From a small town with 2,942 inhabitants in mid nineteenth century, South Jordan, Utah has come a long way. Today its home to many businesses. Family owned businesses are very common in South Jordan, Utah. If you are looking for start a family owned business like many others in South Jordan, Utah consult with an experienced corporate lawyer. How you set up your family business is very important. Depending on your requirements, you must choose the most appropriate business structure for your family business.

Legal Entity

The first thing you need to do after you have decided to set up a family business is to decide on its legal structure. As a legal entity, a family owned business can be organized in four major ways: as a proprietorship, a partnership, a corporation, or a limited liability company. The legal organization of a family owned business has important implications for the ownership, control, and financing of the firm. An experienced corporate lawyer will explain them to you and after understanding them you can choose the most appropriate legal structure.

Proprietorship

A proprietorship is a family owned business owned by an individual or family, called the proprietor. The proprietor has complete control of the firm and the power to make all decisions. He can enter contracts in the name of the firm, but is personally liable for the firm’s obligations and other legal matters. This means that if the family owned business cannot pay its debts or is successfully sued, the proprietor’s house, car, bank accounts, or other personal assets can be seized. Small family owned businesss are typically organized as proprietorships. Even if the proprietor wishes to increase the size of the firm, this type of legal organization is not conducive to obtaining the financing necessary to do so, since most of the money available to the firm is provided by the proprietor and limited bank borrowing. Some family owned businesses start as proprietorships and then change their legal structure to expand, but many continue as proprietorships over their lifetimes.

Partnership

As with sole traders, most partnerships have unlimited liability. However, as there is more than one person involved the liability is joint and several. This means that whilst each partner is jointly responsible for all of the debts a debtor can choose to recover the money from only one partner. If that did happen, the partner who paid the debt could recover the money they had paid out from the other partners.

A partnership is a business owned by two or more individuals, called partners. A general partnership shares many characteristics of a proprietorship. The partners share control, profits, and losses of the firm, and all partners have unlimited liability for the obligations of the firm. Each partner has the legal right to enter into contracts for the firm, and all partners bear responsibility for the decisions made by each one individually. However, partners can pool their financial resources to potentially obtain more money for the firm, which is an advantage relative to a proprietorship.

The necessary corollary of this is that any partner can bind the firm. They can therefore enter into contracts on behalf of the firm, sign checks, hire employees, and other such matters. A partnership can remove this power but has to notify people outside the partnership that it has done so. The partnership relationship does therefore involve an element of trust as the individual’s business identity is not separate but bound up in their membership of the partnership. The finance for partnerships comes from the partners themselves. Whilst they can take out loans this means that there is a limit to the amount of capital they will have access to and therefore the size of undertakings that they can pursue.

The other factor which can inhibit the size of partnerships is the problems associated with unlimited liability. The bigger the partnership, the greater the risk is for the individual partners.

Corporations

Corporations of whatever type, have managed to resolve this problem by allowing unlimited numbers of people to invest capital in the business. The number and size of the investments are controlled by the company itself which can issue what are known as shares to the value of the capital that they require.

Unlike a proprietorship or partnership, a corporation is a legal entity that is separate from the individuals who own it, called stockholders. As a “legal person,” a corporation can enter into contracts, own assets, and incur liabilities independent of its owners. The owners have limited liability. If the corporation fails to pay its debts or is sued, the maximum amount owners can lose is limited to their investment in the firm; their other personal assets cannot be seized. Limited liability makes ownership in the firm more attractive and facilitates selling ownership shares to a large number of individuals. This makes it easier for a family owned business to obtain the money it needs to expand. As a result, large family owned businesses tend to be organized as corporations. It is not always clear exactly who controls a family owned business when it is organized as a corporation. Stockholders elect a board of directors who have the legal authority to make decisions for the family owned business. These decisions are often delegated to managers. Directors and managers may or may not also be owners, and if they are, their ownership shares may be large or small.

Limited Liability Company

A limited liability company (LLC) is a business owned by one or more members. Members can be individuals, corporations, or other LLCs. An LLC has legal attributes of both a partnership and a corporation. While it has the tax advantages of a partnership, it is a legal entity distinct from its owners like a corporation. An LLC can enter into contracts, own assets, borrow money, and sue and be sued, but the assets of owners are protected by limited liability. Because a family owned business organized as an LLC can have from one to a large number of owners and many different types of operating agreements, it is not always clear who controls and makes decisions for the firm. But an LLC with relatively few members is likely controlled in a manner similar to a typical partnership or proprietorship.

The choice of legal organization is related to family owned firm size. The largest family owned businesses are organized as corporations; the smallest are overwhelmingly proprietorships. This is largely because limited liability offered by the corporate form of organization is an essential feature in raising the large amount of money necessary to finance a large family owned business.

Transactions

Once you have set up your family owned business, it must engage in transactions with other businesses and individuals to organize and coordinate the activities required to conduct the business. Before your newly set up A transaction involves an agreement between two parties to exchange a good or service for money. The terms of the agreement is called a contract. The contract may be formal or informal, written or verbal, or unstated but implied. For example, a family owned business makes a transaction with a commercial vineyard when it agrees to exchange $800 for a ton of grapes. The terms of the agreement that specify the price, quantity, grape variety, delivery date, mode of delivery, and so on, constitute the contract.

A family owned business can enter into a variety of different types of contracts. A legal contract is a written, oral, or implied transaction agreement between two parties that is enforceable by law. Certain types of transactions may require a written contract to be enforceable, and implicit agreements are the least likely type of contract to have legal status. For example, a verbal agreement by a family owned business to purchase grapes may be enforceable, but not one to buy a vineyard. If a family owned business has a legal contract with another party and this party breaches the contract by not honoring the terms, enforcement may involve requiring the party either to carry out the terms of the contract or to compensate the family owned business by making payment of a specific amount of money. However, even if a contract is not legally enforceable, the market may provide an enforcement mechanism. A family owned business that breaches legally unenforceable but legitimate verbal or implicit contracts may develop a dubious reputation and have a difficult time finding grape growers, custom-crush producers, distributors, and so on, with whom to transact, which may be very costly or possibly prevent it from conducting business at all. Speak to an experienced corporate lawyer in South Jordan, Utah before you sign any contract on behalf of your family owned business.

Short-Term and Long-Term Contracts

It is useful to make a distinction between a short-term contract and a long term contract. A spot contract (or short term contract) is an agreement between a family owned business and another party to exchange money for a good or service at the same point in time. This type of transaction takes place on the spot market, sometimes called the market for immediate delivery.

A long term contract involves a transaction that extends over time where a family owned business and another party agree to exchange money for a good or service at different points in time. This type of transaction is more complex than the relatively simple spot-market transaction, and therefore is more difficult to negotiate and enforce.

Choosing LLC for tax purposes

As a business owner, you may have assets in a partnership or corporation. You should take a close look at the limited liability company.

To avoid corporate tax issues, real estate is often owned by partnerships. That means the only way to restrict your liability is as a limited partner. But often professionals like doctors own and manage their buildings as general partners, which leaves them open to Liability. The LLC solves this problem because it combines a partnership’s pass-through tax setup with corporate liability protection. That combination is so advantageous that business advisers are unusually enthusiastic about LLCs in real estate ownership and other sideline businesses.

Still, LLCs aren’t for everybody. Say you have a sideline business that’s incorporated, and you figure you’re already protected from the its obligations. Converting the existing corporation to an LLC might trigger capital gains taxes. In such a situation, you should probably stick with what you have. However speak to an experienced South Jordan Utah corporate lawyer before you take a final call. But if you’re setting up a new business, investigate LLCs, Professional often own office and office facilities, for that matter–in S corporations. Those permit pass-through taxation, like partnerships. An LLC might be a better vehicle because S corporations have so many restrictions on who can own them. For example, you can’t put S corporation holdings into estate-planning trusts. That suggests another possible use of LLCs: as estate-planning vehicles. Formerly, you might have put assets into a family limited partnership. Those let you transfer interests to family members easily, while keeping control by remaining a general partner yourself. But that makes your liability open-ended. So if you’ve got an apartment building in the Partnership, and someone slips and falls in the lobby, their suit could threaten your full net worth. Put the asset in an LLC, though, and no individual would have such unlimited liability; only the LLC’s assets are reachable.

Whatever may be the business you are engaging in, it is important to set it up properly to ensure that your rights are protected. Often one legal structure may be more beneficial to a family owned business than the other. Besides the issues of personal liability and taxes, there may be other family issues that you need to consider when setting up a family business. Speak to an experienced South Jordan Utah Corporate lawyer before you take a decision on the legal form of your family business.

South Jordan Utah Business Lawyer Free Consultation

When you need a corporate attorney in South Jordan, please call Ascent Law for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

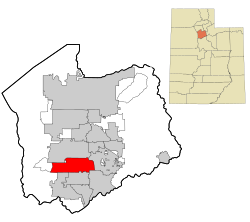

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of The Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

[geocentric_weather id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_about id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_neighborhoods id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_thingstodo id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_busstops id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_mapembed id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_drivingdirections id=”9d240370-0efd-4320-8bd2-de15226eaa86″]

[geocentric_reviews id=”9d240370-0efd-4320-8bd2-de15226eaa86″]