Construction contracts are complex. Never attempt to prepare a construction contract without the services of an experienced Heber City Utah real estate lawyer or sign one for that matter. You could get into a big mess. Always use Utah Real Estate Lawyers when it comes to real estate in Utah.

Bonds in general involve a payment by the contractor to a third party who is able to guarantee certain behavior or performance by the contractor. In the event the contractor fails to perform in the way specified, the bonding agent or surety is obligated to pay the party outsourcing for the service a set payment. Bonds are essentially forms of insurance. As with all insurance, there is a potential for abuse. For example, if a contractor has purchased a performance bond, there may be an increased tendency on the part of the property owner to reject the work or products produced under the contract for less than valid reasons. In cases where the value of the bond is greater than the value of the final product, this temptation is particularly strong. This situation is most likely to happen in cases where there is a good likelihood that the product or service being provided may be quickly outdated. In a situation where the product is no longer serviceable by the time it is delivered, the property owner may look for an excuse to find fault with the performance of the contractor and invoke the protection provided by the bond. Specific types of bonds include (1) performance bonds that require the contractor to perform as specified in the contract, (2) bid bonds which insure that the contractor accepts the contract that has been bid upon, and (3) payment bonds that insure payment for services rendered or goods delivered. If you are a construction contractor and you have been asked to sign a contract, consult an experienced Heber City Utah real estate lawyer.

Liquidated damages provisions require the supplier or service provider to pay the property owner (buyer) a specific amount for the failure to provide a level or quality of service that is specified in the contract and that results in some level of damage to the property owner. Liquidated damages can be assessed for each day beyond the delivery date that the supplier fails to deliver on the contracted product or service, for unusable goods or services, and for services that have been judged unacceptable by an agreed upon measure of service quality.

Liquidated damages in many cases can be assessed against or deducted from the payments that the property owner would make to the contractor. Property owners need to be careful in crafting liquidated damages clauses. The courts generally do not allow liquidated damages provisions to be used as a means to penalize contractors. Instead, such provisions are designed to compensate the property owner for actual damages and must therefore meet a standard of being reasonably connected to actual damages experienced. For example, imagine that a liquidated damages clause in a construction contract required that the contractor provide a financial report by the first of each month or, alternatively, pay the property owner $15,000 (or have the property owner’s payment to the contractor reduced by $15,000). One month the contractor fails to provide the report by the first of the month, but does deliver the required report by the fifteenth of the month. In this case, unless the property owner could prove that the delay of the report actually caused approximately $15,000 worth of damage, the courts would probably rule that the amount of the claim was out of proportion to the extent of the contractor’s performance failure and not allow a liquidated damages claim. One potential consequence of the court ruling that a liquidated damage clause is unreasonable is the complete setting aside of the clause. In such a case, the property owner could be left without the ability to be compensated for the contractor’s poor performance. Because reasonableness is the standard for judging the validity of a liquidated damages clause, property owners need to develop methods for assessing damages in proportion to the whole value of the contract or contract payment.

No damages for delay terms essentially excuse the property owner or buyer from responsibilities for delays that the property owner itself causes. If the work to be done requires a high level of contribution from the property owner or a substantial amount of coordination between the property owner and the contractor, the no damages for delay clause represents a major shift in risk from the property owner to the contractor. Contractors, for the most part, are unwilling to assume such a risk without the potential for higher-than-normal levels of compensation. No damages for delay clauses are probably only appropriate when the property owner must be sure that the work will be completed on time even if the property owner’s own personnel are unable to facilitate the work in the expected manner. Property owners who find themselves requesting this type of clause could perhaps make a larger contribution to property owner efficiency by notifying responsible officials that improvements need to be made in operations.

Clauses related to consequential damages control for substantial unforeseen and undesirable results of using a product or service. For example, the property owner may want to purchase some new water valves at a substantially lower cost than normal. The valves themselves may only cost a few hundred dollars, but the failure of a single valve could result in water damages in the millions of dollars. In reading the sales contract the property owner is likely to notice that the valve’s manufacturer has included a clause that requires the purchaser to forego suing for consequential damages or the damages that result from the failure of the part. In technologies that are subject to the potential for large consequential damages, such clauses can explain large differences in price that are otherwise unexplainable. Because the Uniform Commercial Code generally allows for consequential damages, the typical contract language in this area will be a disclaimer of such damages.

Assignment clauses are used to control for the possibility of a contractor winning the contract award and then assigning the work to another service provider.

Force majeure is a legal doctrine that excuses contractors or the property owner from performing their contracted duties because of conditions beyond the control of the respective parties (e.g, bad weather, vehicle breakdown, civil disturbances, etc.). Force majeure clauses are typically included as a boilerplate in most contracts. In some cases, however, property owners need to be careful not to include such clauses. When the point of the contract is to provide for emergency services (e.g, to back up service providers who have failed to deliver because of conditions beyond their control), force majeure clauses should either not be included or should be qualified so as to exclude conditions that the service provider is expected to overcome.

Clauses related to being an independent contractor are often included in contracts as a means of establishing that the contractor cannot claim benefits (e.g., overtime, etc.) to which property owner’s employees are entitled.

Requirements contracts clauses specify that the property owner is only contracting for services as required, that the payments or contract value is only estimated, and that the property owner does not guarantee the amount of work or requirements over the course of the contract. These clauses are commonly used in conjunction with services, such as snow removal, vehicle repair, tree removal, emergency response services, and facilities renovation work, for which a service level cannot be easily estimated.

Risk-related clauses are those that attempt to appropriate the risk levels to be borne by the parties to the contract. Not every contract involves every type of risk. Good contract management calls for a close fit between the type and level of risk involved in the contract and the type and degree of risk-management contract terms that one intends to require.

Assessing the potential for risk is not always easy, but experience suggests that a number of conditions are related to risk, including such factors as the length of the preexisting contractual relationship, the reputation of the contractor, the complexity of the work, the reliability of the subcontractors, and so on.

While it may be relatively easy to assess the potential for higher-than- average risk in a contract, it is often more difficult to decide how to manage this risk. This is the case because each of the risk-management clauses outlined has a cost. The cost is rarely explicit or itemized. Instead, it is usually included as part of the overall contract payment cost. Theoretically speaking, the contractor could lower the contract price for every risk-management clause or behavior that the property owner decides not to require. Sometimes the theory is evident in real contract situations. For example, if the property owner decides not to require a performance bond, companies that bid on the contract should be able to lower their price by the cost of the performance bond. While this may be the case in uncomplicated bidding situations (e.g., where all the bidders are not already bonded and where all performance bonds are nearly equal in price), the risk-for-cost tradeoff is more likely to occur in an indirect, rather than direct, manner. For example, the property owner may decide that a performance bond that is regularly needed in a particular type of work will not be required in a particular instance of the work being contracted.

Payment Terms or Provisions. These clauses would outline the payment type (e.g., fixed, reimbursement, etc.), the schedule of payments, and the maximum and minimum payment amounts.

Contract Change Provisions

Most contracts will specify a method by which the parties agree to make needed changes to the contract. Sometimes change clauses are as simple as a statement that the parties can change the contract by mutual agreement. At other times, it may be more efficient to allow one party to unilaterally make specific changes or a certain number of changes within a certain time frame. For example, in complex building projects, the project manager may be given authority to change certain material specifications as long as they are of equivalent or better quality.

Contract Suspension Provisions. There may be times when the property owner would want to have a right to suspend the work that has been contracted. For example, if the property owner plans to pay for a project out of expected sales receipts, a situation may occur where the property owner fails to collect the expected level of sales receipts according to schedule. If this schedule is closely tied to the project itself and the property owner has not allocated any other resources to the project, it may be necessary to suspend the contract until the necessary funds are collected. Contract suspension, however, is usually not a cost-free activity unless this is clearly specified. Without provisions for the orderly suspension of work, the cost of suspension to the contractor (e.g., in terms of lost work, funds expended on subcontractors and materials, warehousing costs, etc.) can form the basis for a claim against the property owner. Contract suspension provisions typically include a limit on the amount of time in which the contract can be suspended, as well as specification of some compensation to the contractor for the suspension costs incurred.

Contract Renewal Provisions. Contract renewal provisions are important in keeping the cost of property owner contracting down. Contract renewal provisions allow the property owner the option of renewing the contract at the current price without having to bear the cost of rebidding the contract. It is often the case, however, that because of inflation a contractor will not be interested in the renewal offer at the same price. If this is likely to be the case and the property owner wants to keep the renewal option alive, the contract will need to include a price adjustment or escalator that will allow the contract value to be maintained in the face of price or wage inflation.

Speak to an experienced Heber City Utah real estate lawyer. The lawyer can prepare a customized construction contract for you.

Heber City Utah Real Estate Lawyer Free Consultation

When you need legal help regarding real estate law in Utah, including purchase and sale agreements (REPC) or a commercial real estate deal, real property litigation, real estate partition actions, evictions for landlords, or other real estate cases, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Heber City, Utah

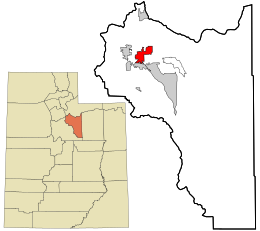

Heber City is a city and county seat of Wasatch County, Utah, United States. The population was 11,362 at the time of the 2010 census. It is located 43 miles southeast of Salt Lake City.

[geocentric_weather id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_about id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_neighborhoods id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_thingstodo id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_busstops id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_mapembed id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_drivingdirections id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]

[geocentric_reviews id=”7402c2c4-3fd6-4960-b577-c940a211dd17″]