South Salt Lake estate planning is essential for residents of the Utah State. Basic strategies should encompass executing a last will and testament; establishing a healthcare proxy; and designating power of attorney rights. Dependent on estate value, establishing a trust can further protect inheritance assets.

South Salt Lake estate planning strategies must comply with state and federal laws. South Salt Lake has some of the most complex probate laws in the country, so it is best to work with a qualified estate planner or probate attorney.

Probate is used within the South Salt Lake Utah to settle estates that are not protected by a trust. The process varies depending on if decedents engaged in estate planning procedures prior to death. When individuals die without leaving a Will, the estate settlement process requires additional time and exposes the estate to a higher level of creditor claims or the potential for heirs to contest the Will.

The last will and testament provides directive as to how estate assets should be distributed. It is also used to appoint a personal representative charged with duties required to complete estate settlement process.

Without these written directives, the estate must be settled according to South Salt Lake Utah probate code. The timeliness of estate settlement depends on various factors. One of the most prevalent is estate value. In South Salt Lake, estates appraised with values of less than $100,000 are usually exempt from probate if a legal Will has been executed and filed through court. The estate must undergo a 40-day waiting period to avoid probate. Afterward, the personal representative must present a legal affidavit to the court before distributing inheritance gifts to designated beneficiaries.

When decedents do not leave a Will the estate is required to undergo a probate proceeding to determine rightful heirs. This is particularly important to understand if South Salt Lake residents do not want to bequeath gifts to direct lineage relatives. In order to disinherit relatives the Will must include a disinheritance clause which states the reason why heirs are not entitled to estate assets.

The purpose of including the disinheritance statement is to minimize risks of heirs contesting the Will. It is not uncommon for disinherited relatives to claim the decedent was under the influence of another person or was of unsound mind. Contesting a Will can freeze assets in probate for months on end. This act can force personal representatives to sell inheritance assets to cover legal expenses. Defense fees can easily bankrupt small estates and leave nothing for designated beneficiaries.

In addition to protecting assets, South Salt Lake estate planning is the most effective strategy for establishing healthcare proxies. This document allows individuals to document the type of medical treatment they do or do not want to have if they are incapable of making decisions due to illness or injury. Healthcare proxies include ‘Do Not Resuscitate’ (DNR) orders, as well as providing directives regarding life support and delivery of nutritional intravenous feedings.

Estate planning is also used to grant Power of Attorney rights. POA is an important decision that should not be taken lightly. The person granted with POA powers should be someone who can be trusted to make smart financial decisions, and make difficult decisions on your behalf if you become incapacitated. Establishing South Salt Lake estate planning strategies is one of the best gifts to leave loved ones. Without written directives, decisions surrounding your estate will be left to the courts and chances are they won’t be what you would have wanted. Additionally, putting affairs in order can reduce family discord and allow for efficient distribution of inheritance gifts.

Estate Planning Tips to Reduce Family Disputes Over Inheritance

Sadly, family disputes over inheritance are a common occurrence. As a probate liquidator I’ve watched countless feuds erupt in court rooms over personal belongings and valuable assets. One thing is certain. Death can unite or separate families and separation often occurs when decedents do not engage in estate planning.

While estate planning cannot prevent family disputes over inheritance it can minimize the risk of heirs contesting the Will and ensure heirs receive intended inheritance gifts. The level of estate planning strategies required depends on several factors including: type and value of owned assets, number of heirs, and state probate laws. Every estate is required to undergo the probate process unless assets are protected by a trust. Trusts are often used when estate value exceeds $100,000. Some states exempt small estates from undergoing probate as long as a legal Will has been executed.

Executing a last will and testament is essential because it provides estate settlement directives, including how property should be distributed. Wills are also crucial for those who have minor children because they appoint legal guardianship. Other important directives can include burial preferences, charitable gifts and donations, and disinheritance of heirs. While most people do not desire to disinherit family members, if there is a need to do so the only legal way is to include a disinheritance clause. It is strongly recommended to consult with a lawyer to determine the appropriate manner for disinheriting heirs. Some states allow decedents to entirely write a person out of the Will, while others require a minimal gift of one dollar.

Individuals who are concerned that heirs might contest the Will can insert a no-contest clause. This action declares that heirs who contest the Will relinquish rights to any estate assets. No-contest clauses can be a good preventative measure to reduce risk of family inheritance wars from erupting. If substantial family strife exists it is smart to work with a probate attorney. Lawyers can help individuals determine which options are best suited for protecting inheritance property. When estates are required to undergo probate a personal representative is appointed to settle the estate.

Oftentimes, personal representatives are family members, but this can cause additional problems when family dysfunction exists. It can be beneficial to appoint a neutral party, such as a probate litigator or lawyer, to settle the estate. Although it is more costly to hire professionals, doing so could save the estate money if family disputes arise. If heirs contest a Will the legal defense fees can quickly bankrupt estates and force personal representatives to sell inheritance property. Most states require court authorization of the sale of probated assets.

Establishing trusts offers additional protective measures and is a simpler process than probate. However, it is also more costly. It’s best to consult with an estate planner to determine which type of trust is best suited. The benefits of trusts are property is often exempt from inheritance taxation; gifts can be distributed quickly; and the last will and testament remains private and is not available through public records. With probated estates, the Will is a matter of public record and available to anyone who wishes to view it.

Estate planning is essential for everyone, but especially when potential for family fighting over inheritance exists. Grief can cause irrational behavior and has tendency to magnify existing dysfunction. If possible, hold a family meeting and openly discuss inheritance gifting. Relatives can place claim on items they want and negotiate when multiple people want the same item. If meetings aren’t possible, talk to heirs privately. Once the Will is drafted, provide heirs with a copy so they know what they will receive ahead of time.

While there is no ironclad protection method that can stop family disputes over inheritance from occurring, there are strategies that can diminish damage to relationships. Estate planning can lessen potential for arguments and provide peace of mind knowing final affairs are in order.

Why Is Having an Estate Plan Important?

Estate planning is important for a number of reasons. For instance the regulations about wills and estates where you live can mean that if you pass away without a valid will, your family will not be entitled to receive the benefit of your estate. It may pass to the government if there is nothing specified in your will.

It is therefore important to look carefully at the structure of your estate to ensure that it creates the maximum benefit for your beneficiaries.

Estate planning can be important from the perspective of taxation law. In many jurisdictions around the world, there are implications for both capital gains tax and income tax if the estate is not correctly planned. Not obtaining adequate professional advice about your estate can mean that your family is unnecessarily exposed to taxes which could be avoided if a proper estate plan was in place. Complex considerations in relation to the claiming of dividend imputation credits can also require the creation of testamentary trusts.

Another often overlooked part of the estate planning procedure is the period prior to death which can involve incapacity and therefore the need for an enduring power of attorney, enduring guardianship, living will or advance health directive. These legal instruments can assist with arranging one’s affairs where there is a prolonged period of mental incapacity requiring palative care. Ensuring that your wishes are followed in relation to a period of mental incapacity can ensure that the end of your life is lived with dignity and in accordance with the wishes that you have previously expressed. In an increasingly global world, people often own assets in more than one jurisdiction. The reason that this can be an issue in estate planning is that it can result in an extremely complicated, expensive and time consuming process of estate administration if the executors of the estate are required to conduct a search for property which extends internationally. In some jurisdictions of the world there can also be issues of entitlement to recover property if the executor is not located in the jurisdiction where the assets are and this can mean that the person’s estate is consumed by the foreign jurisdiction rather than the jurisdiction in which they intended to leave their estate. There are also some jurisdictions of the world where taxation laws mean that when an asset passes to a foreign beneficiary it will be exposed to additional taxes.

Estate Planning With Retirement Plans

Retirement plans are one of the greatest tax breaks available. When you are making money and your income tax rate is high, you place pre-tax income into an account. The money compounds tax free for several decades, then in your elderly years when your personal tax rate is likely to be lower, you pay income tax only on annual distributions. The downside to retirement plans is that because they are treated differently than other financial accounts, you have to treat them differently in your estate planning too. There are three facts you should know about retirement accounts and estate plans.

First, retirement plans are not easy to integrate into your estate plan. If you have a will-based plan, you must be aware that the beneficiary designation on the retirement account overrides your will. Suppose you get divorced and write a new will stating that your children, instead of your former spouse, should inherit your IRA. Unless you also update the IRA beneficiary designation, which probably names your former spouse, the money will not pass to your children. Rather, the account will pass to whoever is named on the beneficiary designation at the time of your death. In trust-based estate plans, you need to be careful to avoid retitling retirement accounts in the name of the trust, because that is considered a distribution and may prompt early taxes and penalties.

Second, regulations governing retirement accounts have become more flexible recently, and children can now inherit an IRA and stretch out the annual distributions based on their life expectancy. Retirement plans have what are known as required minimum distributions, which require the account owner to withdraw account funds as they get older. The required minimum distributions are based on the owner’s life expectancy, such that a percentage of account funds are distributed every year until the account is exhausted when the account owner dies. But if the account owner dies unexpectedly with a sizable retirement account, the account can pass to their spouse, and the required minimum distribution schedule is reset to match the spouse’s life expectancy.

Recent law changes extended this special spousal treatment to children. Today, if a child inherits an IRA, the required minimum distribution schedule is based on the child’s life expectancy, which might be 40-50 years, or longer. This allows for phenomenal tax-deferred growth of account funds.

Third, many children (and their spouses) are too short-sighted to see the long-term value of an inherited retirement account. They take the money out, pay taxes now, take that well-deserved vacation and buy a new car, among other suddenly necessary expenditures. You can prevent this financial planning tragedy with a little foresight in your estate plan, but it requires planning ahead. Without a plan, your daughter-in-law might need a larger jewelry case.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How To Hire An Estate Planning Attorney

Estate Planning Attorney Snyderville Utah

Estate Planning Attorney South Ogden Utah

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

South Salt Lake, Utah

|

|

|

South Salt Lake, Utah

|

|

|---|---|

| City of South Salt Lake | |

South Salt Lake City Hall, South Salt Lake, Utah

|

|

| Motto:

City on the Move

|

|

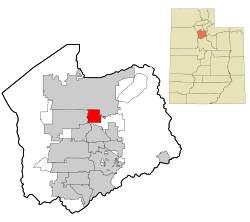

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°42′28″N 111°53′21″WCoordinates: 40°42′28″N 111°53′21″W | |

| Country | United States |

| State | Utah |

| County | Salt Lake |

| Settled | 1847 |

| Incorporated | 1938 |

| Named for | Great Salt Lake |

| Area | |

| • Total | 6.94 sq mi (17.98 km2) |

| • Land | 6.94 sq mi (17.98 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,255 ft (1,297 m) |

| Population

(2010)

|

|

| • Total | 23,617 |

| • Estimate

(2019)[2]

|

25,582 |

| • Density | 3,685.11/sq mi (1,422.76/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84106, 84115, 84119

|

| Area code(s) | 385, 801 |

| FIPS code | 49-71070[3] |

| GNIS feature ID | 1432753[4] |

| Website | https://sslc.gov/ |

South Salt Lake is a city in Salt Lake County, Utah, United States and is part of the Salt Lake City Metropolitan Statistical Area. The population was 23,617 at the 2010 census.

[geocentric_weather id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_about id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_neighborhoods id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_thingstodo id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_busstops id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_mapembed id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_drivingdirections id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]

[geocentric_reviews id=”af8321d6-6f06-4e88-85d9-aee14b8f4ba1″]