If you are facing foreclosure because you are a victim of predatory lending, speak to an experienced Bluffdale foreclosure lawyer.

“Predatory lending,” as the term is used by the lay public, is difficult to define because it encompasses an unusually wide range of fraudulent and unscrupulous conduct. HUD and the Department of the Treasury have described predatory lending as “engaging in deception or fraud, manipulating the borrower through aggressive sales tactics, or taking unfair advantage of a borrower’s lack of understanding.” These practices are often combined with loan terms that typically make the borrower more vulnerable to financial exploitation.

While there is no definitive list of predatory practices, three basic types of abusive lending practices are commonly associated with predatory lending. The first is fraud or deception in the presentation of the terms of the loan. Predatory lenders or brokers frequently alter loan application information or loan terms after obtaining borrower signatures, or simply forge the signatures. A second common predatory practice involves lending without consideration of the borrower’s ability to repay the loan. In these situations, a predatory lender is more concerned with taking the collateral—the borrower’s home—through foreclosure than in securing steady and timely repayment of principal and interest. Foreclosure is accomplished by encouraging the borrower to commit to a loan at a price he or she cannot afford. The third—and perhaps hallmark—practice associated with predatory lending is equity stripping. This is achieved through exorbitant (and often hidden) fees and costs. This practice can be devastating, for even those borrowers who recognize their error and ultimately refinance the loan (which may be costly if the loan contains a prepayment penalty) have lost the large up-front fees that the broker or lender skimmed from the transaction at closing. Fee abuse gives the lender or broker added incentive to “flip” or repeatedly refinance the loan. Each refinancing results in more up-front fees for the lender while the borrower continues to lose her equity in the property.

These basic and common predatory practices are reflected in the following hypothetical mortgage transaction. Imagine the following facts:

Acme Mortgage (a fictitious name) operates in the African American neighborhood of a major American city. Through one of its cooperating brokers, it identifies a young African American woman (Mary) who is in urgent need of a modest loan ($30,000) to repair and renovate her home. Mary has limited formal education.

She inherited her house from her mother without any mortgage or lien on the property. The house is a modest, older row house, fairly appraised at $175,000. Mary has no credit history, no credit cards, pays cash for all purchases, and has never applied for or obtained a loan. She earns $2,000 per month. From the broker, Mary learns that she can have the loan in one week. All she has to do is come to the closing and sign the papers. The broker tells her that the interest rate will be high at first (15 percent), but that he will make sure that after a few months she gets a lower rate. Mary arrives at the closing to find no one but a notary. She signs where

told to, but does not understand the fine print of the loan documents.

Little does Mary know that she has signed her name to a loan in the amount of $60,000 at an annualized interest rate of 18 percent. The loan terms contain broker fees in the amount of $8,000, an escalator clause taking the APR to 18 percent if she is late in paying one time, a “no-insurance” penalty of 1 percent for each month she fails to have homeowners’ insurance, and mandatory attorneys’ fees should the lender move to foreclose. Mary’s monthly payments are more than half her monthly income. Mary is also unaware that this is a “balloon” note, meaning that her monthly payment covers only the interest on the loan, and does not go to

pay back principal. She will have to pay back the entire principal of the loan in seven years.

Within six months Mary is temporarily laid off from work. She has no reserves and quickly falls behind in her loan payments. Three months later Acme moves to foreclose on the property, asserting late fees, interest on interest (at 24 percent), no insurance penalties, attorneys’ fees, and unpaid principal totaling $100,000. The property goes to foreclosure sale at a market price of $175,000, and Acme obtains the deed to Mary’s house for a payment of $65,000 (after deducting for foreclosure costs and expenses). Two months later, Acme resells the property for $185,000

to an unsuspecting neighbor of Mary’s. The sale is financed by an Acme loan with terms similar to Mary’s.

Step back for a moment and consider the elements of this transaction: a fraudulent inducement to sign a loan document with false promises of affordability; no effort by the underwriter of the loan to determine Mary’s ability to pay; hidden fees and terms designed to get Mary behind on her payments quickly and irreparably; and foreclosure of the property designed to strip the equity quickly from Mary’s home and flip the property, recycling the abuse on another unsuspecting member of a minority community starved for hard money credit. This is traditional predatory lending at its (not uncommon) worst.

Virtually all predatory lending occurs in the subprime market. The converse, however, is not true. Subprime lending, of course, need not be predatory and does in some instances provide a necessary and valuable service by increasing the amount of credit available to borrowers who would not qualify for products at the prime rate. When done responsibly and transparently, subprime lending can offer consumers with higher or non-traditional credit risk profiles loan products that are priced according to their relative risk. The subprime market, however, lacks comprehensive and efficient regulation. This fact, coupled with the limited choices available to borrowers who are forced to rely on subprime lending, has fostered an environment where predatory practices are free to flourish.

Federal Statutes

Seven major federal statutes provide borrowers with varying degrees of protection against predatory lending. Each, however, falls short in critical respects. These include:

• The Truth in Lending Act (TILA)

• The Home Ownership Equity Protection Act (HOEPA)

• The Real Estate Settlement Procedures Act (RESPA)

• The Equal Credit Opportunity Act (ECOA)

• The Fair Housing Act (FHA)

• The Racketeer Influenced and Corrupt Organizations Act (RICO)

• The Federal Trade Commission Act (FTC Act)

Truth in Lending Act (TILA)

Enacted in 1968, the Truth in Lending Act represents Congress’ first major effort of the modern era at regulating consumer credit transactions. Its purpose is to protect borrowers from inaccurate and unfair credit billing and credit card practices by requiring a meaningful disclosure of credit terms in the credit transaction.

TILA applies broadly, regulating most forms of consumer credit, including home mortgages, personal loans, and credit cards. Four conditions must be met for TILA to apply. First, credit must be offered or extended to consumers. Second, the lender must offer or extend credit regularly. Third, credit must be subject to a finance charge and/or be payable by a written agreement in at least four installments. Fourth, the credit sought must be primarily for personal, family, or household purposes, not business or commercial purposes.

TILA’s key provisions require that certain information be disclosed in a uniform manner in order to allow consumers to compare the cost of credit. The two core pieces of data are (1) the finance charge, which is the total dollar cost of credit, and (2) the APR, or annualized simple interest rate of the finance charge, which informs borrowers of the cost of credit over time.

For purposes of TILA, “finance charge” is defined broadly to include “any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit.” There are, however, significant exceptions to this definition. For example, in real estate and mortgage lending transactions, the finance charge need not include fees for credit reports, notary costs, property appraisal and inspection, title examination, title insurance, property survey, and the preparation of deeds of trust or settlement documents. In addition, the creditor need not include charges for consumer credit or property insurance in the finance charge if the creditor does not require insurance coverage and informs the borrower of that fact.

TILA grants an automatic right of rescission in transactions where “a security interest … is or will be retained or acquired in any property which is used as the principal dwelling of the person to whom credit is extended.” During a three-day “cooling-off period” following the loan closing, the borrower may elect to rescind or cancel the loan by sending notice of the decision to the lender. The lender must then cancel all notes, mortgages, and other instruments and return to the borrower all funds or other property received.

Notwithstanding these disclosure requirements and the right of rescission, TILA does not always ensure “the informed use of credit.” In residential mortgage lending transactions, consumers are inundated with scores of forms and dozens of pages of paperwork, of which TILA disclosures are just one small part. TILA forms are often lost in this avalanche of paperwork, adding little to the borrower’s true understanding of the costs of the transaction or the loan over its life. This is particularly true for borrowers who are targeted by predatory lenders for their lack of financial sophistication. Ironically, the lender is often the only party assisted by the small print of TILA disclosures buried in the paperwork of the loan transaction. As HUD and the Department of the Treasury recognized, “written disclosure requirements, without other protections, can have the unintended effect of insulating predatory lenders where fraud or deception may have occurred.”

Our hypothetical with Mary and Acme illustrates the point. TILA’s disclosure requirements would be unlikely to make any difference in the outcome of that loan transaction. Assuming that Acme included the disclosure forms among the many documents Mary was required to sign, without proper advice and guidance there is little chance that Mary would either read or understand those disclosures. Worse, her signature on the forms would, if anything, potentially help Acme argue that Mary’s subsequent dilemma was one of her own making, and that the terms of her loan agreement were known to her from the beginning.

Even if TILA’s substantive protections were effective in providing meaningful protection to the borrower, violations result in no real cost to the lender. The monetary remedies available for a TILA violation are relatively modest and do not have a deterrent effect. A prevailing plaintiff may recover actual damages, statutory damages, and attorneys’ fees and costs. Actual damages for disclosure violations may be calculated in one of two ways: the borrower may show that, but for the inaccurate disclosures, he or she could have received equivalent credit at a lower rate elsewhere. Or, if disclosure documents understate, for example, a finance charge, the borrower may recover the sum of the undisclosed charges. But these damages may be small, and are difficult for the borrower to prove in most situations. History shows that this type of claim is unlikely to be pursued.

TILA’s limited remedies and emphasis on paperwork make the statute, from the lender’s perspective, more of a nuisance than a deterrent to deceptive and fraudulent practices. TILA represented a step in the right direction when it became law in 1968, but in the current climate of abusive practices, it remains of marginal use in stopping predatory lending or remedying its harms.

Home Ownership Equity Protection Act (HOEPA)

In 1994, Congress amended TILA to provide for additional disclosures and increased protection for loans defined as “high cost.” The result was the Home Ownership and Equity Protection Act of 1994. The statute defines high-cost loans as those with (1) an APR greater than 10 percent above the yield on Treasury securities with a maturity date comparable to the term of the loan or (2) points and fees exceeding the greater of 8 percent of the total loan amount or $400 (which is adjusted up for inflation).18 After the Act was passed, the Federal Reserve Board lowered the interest rate threshold to eight points above the Treasury yield.

For loans that fall within the definition of “high cost,” HOEPA precludes certain types of balloon payments; forbids negative amortization; restricts payments prepaid from proceeds; outlaws increased interest payments after default; and limits prepayment penalties. Fixed-rate HOEPA loans must disclose the APR and monthly payment amount. Adjustable-rate HOEPA loans must disclose the APR, the regular monthly payment, the amount of the highest monthly payment based on the allowable interest rate, and make clear that the interest rate and payment may increase. HOEPA also prohibits lenders from engaging in a “pattern or practice” of issuing high cost loans without regard to a borrower’s ability to repay. While TILA defines a “creditor” as one who regularly (by six or more transactions) extends consumer credit secured by a dwelling, HOEPA defines “creditor” as any entity that has made two high-cost mortgages. If the transaction involved a broker, one high-cost mortgage may be sufficient to trigger the Act. Creditors that violate HOEPA are liable for actual and statutory damages, attorneys’ fees and costs, and “enhanced” damages in an amount equal to the total finance charge and fee paid by the borrower.

There are laws in place to protect victims of predatory lending. Speak to an experienced Bluffdale foreclosure lawyer to know more.

Bluffdale Utah Foreclosure Lawyer Free Consultation

When you need legal help with a foreclosure in Bluffdale Utah, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

What Are The Rules For Alimony?

Can Prenups Affect Child Support?

Ascent Law LLC St. George Utah Office

Ascent Law LLC Ogden Utah Office

Bluffdale, Utah

|

Bluffdale, Utah

|

|

|---|---|

Bluffdale Fire Station in 2013

|

|

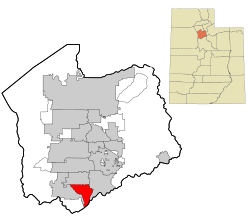

Location in Salt Lake County and the state of Utah.

|

|

Location of Utah in the United States

|

|

| Coordinates: 40°28′24″N 111°56′40″WCoordinates: 40°28′24″N 111°56′40″W | |

| Country | United States |

| State | Utah |

| County | Salt Lake, Utah |

| Founded | 1886 |

| Incorporated | October 13, 1978 |

| Named for | Bluffs (high cliffs) and dales (valleys) along the Jordan River |

| Government

|

|

| • Mayor | Derk Timothy |

| • City Manager | Mark Reid |

| Area | |

| • Total | 11.14 sq mi (28.86 km2) |

| • Land | 11.14 sq mi (28.85 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation

|

4,436 ft (1,352 m) |

| Population | |

| • Total | 17,014 |

| • Density | 1,527.29/sq mi (589.74/km2) |

| Time zone | UTC-7 (MST) |

| • Summer (DST) | UTC-6 (MDT) |

| ZIP code |

84065

|

| Area codes | 385, 801 |

| FIPS code | 49-06810 [3] |

| GNIS feature ID | 1425844 [4] |

| Website | bluffdale.com |

Bluffdale is a city in Salt Lake and Utah counties in the U.S. state of Utah, located about 20 miles (32 km) south of Salt Lake City. As of the 2020 census, the city population was 17,014.

From 2011 to 2013, the National Security Agency‘s (NSA) data storage center, the Utah Data Center, was constructed at Camp Williams in Bluffdale. It is approximately 1 million square feet in size.[5][6]

[geocentric_weather id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_about id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_neighborhoods id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_thingstodo id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_busstops id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_mapembed id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_drivingdirections id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]

[geocentric_reviews id=”404fb9c6-d4df-4872-80d2-dae4148453bf”]