Farmington is a city in Davis County, Utah, United States. It is part of the Ogden–Clearfield, Utah Metropolitan Statistical Area. The population was 18,275 at the 2010 census and was estimated at 24,514 in 2018. An amusement park, called Lagoon Amusement Park, is located in Farmington. The city was ranked 12th on Money magazine’s “Best Places to Live” index in 2011. Farmington is a suburb of Salt Lake City with a population of 23,208. Farmington is in Davis County and is one of the best places to live in Utah. Living in Farmington offers residents a sparse suburban feel and most residents own their homes. In Farmington there are a lot of parks. Many families and young professionals live in Farmington and residents tend to be conservative. The public schools in Farmington are highly rated.

Sometimes, homeowners aren’t able to afford the fees that an attorney would charge to represent them during a foreclosure. If you’re facing a foreclosure, but don’t have money available to hire a lawyer to work with you throughout the process, you might want to consider:

• dealing with the foreclosure on your own without an attorney

• paying for just one consultation with an attorney

• finding a pro bono (free) attorney, or

• getting assistance from a free legal aid society or a foreclosure prevention clinic in your area.

How Much Will a Foreclosure Lawyer Charge?

Most foreclosure attorneys structure their fee agreements by charging an hourly rate, collecting a flat fee, or charging a monthly rate. The amount you’ll pay in total could range from several hundred dollars to several thousand dollars. Exactly how much you’ll have to pay varies based on a number of factors, including the attorney’s level of experience and how much other attorneys in the area charge.

Deal With the Foreclosure Without a Lawyer

At Ascent Law, we strongly discourage you to face a foreclosure without having a lawyer on your side. The truth is, you should speak with a foreclosure attorney to discuss the specifics of your case if you don’t do that, you are not making a wise choice. However, it is your choice. So, if you don’t want to fight the foreclosure, you can probably deal with it on your own. You should educate yourself about what steps are involved, how long a foreclosure typically takes in your state, and exactly when you’ll have to move out of your home. You can apply for a mortgage modification during foreclosure without an attorney. You probably don’t need an attorney to help you apply for a mortgage modification. A modification is a permanent change to the loan terms, such as an interest rate reduction, to make the monthly payments more affordable. To get the ball rolling, call your loan servicer and let it know you would like to apply for a modification. The servicer will tell you exactly what you need to do to submit an application

Why you might want to apply for a loan modification

If you apply for a modification, you might be able to work out an agreement that will allow you to keep the home. Even if you can’t work out a deal, applying for a modification will you buy you some time to stay in the home before the lender completes the foreclosure. Generally, under federal law (and some state laws), a foreclosure must stop while the servicer evaluates your application.

Hiring a Foreclosure Attorney

You should seriously consider hiring a foreclosure attorney if you think you have a valid defense to the foreclosure, like the servicer didn’t follow the law or made a serious error with your account. In most cases, you’ll have to raise the defense in court, either by filing your own lawsuit (if the foreclosure is non-judicial) or responding to the lender’s lawsuit (if the foreclosure is judicial), which can be complicated. This means that it is usually better to hire an attorney than to go it alone if you want to successfully save your home.

Pay for a Consultation With a Lawyer

You might want to schedule at least one consultation with a lawyer even if you can’t afford to hire an attorney to represent you through the entire process. A lawyer can tell you exactly how foreclosure works in your state and how much time the process will likely take.

Setting expectations

Before going into the meeting, make sure you know how much time the attorney will spend with you, what he or she will help you with—for example, the lawyer may be willing to answer questions about foreclosure, but not about filing for bankruptcy—and how much the attorney charges for the consultation.

At the meeting, you might want to ask the lawyer to provide you with details about foreclosure procedures, to review the facts of your case, and determine whether you might have a defense to the foreclosure. The lawyer can also help you decide your next steps and explain your legal rights.

If you can’t afford to hire an attorney—even for just one meeting—then you could try to find a pro bono (free) attorney.

Some attorneys take on a certain number of pro bono cases to help people who have little or no income (or based on other factors). Contact your state bar association to get help finding pro bono attorneys who might be willing to assist you with your foreclosure case.

What is a Foreclosure Property, and Should You Buy One?

Foreclosures occur due to nonpayment, and though the process and timelines vary by state, the end result is the same: The mortgage borrower loses his or her home. Once the lender takes control of the property, it can sell it off to make up for financial losses on the home. Investors and consumers can purchase these homes—often at auctions or directly from the bank or government agency that owns them.

Why Foreclosures Happen

Foreclosures, at their most basic, occur because the homeowner has failed to make agreed-upon payments with their mortgage lender. The reasons behind this nonpayment can vary. Sometimes, job or income loss is the culprit; for other borrowers, medical bills or credit card debt made it impossible to stay afloat. In some cases, it may be due to bankruptcy, divorce, disability, or other personal or financial issues.

Pros & Cons of Foreclosed Property

Pros

• May be priced lower than other homes on the market

Cons

• Properties are often poorly maintained or in disrepair

• Sellers are often unwilling to make repairs

• Previous homeowner may take the home back, in some cases

• Could require significant amounts of cash if purchased at auction

• No record of property repairs and maintenance

Most buyers consider buying a foreclosed property to save money. Though not all bank-owned and foreclosed properties are a bargain, many are priced lower than market value due to their condition or the lender’s need to recoup their financial losses quickly. The Department of Housing and Urban Development (HUD), for example, even has homes listed at $1.4 Buying a foreclosed property may allow you to purchase a home you might not otherwise have been able to afford—perhaps one in an in-demand area or with more square footage than you budgeted for. That’s about where the perks end, though. Foreclosed properties often come in poor condition and require many repairs—repairs the seller is typically unwilling to make (the majority are sold as-is). Additionally, a majority of property auctions require cash to purchase the home, so you may not be able to finance the purchase via a traditional mortgage loan.

Finally, there are concerns regarding the previous homeowners. These include:

• Redemption periods. Many states have what’s called a “right of redemption” period, which allows the homeowner to catch up on payments and take back his or her property.

• Squatters. If the previous homeowner (or anyone, for that matter) is squatting in the home, it may be difficult and time-consuming to remove them.

• Lack of maintenance records. Because the previous homeowner is not directly involved with the sale, it can be very difficult to know what repairs and maintenance have been done to the house before you move in. Banks don’t have a record of this type of upkeep.

Stages of Foreclosure

The actual foreclosure process that a lender must go through to seize a property varies by state. In some places, foreclosures must advance through judicial proceedings before the home can be seized. In others, there are non-judicial options. Legally, a foreclosure cannot be initiated until a borrower is at least 120 days behind on their mortgage payments.

How to Negotiate With Sellers

When buying a foreclosure, you’re often purchasing from a large financial institution like a bank or private lender. Because of this, offers usually require multiple approvals and may take longer to move through the pipeline. You can generally expect negotiations to be slower and more difficult than they would be with a traditional seller. Additionally, banks are looking to recoup as much of their losses as possible. As such, they’ll usually present a counteroffer during negotiation which, again, must be approved by several people. When purchasing in a traditional home sale, you can include a home inspection contingency and negotiate on repairs and pricing based on the inspection’s findings. When buying a foreclosed property at auction, individual buyer contingencies (and thus the negotiations based on them) are not allowed. Your best bet for negotiating a foreclosure purchase is to engage a real estate agent—ideally one with foreclosure experience. He or she will be able to help you craft a competitive offer based on comparable sales and market conditions. Foreclosed properties are attractive to buyers because of lower selling prices. Acquisition of a foreclosed property requires awareness of the buying process and considerations that differ from a new development. Nowadays, in this age of rising prices and inflation, prospective homeowners must consider other options other than new developments when scoping for purchases. One of these options is foreclosed properties, which are properties repossessed by either lenders or the local government. Foreclosure happens when the property’s titular owner is unable to keep up the periodic repayments to a lender or the real property tax owed to the local government. There are two ways to acquire foreclosed properties:

• Purchase from a lender, such as a private bank or insurance companies. Interested buyers can inquire via websites or offices, or source listings through SPAV companies who help banks sell off non-performing assets. Foreclosed properties are also listed on housing portals.

• Auction from a government agency. Listings and auction schedules are available from HDMF (Pag-Ibig) and SSS, as well as from government banks such as Land Bank and BSP.

Foreclosed properties can be advantageous both to homeowners and investors. Apart from lower selling prices, foreclosed properties come with lower down payment rates of around 5-10 percent as opposed to 20-30 percent for a new development. Thus, monthly repayment rates are expected to be lower. Foreclosed properties can also appreciate in value depending on ongoing or future developments in its vicinity.

Things to Consider When Buying Foreclosed Properties

• Location: This is a consideration for any property, regardless of its condition or selling prices. Homeowners would do well to consider the area’s safety, vulnerability to natural calamities such as floods or earthquakes, as well as access to basic services such as schools and hospitals. Investors may also look at the presence of major thoroughfares, transport hubs, malls and commercial developments in the area.

• Additional Costs: Apart from paying the selling price or assuming the responsibility for monthly repayments, buyers also shoulder other expenses when acquiring a foreclosed property. These include real property taxes, association dues in private properties or developments, and taxes and fees for the transfer of the property title. In addition, the documentary stamp tax for transactions has increased by 100% due to the train law of 2018.

• Condition of the Property: Foreclosed properties are sold “as is”, meaning the seller will not make further improvements before turning over or selling the property. Prospective buyers must take extra care to check for structural flaws and pitfalls, or features such as plumbing that may require repair. These are additional costs to consider in the acquisition of foreclosed property.

Foreclosure Attorney

When you need a Foreclosure Lawyer in Farmington Utah, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Recent Posts

Hotel Owner’s Liability For Meth

Can I File Taxes As Single If Married But Separated?

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

Farmington, Utah

|

Farmington, Utah

|

|

|---|---|

The new City Hall, built in 2010

|

|

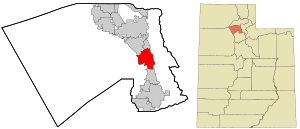

Location in Davis County and the state of Utah

|

|

| Coordinates: 40°59′12″N 111°53′57″WCoordinates: 40°59′12″N 111°53′57″W | |

| Country | United States |

| State | Utah |

| County | Davis |

| Settled | 1847 |

| Incorporated | February 18, 1852 |

| Founded by | Hector Caleb Haight |

| Named for | Farming |

| Area | |

| • Total | 10.05 sq mi (26.02 km2) |

| • Land | 9.95 sq mi (25.78 km2) |

| • Water | 0.09 sq mi (0.24 km2) |

| Elevation | 4,305 ft (1,312 m) |

| Population | |

| • Total | 24,531 |

| • Density | 2,465/sq mi (951.6/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84025

|

| Area code(s) | 385, 801 |

| FIPS code | 49-24740[4] |

| GNIS feature ID | 1441004[2] |

| Website | www |

Farmington is a city in Davis County, Utah, United States. The population was 24,531 at the 2020 census.[3] The Lagoon Amusement Park and Station Park transit-oriented retail center (which includes a FrontRunner train station) are located in Farmington.

[geocentric_weather id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_about id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_neighborhoods id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_thingstodo id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_busstops id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_mapembed id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_drivingdirections id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]

[geocentric_reviews id=”93963f2b-ec0d-4b77-8ab3-26b6545d7038″]