of the property and can sell it. Of course, for individually owned property, you need to list the owner of the property.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Are You Being Harassed By Creditors Calling You To Collect?

Chapter 13 Bankruptcy Eligibility

Estate Planning St. George Utah Office

Estate Planning Ogden Utah Office

Holladay, Utah

|

Holladay, Utah

|

|

|---|---|

Holladay Village (Downtown Holladay, Utah)

|

|

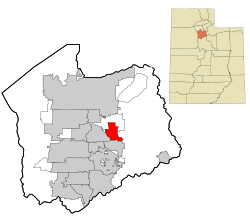

Location within Salt Lake County and the State of Utah.

|

|

| Coordinates: 40°39′23″N 111°49′10″WCoordinates: 40°39′23″N 111°49′10″W | |

| Country | |

| State | |

| County | Salt Lake |

| Settled | 1847 |

| Incorporated | November 29, 1999 |

| Founded by | John Holladay |

| Government

|

|

| • Mayor | Robert M. Dahle |

| • Councillor | Ty Brewer, Matt Durham, Paul Fotheringham, Drew Quinn, Dan Gibbons |

| Area | |

| • Total | 8.50 sq mi (22.02 km2) |

| • Land | 8.50 sq mi (22.02 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,465 ft (1,361 m) |

| Population

(2010)

|

|

| • Total | 26,472 |

| • Estimate

(2019)[2]

|

30,325 |

| • Density | 3,567.23/sq mi (1,377.29/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84117, 84121, 84124

|

| Area code(s) | 385, 801 |

| FIPS code | 49-36070[3] |

| GNIS feature ID | 1441810[4] |

| Website | www |

Holladay is a city in central Salt Lake County, Utah, United States. It is part of the Salt Lake City, Utah Metropolitan Statistical Area. The population was 26,472 at the 2010 census,[5] a significant increase from 14,561 in 2000. The city was incorporated on November 29, 1999, as Holladay-Cottonwood, and the name was shortened to Holladay on December 14 of that year. It was reported in the 1990 census as the Holladay-Cottonwood CDP.

[geocentric_weather id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_about id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_neighborhoods id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_thingstodo id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_busstops id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_mapembed id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_drivingdirections id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]

[geocentric_reviews id=”627cac87-08fd-49ad-b8c4-8f34c72cb090″]