As the old saying goes, you can’t take it with you when you die. But a probate lawyer can help surviving family members settle your debts and distribute your assets after you’re gone, with or without a will. Generally speaking, probate lawyers also called estate or trust lawyers help executors of the estate (or “administrators,” if there is no will) manage the probate process. They also may help with estate planning, such as the drafting of wills or living trusts; advise on powers of attorney; or even serve as an executor or administrator.

Hiring a Probate Lawyer: With a Will In South Jordan

The process will likely go smoother when the decedent has drafted a will prior to his or her death. If an individual dies with a will, a probate lawyer may be hired to advise parties such as the executor of the estate or a beneficiary on various legal matters. For instance, an attorney may review the will to ensure the will wasn’t signed or written under duress (or against the best interests of the individual). Elderly people with dementia, for example, may be vulnerable to undue influence by individuals who want a cut of the estate. There are numerous reasons that wills may be challenged, although most wills go through probate without a problem. Additionally, a probate attorney may be responsible for performing any of the following tasks when advising an executor:

• Collecting and managing life insurance proceeds;

• Getting the decedent’s property appraised;

• Finding and securing all of the decedent’s assets;

• Advising on how to pay the decedent’s bills and settle debts;

• Preparing/filing documents as required by probate court;

• Managing the estate’s checkbook; and

• Determining whether any estate taxes are owed.

Hiring a Probate Lawyer: Without a Will In South Jordan

If you die without having written and signed a will, you are said to have died “intestate.” When this happens, your estate is distributed according to the intestacy laws of the state where the property resides, regardless of your wishes. For instance, the surviving spouse receives all of your intestate property under many states’ intestate laws. However, intestacy laws vary widely from state to state. In these situations, a probate lawyer may be hired to assist the administrator of the estate (similar to the executor) and the assets will be distributed according to state law. A probate lawyer may help with some of the tasks listed above but is bound by state intestacy laws, regardless of the decedent’s wishes or the family members’ needs. A relative who wants to be the estate’s administrator must first secure what are called “renunciations” from the decedent’s other relatives. A renunciation is a legal statement renouncing one’s right to administer the estate. A probate attorney can help secure and file these statements with probate court, and then assist the administrator with the probate process (managing the estate checkbook, determining estate taxes, securing assets, etc.).

Important Benefits of Working with a Probate Attorney

When a loved one dies, the profound sense of loss can overwhelm you. It’s important to take time to heal. You should step back from your job duties and household responsibilities. It’s essential to maintain a connection with family and friends. And if you’re the executor or executrix of your loved one’s estate, or if they had no will, you should seek professional guidance and assistance from a probate attorney. When you’re in charge of handling an estate, you must navigate the probate court system and comply with court guidelines and schedules. You’ll execute complicated will provisions, create complex court required documents, obtain a federal tax identification number, secure a probate bond and manage funds. Even minor estate matters can present added burdens when you’re least prepared to handle them. It’s not a time for a DIY legal fix.

Your probate specialist

Any attorney can agree to handle your probate case, but only probate attorneys are dedicated probate specialists. They don’t negotiate injury claims or defend criminal matters. Probate attorneys resolve probate and trust cases only. They know probate court rules, forms, procedures, court officials, and probate complications. They perform the same tasks and see different versions of the same issues every day so they understand what’s critical to your case.

No upfront fees

You don’t have to pay a retainer or any other attorney fees to get your case moving forward. Your probate attorney will eventually receive payment for services but only after the case is finalized. Probate legal fees are approved by the court and paid out of the proceeds of the estate. You’ll never have to worry about budgeting for legal expenditures.

Time to connect with family

Estates can be complicated and time-consuming. The process can seem like an endless stream of details, documents, and court requirements. The activity can take you away from friends and family members when they need you most. Probate attorneys shoulder these responsibilities on your behalf and keep you apprised of the details. If your attorneys require an answer or an action from you or need to inform you of a hearing or procedure, they keep you notified.

Faster Resolution

If you attempt to administer an estate without professional help, you’ll eventually learn by trial-and-error. You’ll get it done, but it’s not a prudent, efficient, or timely way to handle such an important matter. Probate cases involve a lot of details. Your best effort can translate into a long, drawn-out, frustrating process. Probate attorneys don’t have that learning curve. They have the knowledge and experience to expedite the process and that can make a big difference in your peace of mind

Freedom from liability

With so many details to master, it’s easy for an inexperienced administrator to make a mistake. If you fail to properly marshal assets, pay heirs or creditors or perform other required tasks, you may be financially liable for your inadvertent error. Your probate attorneys can perform these tasks more accurately and efficiently. And if they commit an error, they assume the responsibility instead of you.

Minimal disputes

Estate cases sometimes trigger disputes that end up in litigation. The resultant court cases can take years to resolve. The legal fees and expenses can reduce the estate’s value. Probate attorneys minimize the chance of disputes by handling cases in the most efficient, effective, professional, and timely manner.

You Need a Probate Professional

When you’re responsible for administering an estate, the added responsibilities can monopolize your time. In the absence of a will, the process can become even more complicated Probate attorneys can minimize problems, expedite the process, and give you more time to care for your family.

What Will The Probate Lawyer Do?

You don’t have to turn everything over to a lawyer these days; legal services are available a la carte. This can save on legal fees. Most people, thankfully, don’t need to hire a lawyer very many times in their lives. And even if you’ve gone to a lawyer for a business matter, real estate transaction, or a divorce, working with a probate lawyer is likely to be a different kind of experience. Some things are the same whenever you hire a lawyer, though: to fully understand what’s going on, you will probably need to ask a lot of questions, and to keep costs down, you will have to take on some of the routine work yourself. Here are some issues to think about as you begin your relationship with a probate lawyer.

Who Does What

When you’re winding up an estate, there’s usually a lot of legwork to be done things like making phone calls and gathering documents. Many of these tasks don’t need to be done by someone with a law degree. So if you’re paying the lawyer by the hour, you’ll probably want to volunteer to take on some of this work yourself. Just make sure it’s clear who is responsible for what tasks, so things don’t fall between the cracks. For example, make sure you know who is going to:

• order death certificates

• file the will with the local probate court

• get appraisals of valuable property, and

• file the deceased person’s final income tax return.

Keep in mind that many lawyers are more flexible than they used to be about offering what’s often called “limited representation” or “unbundled services.” In other words, many lawyers no longer insist on taking responsibility for all the work of a probate case. They will agree to provide limited services for example, answering your questions during the probate process while you take on other tasks traditionally done by the lawyer, such as drawing up the probate court papers. Especially if your court provides fill-in-the-blanks probate forms, this kind of arrangement may be good for you. Be sure to get your agreement in writing, so both you and the lawyer are clear on your responsibilities. It’s a good idea to ask the lawyer for a list of deadlines—for example, when is the cutoff for creditors to submit formal claims, and when will the final probate hearing be held? This will be helpful both if there are things you need to do, and if creditors or beneficiaries contact you with questions.

Dealing With Beneficiaries and Creditors

If everyone gets along, it probably makes sense for you, not the lawyer, to field questions from beneficiaries. It will save money, and you’ll know what beneficiaries are concerned about. If you send regular letters or emails to beneficiaries to keep them up to date (this usually helps keep them from fretting), you might ask the lawyer to review your communications before you send them, to make sure you’ve got everything right.

Getting Legal Advice as You Go

Check in with the lawyer regular to see if anything is happening with the probate case. Usually, no news is good news. State law requires you to keep the probate case open for months, to give people time to come forward with disputes or claims but in most probates, beneficiaries don’t argue about anything in court, and few creditors submit formal claims. By all means, ask the lawyer any questions you have about the proceeding. But if the lawyer is charging by the hour, try to be efficient when you communicate. If you can, save up a few questions and ask them during one phone call or visit to the lawyer. But if you are unsure about taking a particular action that will affect the estate for example, you want to give one needy beneficiary his inheritance months before the probate case will close get legal advice before you act.

Will You Need to Hire a Probate Lawyer?

If you read the conventional advice for executors, the first step is usually hire a lawyer. And you may well decide, as you wind up an estate, that you want legal advice from an experience lawyer who’s familiar with both state law and how the local probate court works. Not all executors, however, need to turn a probate court proceeding over to a lawyer or even hire a lawyer for limited advice. If the estate that you’re handling and doesn’t contain unusual assets and isn’t too large, you may be able to get by just fine without a lawyer’s help. To determine whether or not you may be able to go it alone, ask yourself the questions below. (If you don’t know the answers, ask a lawyer before you agree to hire the lawyer to handle things for you.) The more questions you answer with a “yes,” the more likely it is that you can wrap up the estate without a professional at your side. Can the deceased person’s assets be transferred outside of probate? The answer to this question depends on how much (if any) probate-avoidance planning the deceased person did before death. Ideally, all assets can be transferred to their new owners without probate court. Some common examples of assets that don’t need to go through probate are assets are held in joint tenancy, survivorship community property, or tenancy by the entirety. Assets held in a living trust can bypass probate, too. Probate is also unnecessary for assets for which the deceased person named a beneficiary—for example, retirement accounts or life insurance policy proceeds. Does the estate qualify for your state’s simple “small estate” procedures? It’s best if no probate at all is required, but if that isn’t an option, figure out whether the estate can use “small estate procedures. In most states, these include streamlined “summary probate” and an entirely out-of-court process that requires presenting a simple sworn statement (affidavit) to the person or institution holding the asset. Every state has its own rules on which estates can use the simpler procedures. But in many states, even estates that are fairly large not counting non-probate assets can use the simpler processes. Are family members getting along? Will contests are rare, but if a family member is making noises about suing over the estate, talk to a lawyer immediately. Probate lawsuits tear families apart and can drain a lot of money from the estate in the process. A lawyer may be able to help you avoid a court battle.

How a Probate Lawyer Assists a Personal Representative

The probate lawyer advises and assists with four areas of responsibility when representing the personal representative of an estate:

Collecting Assets

An attorney might assist in helping the executor locate and secure both probate assets and non-probate assets, and determining date-of-death values by appraisal, if necessary. The executor will be required to collect any life insurance proceeds if the estate is named as beneficiary, and rolling over and making appropriate elections with regard to retirement plans, including IRAs and 401(k)s. The attorney will assist with all this. Eventually, the decedent’s real estate and other assets will have to be retitled in the names of the estate beneficiaries if they’re not being sold. The lawyer typically takes care of this paperwork as well, then the executor can distribute what’s left of the decedent’s assets to the beneficiaries after bills and taxes are paid.

Handling Finances

A probate lawyer will advise on the payment of the decedent’s final bills and outstanding debts, and will prepare and file all related documents required by the court. The executor must keep track of the estate’s checking account, and the attorney might oversee this as well, in addition to determining if any estate taxes or inheritance taxes will be due at the federal or state levels. If so, the attorney will figure out where the cash will come from to pay these taxes, as well as any income taxes due from the decedent’s last year of life.

Settling Disputes

The attorney will settle any disputes that arise between the personal representative and the estate’s beneficiaries, and assist with the sale of estate property. It’s the attorney’s responsibility to request court permission for various actions as required by state laws, including the sale of property. Court approval can help reassure unhappy beneficiaries.

Things To Bring To The Probate Attorney

Death Certificate

It usually takes between 2-4 weeks to obtain a death certificate from the county. You certainly are not required to wait until you obtain a death certificate before you go see the probate attorney, but one will be required in order to complete the paperwork for the Court. Generally, the law office will retain at least one original death certificate.

Banking Information

Gather and bring with you a copy of each statement of the decedent. The most recent statement will suffice. This includes checking, savings, IRA, CD, and credit union accounts.

Retirement statement

Most retirement benefits will end upon the death of the decedent but this not always the case. It is prudent to bring any retirement information with you to the appointment with the probate attorney so they can determine if any benefits remain or will continue to the beneficiaries.

Address book

Bring you address book for the relatives of the decedent. It may be required to provide notice to relatives (even if they are not named in the will or trust). The court requires that they receive notice at the last known address. This is usually the most difficult information to provide to the attorney, but nonetheless, it’s a constitutional requirement.

Original Will and/or Trust

This probably goes without saying, but brings the original will or trust to the attorney. In Utah you need to probate a will within 3 years of death. We prefer to file the probate case within 30 days of death. If you have exceeded this time frame do not delay in contacting a probate lawyer right away.

List of Assets

The probate attorney will have to inform the court what assets were owned by the decedent at the time of death. Any and all information you can find regarding the assets will be helpful to the attorney. This may include deeds, property information, financial planner contact information, and other documents.

Probate Lawyer

When you need help with probate law, estate planning, wills, trusts, guardianships and more, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How To Legally Get Out Of A Contract

Real Estate Lawyer Riverton Utah

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

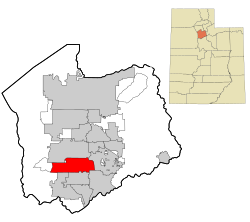

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of The Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

[geocentric_weather id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_about id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_neighborhoods id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_thingstodo id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_busstops id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_mapembed id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_drivingdirections id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_reviews id=”9d240370-0efd-4320-8bd2-de15226eaa86″]