The golden rule in real estate development is that every agreement concerning real property (land and buildings) must be in writing. This rule had its origins in England, where the Statute of Frauds was enacted in 1677. The Statute of Frauds was founded on these key premises: Each parcel of land is unique, and as long as a seller has agreed in writing to sell the land and the purchaser has agreed in writing to buy it, the purchaser will be able to force the seller to sell that unique parcel to the purchaser. Every state including now have similar laws governing real property. Therefore, you must reduce to writing any agreement relating to the possible purchase of a property. A written document, whether a purchase contract, an option, or any other form of agreement, allows the purchaser to “specifically enforce” the agreement or to force the seller to comply with its terms in a court of law. An experienced Bluffdale Utah real estate lawyer can draft the purchase contract for you.

Purchase contracts are the most common form of written agreement between a seller of property and a potential purchaser. In fact, the vast majority of real estate transactions that take place in the United States—the purchase and sale of single-family homes—utilize purchase contracts. A description of the provisions that purchasers should look for in their purchase contracts is given below. Special mention is made of provisions that may be of particular interest to the purchaser organizations. As with any legal document, the terms of the purchase contract should be as clear and unambiguous as possible. You should consult with an experienced Bluffdale Utah real estate lawyer prior to entering into any written agreement.

Parties

The purchase agreement must clearly state the identities of the purchaser and the seller and include an address where the parties must deliver any written notices required under the agreement. The address provisions may be included in a separate paragraph.

Description of Property

The purchase contract must contain a paragraph that describes in detail the real property to be transferred and addresses how the personal property owned by the seller and located on the property will be disposed of.

Real Property.

The description of the real property (land and whatever else is built on the land) provided in the purchase agreement may be the single most important section of the document. The sponsor will be able to “specifically enforce” or force the sale of the specific parcel of land described in the purchase agreement only if the terms of the written agreement clearly describe the property in question. The sponsor should be certain that the description included in the purchase agreement is the legal description of the property that can be found in the land records of the jurisdiction where the property is situated. Additional means of identifying the property, for example, the lot and square numbers used to identify the property for property tax purposes and the property mailing address, should be used only to supplement the legal property description.

Personal Property

The contract must state how the parties are going to treat any personal property (everything not permanently affixed to the land) that is located on the property on the date of transfer. This personal property usually includes such items as appliances, light fixtures, heating and air-conditioning units, lawn mowers, and so on. As a general rule, these items are transferred to the purchaser. However, the contract should state the transfer (if that is the case) or the limitations on the personal property to be conveyed.

Purchase Price

The purchase contract must contain a paragraph that states a definite purchase price for the property. This paragraph also may contain details on how the purchase will be financed.

The purchase contract must state a definite purchase price for the property. The final purchase price can change during the contract period, perhaps increasing by $1,000 for every day that the purchaser must extend settlement beyond the date specified in the contract. The purchase price can even be based on a formula, such as the outstanding balance on the mortgage as of the date of settlement plus a profit of 10 percent of that mortgage balance. The terms must be objectively discernible; an independent third party should be able to ascertain the sales price of the property at any given time.

Financing.

The purchase contract may contain provisions detailing how the property will be financed. For example, if the seller will be providing the purchaser with a purchase money mortgage for all or part of the purchase price, then the terms of this owner take-back financing will usually be negotiated as part of the purchase contract and included in the contract itself. If no owner financing is being provided, the contract may contain only a provision that states that the purchase must be all cash or that the purchaser will be seeking conventional financing at market rates in order to complete the purchase. Specification of the type and terms of the financing sought by the purchaser generally is relevant only if the contract explicitly states that the purchaser is excused from completing its performance under the contract if it fails to secure financing terms at least as favorable as those set out in the contract. With this clause, the seller holds the purchaser accountable for securing the required amount of cash from whatever sources are necessary in order to complete the purchase.

Deposit and Escrow

Most real estate purchase contracts will require the purchaser to provide an earnest money deposit, which is held in escrow until termination of the contract.

Earnest Money Deposit.

Generally, the deposit:

1. Must be provided at the time the contract is executed.

2. Commonly ranges from 5 percent to 20 percent of the purchase price.

3. Forces the purchaser to show its financial stability by requiring it to produce a significant amount of cash early in the transaction.

4. Forces the purchaser to make a financial commitment to the completion of the sale by putting some or all of this cash at risk of loss, should closing not occur.

5. Provides the seller with a source of funds to compensate itself for lost opportunities, should closing not take place under the contract.

Although these are the most common purposes of an earnest money deposit, the parties are free to negotiate the specific terms surrounding the deposit. For example, the deposit may be less than 5 percent of the purchase price; it may be “paid” with assets other than cash such as a letter of credit or the pledging of securities; and it does not have to be “at risk” of loss, should the purchaser fail to close on the acquisition. All of these terms are negotiable, but the amount and the form of the deposit will be easier to negotiate than the “at risk” nature of the funds. The concept that a deposit will be forfeited by the purchaser should settlement fail to occur is a longstanding tradition in American real estate.

Escrow

The parties to the real estate contract will likely want the deposit to be held by a third party, someone other than the seller or the purchaser, until the contract is terminated. This third party, usually referred to as an escrow agent, may be a disinterested third party, such as a representative of the title company, or may be the attorney for the seller or the purchaser. Regardless of who serves as the escrow agent, both parties should enter into an escrow agreement that clearly states how the moneys will be held, how they can be paid out, and what happens in case of a disagreement between the parties as to the disposition of the escrowed funds. The purchase contract should specify how the deposited funds are to be disbursed upon termination of the contract or settlement on the property. However, if this disbursement is not specified in the contract, it should be stated in the escrow agreement.

Typically, the escrow agent makes no decisions concerning the disposition of funds and only follows identical instructions provided by the buyer and the seller. The escrow agent typically is indemnified by the buyer and the seller.

Title

Most purchase contracts have a provision concerning the seller’s ability to give the purchaser clear title to the property. Under the terms of such a provision, the purchaser usually will be given an opportunity, at its own cost, to have a title search of the property conducted by a title company of the purchaser’s choice. If the title is not good and marketable—if it is subject to claims against the seller, other than reasonable covenants, rights of way, and easements and tenancies, that cannot be cured in a reasonable period of time and/or by the payment of a reasonable amount of money—then the purchaser should have the right to the return of the earnest money deposit. Under those circumstances, the seller should pay the purchaser’s cost of examining the title. The purchase contract should provide the purchaser with a reasonable amount of time to order (5 to 7 days after contract execution) and review the title report and to file written objections (7 to 14 days after issuance of the title report) with the seller concerning any claims against the title stated in the title report. The parties should negotiate and the contract should state how long the seller would have to cure these defects and how much money the seller will be required to spend to cure title defects. Liens that can be cured at settlement from funds paid by the purchaser to the seller do not make a title unmarketable. Issuance of a title insurance commitment by a title insurance company usually will be conclusive evidence that the title is good and marketable.

Deed

The purchase contract should state the type of deed that the purchaser will want the seller to provide at settlement.

Adjustments

The purchase contract should have a provision that requires the parties to purchase an existing rental property to make adjustments on the date of settlement for items such as rents received, taxes, water and sewer charges, insurance, interest on existing encumbrances, the cost of fuel in storage tanks, salaries and accrued benefits of employees, and other operating charges. For example, if settlement takes place on the 15th day of a 30-day month and the seller has received $10,000 in rents by that date, a provision requiring an adjustment for rents received would mean that the seller is allowed to keep rents applicable to the first 15 days of the month ($5,000) but must give the purchaser credit for the rents applicable to the second half of the month ($5,000). Similarly, if the seller paid $12,000 in insurance for the entire year in January and sold the property on March 1, the purchaser would owe the seller an additional $10,000 as an adjustment for prepaid insurance.

A “security deposits” provision commonly is stated in real estate purchase contracts for tenanted properties in the “adjustments” paragraph. Generally, the purchaser should require the seller to transfer all security deposits plus interest to the purchaser at settlement or to credit the full amount of the deposits plus interest against the amount due from the purchaser at settlement.

Closing and Recording Costs

A provision should be included that specifies the responsibility of each party to pay for closing and recording costs such as title examination, tax certificates, recording fees and taxes, transfer fees and taxes, and other miscellaneous charges incurred in order to complete settlement. If no provision is included in the contract, whatever local convention is followed (e.g., seller pays transfer charges and purchaser pays recordation charges) might be imposed on the parties.

Hire the services of an expert

A real estate purchase agreement is a complex document. Yet it is vital for the transaction. Each real estate purchase agreement must be customized for the specific transaction. Don’t use a fill in the blanks form. Hire the services of an experienced Bluffdale Utah real estate lawyer.

Bluffdale Utah Real Estate Attorney Free Consultation

When you need help with a real estate matter in Bluffdale Utah, please call Ascent Law for your free consultation (801) 676-5506. We want to help you. We can help with quiet title actions, probates, estate, trusts, evictions, partion actions, and anything related to real estate law.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

How Often Do First Time DUI Offenders Go To Jail?

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

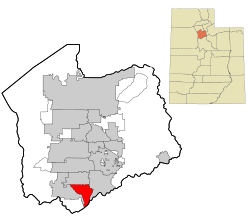

Bluffdale, Utah

Coordinates: 40°28′24″N 111°56′40″WCoordinates: 40°28′24″N 111°56′40″WCountryUnited StatesStateUtahCountySalt Lake, UtahFounded1886IncorporatedOctober 13, 1978Named forBluffs (high cliffs) and dales (valleys) along the Jordan RiverGovernment

• MayorDerk Timothy • City ManagerMark ReidArea

• Total11.14 sq mi (28.86 km2) • Land11.14 sq mi (28.85 km2) • Water0.00 sq mi (0.01 km2)Elevation

4,436 ft (1,352 m)Population

• Total17,014 • Density1,527.29/sq mi (589.74/km2)Time zoneUTC-7 (MST) • Summer (DST)UTC-6 (MDT)ZIP code

Area codes385, 801FIPS code49-06810 [3]GNIS feature ID1425844 [4]Websitebluffdale.com

Bluffdale is a city in Salt Lake and Utah counties in the U.S. state of Utah, located about 20 miles (32 km) south of Salt Lake City. As of the 2020 census, the city population was 17,014.

From 2011 to 2013, the National Security Agency‘s (NSA) data storage center, the Utah Data Center, was constructed at Camp Williams in Bluffdale. It is approximately 1 million square feet in size.[5][6]

[geocentric_weather id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_about id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_neighborhoods id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_thingstodo id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_busstops id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_mapembed id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_drivingdirections id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_reviews id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]